Macroeconomics and financial markets

On the US NY stock market on the 8th, the Dow Jones Industrial Average continued to rise by $216.9 (0.58%) from the previous day. The Nasdaq index closed 319.7 points (2.2%) higher. The decline in long-term interest rates on U.S. bonds, which makes them less expensive, is also providing a tailwind to the stock market, including high-tech stocks.

Among crypto assets (virtual currency) related stocks, Coinbase rose 3.4% from the previous day, Marathon Digital rose 7.09%, and among the top market capitalization stocks, Apple led the market with a rise of 2.3% and Nvidia rose 6.07%. .

CoinPost app (heat map function)

Meanwhile, Cathie Wood’s ArkInvest sold $20.6 million worth of Coinbase stock to rebalance its ETF portfolio. Accordingly, the weight of Coinbase stock in the Innovation ETF (ARKK) decreased to 10.4%.

connection:10 major virtual currency stocks in the Japanese and US stock markets

Virtual currency market conditions

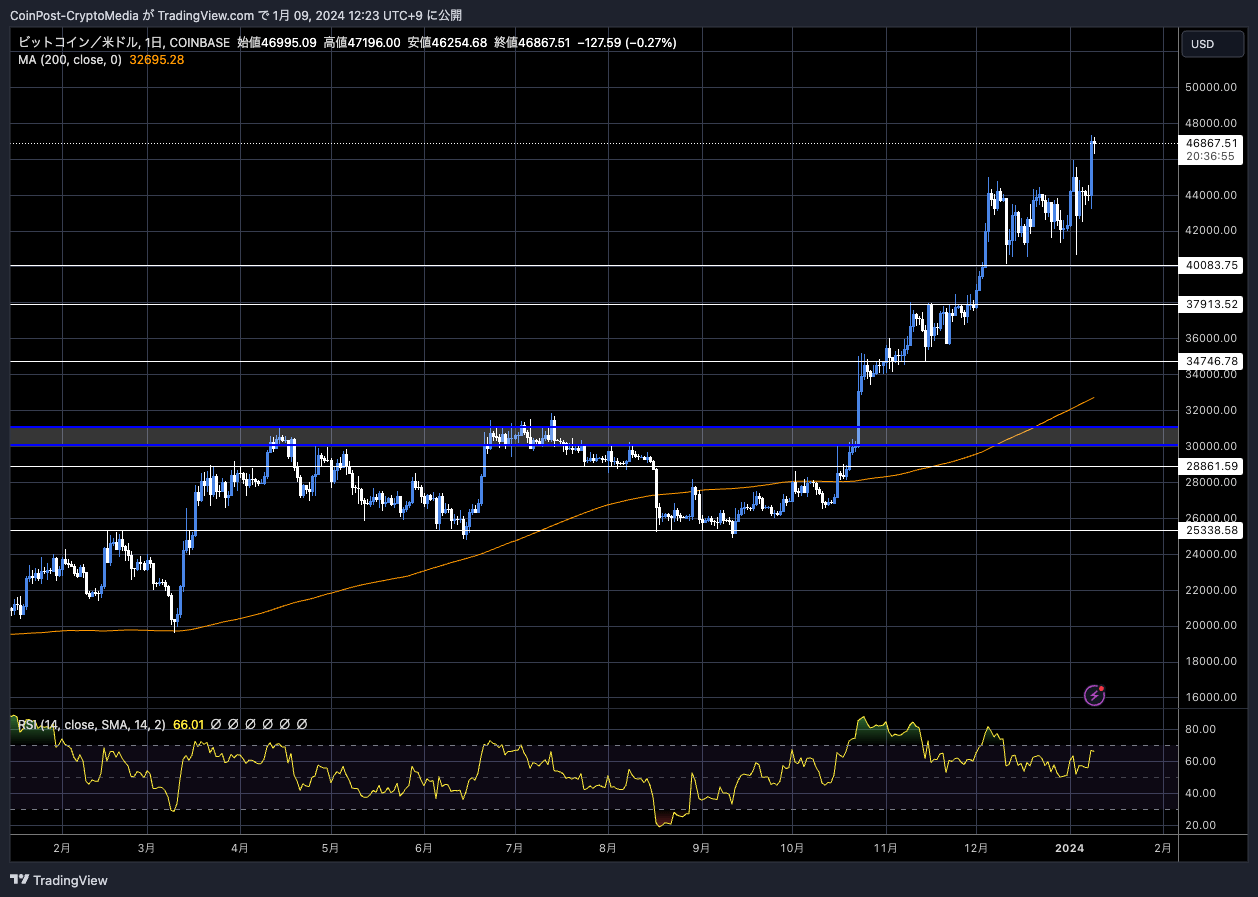

In the crypto asset (virtual currency) market, the Bitcoin price rose 8.17% from the previous day to 1 BTC = $46,869.

It hit a new high since the beginning of the year, exceeding 1 BTC = $47,000.

BTC/USD daily

Major asset management companies, including BlackRock and Fidelity, have filed updated documents with the U.S. Securities and Exchange Commission (SEC) disclosing their fees.

The US SEC (Securities and Exchange Commission)’s final approval date for the Bitcoin Spot ETF (Exchange Traded Fund) application by ARK Invest and 21Shares will be on the 10th, so the market is buying Bitcoin in anticipation of the approval. The momentum is growing.

If the price rises sharply after approval, it has been pointed out that there is a possibility of a major adjustment accompanied by actual selling, so the market may be expecting only the optimistic scenario.

connection:Learn about Bitcoin ETFs from the beginning: Explaining the advantages and disadvantages of investing and how to buy US stocks

Appearing on Bloomberg TV, GTS Co-Global Head of ETF Trading Sales predicted that if a spot Bitcoin ETF (exchange traded fund) is approved, the stock will trade at a premium (positive divergence).

“U.S. securities firms cannot trade cash and bitcoin directly, so they will command a premium over the net asset value based on market prices. With the exception of a few broker-dealers, most cannot.” There is a possibility that a premium may occur due to limited supply compared to high demand for Bitcoin ETFs.

Premiums are already occurring in the Bitcoin futures ETF market, which is already listed.

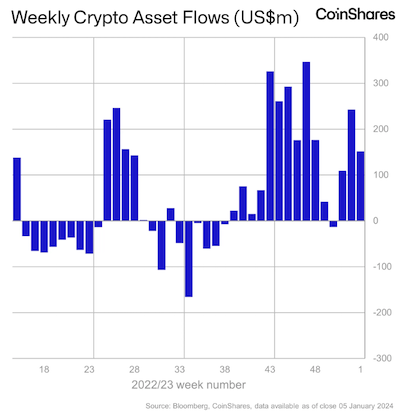

According to a weekly report from asset management firm CoinShares, the first week of the new year 2024 saw a total inflow of US$151 million.

Although inflows from the US have been on the decline recently, 55% of the inflows this time came from US crypto asset (virtual currency) exchanges, exceeding that of Europe, which had recently held a large share.

coin shares

altcoin market

Along with the rise in Bitcoin (BTC), Ethereum (ETH) also rose 6.1% from the previous day.

Crypto Tony said it would be bullish if the price sustains above $2,130. He said he would be even more bullish if the price reaches the $2,500 high zone.

According to Ali, whales (large investors) have amassed 410,000 ETH worth about $1 billion in the past month. On-chain data shows a steady increase since early December last year.

In the past month, #Ethereum whales bought over 410,000 $ETHworth nearly $1 billion! pic.twitter.com/1gGguoEypx

— Ali (@ali_charts) January 6, 2024

Bitcoin ETF special feature

We have introduced the “Heat Map” function to the CoinPost app for investors!

In addition to important news about virtual currencies, you can also see at a glance exchange information such as the dollar yen and price movements of crypto asset-related stocks in the stock market such as Coinbase.

■Click here to download the iOS and Android versions

https://t.co/9g8XugH5JJ pic.twitter.com/bpSk57VDrU

— CoinPost (virtual currency media) (@coin_post) December 21, 2023

Click here for a list of past market reports

The post Bitcoin rises to $37,000 level due to ETF listing approval speculation, new year-to-date high appeared first on Our Bitcoin News.

1 year ago

107

1 year ago

107

English (US) ·

English (US) ·