Macroeconomics and financial markets

In the US NY stock market on the 1st, the Dow closed at $6.9 (0.02%) higher than the previous day and the Nasdaq at $231 (2.00%) higher.

The US Federal Open Market Committee (FOMC) announced just after 4:00 am Japan time on the 2nd, and the FRB (US Federal Reserve System) unanimously decided to reduce the rate hike by 0.25 basis points (bps).

“We think we’ve made a lot of progress with the tightening monetary policy, but there’s still work to be done,” Powell said at a press conference. It seems that the market has been favorably received by referring to the start of the process of “disinflation”, which indicates a situation in which the price increase (inflation) rate is declining.

On the other hand, although the inflation rate has slowed from its peak, it is still at a high level, and there is concern about the risk of a further rise in the future. Chairman Powell said, “We do not anticipate an interest rate cut (money easing) in 2023,” piercing market expectations.

Among crypto assets (virtual currency)-related stocks, US largest exchange Coinbase rose 12.3% from the previous day, MicroStrategy, which holds a large amount of Bitcoin, rose 6.43%, and mining company Riot Platforms rose 9.4%. .

Relation:NY Dow and cryptocurrency-related stocks all-around rise FOMC interest rate hike narrowed | 2nd Financial Tankan

Virtual currency market

In the crypto asset (virtual currency) market, Bitcoin rose 3.2% from the previous day to $23,884.

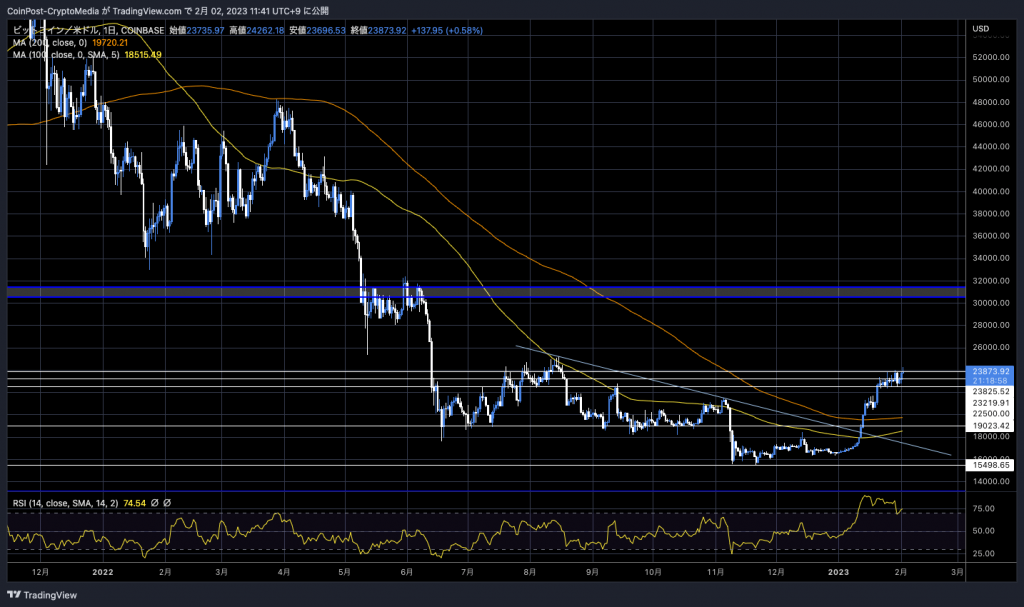

BTC/USD daily

A sense of wariness about the FOMC increased, and in reaction to the reversal trend until the day before, short cover buybacks took precedence. BTC price reached $24,262 at one point and hit a new high.

“Bitcoin has formed an extremely rare bottom price pattern,” said Peter Brandt, a prominent investor who foresaw the 2018 crash, on January 30. He suggested a move to $25,000.

The bottom in $BTC is a double walled fulcrum pattern. Extremely rare. The 2X target is mid 25’s. pic.twitter.com/NfffzbniO5

— Peter Brandt (@PeterLBrandt) January 29, 2023

Ethereum (ETH)

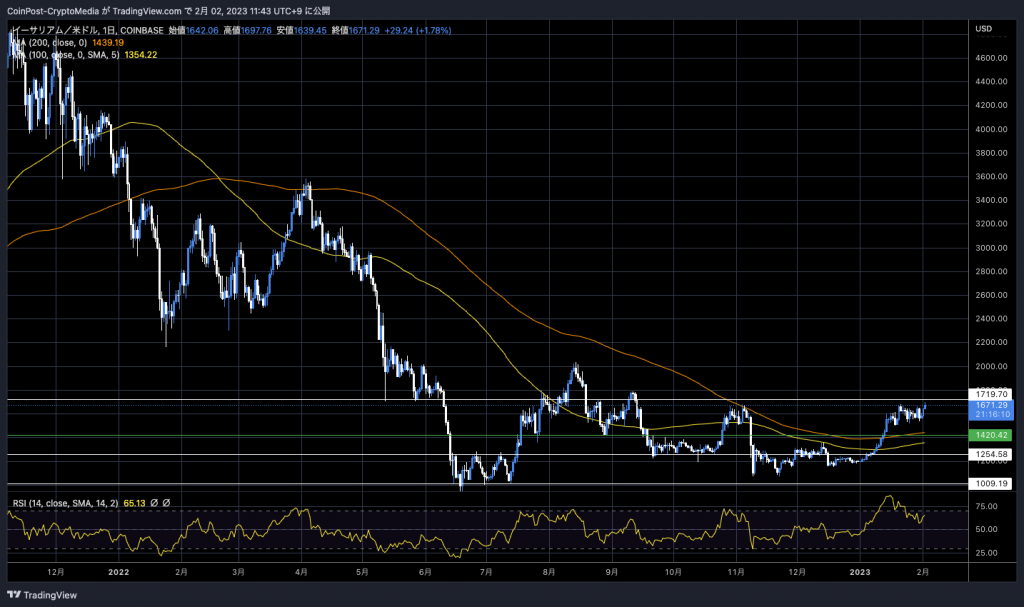

Ethereum (ETH), the second largest market capitalization, also rebounded. After the FOMC, it quickly turned around and rose 5.3% from the previous day.

ETH/USD daily

Market interest is focused on the Shanghai upgrade of Ethereum (ETH) scheduled for March this year. After the upgrade, investors and validators who have been staking so far will be able to withdraw ETH assets that have been deposited and locked on the beacon chain.

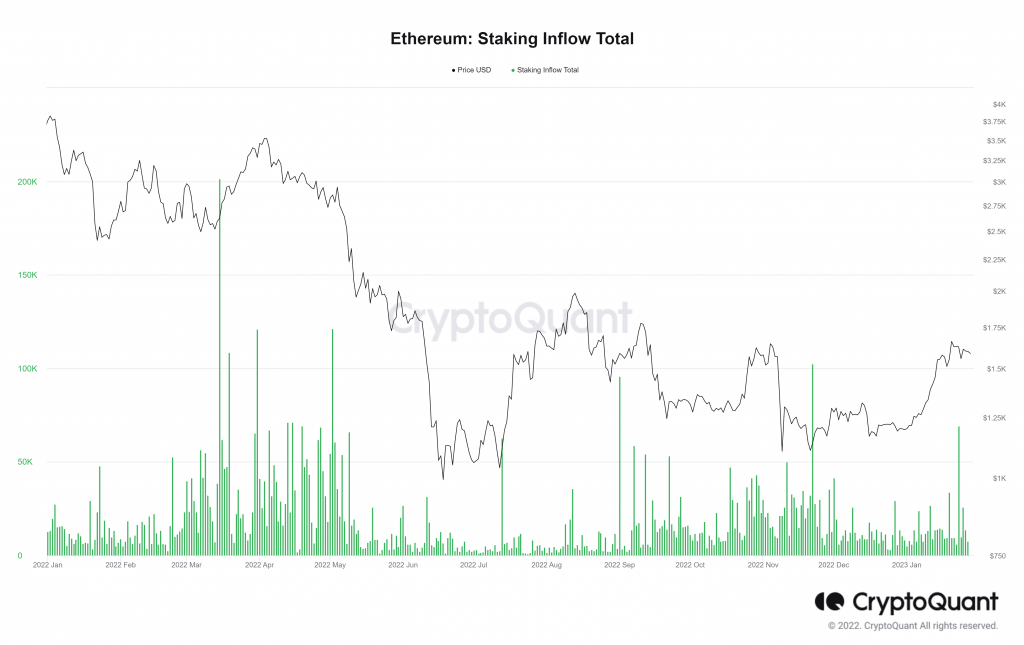

About 15.9 million ETH, equivalent to about 13.2% of the total supply, is staked on the beacon chain, and there are concerns about the corresponding selling pressure.

The total number of ETH staked has reached a new all-time high of 15,9 million

• Accounting for more than 13% of the total ETH supply.

1/6

pic.twitter.com/wesx84E2hK

pic.twitter.com/wesx84E2hK

— CryptoQuant.com (@cryptoquant_com) January 27, 2023

On the other hand, APR (annualized rate of return) is maintained at a high level of approximately 5.45%, and the ability to freely withdraw from the beacon chain eliminates the uncertainty of capital constraints and at the same time contributes to the improvement of liquidity. Therefore, even if staking is lifted, the amount of funds that can be used to secure profits is limited, and there are also those who believe that the total amount of deposits can be expected to increase after a certain amount of selling.

$ETH staking is going to explode after the Shanghai fork allows withdrawals- esp. now as Metamask integration makes it easy for Dummies.

But LSD tokens are overvalued in anticipation of this- revenue is not going to change much, bc reward yields will plunge as staking % goes up. pic.twitter.com/8DS99H207G

— Jordi Alexander (@gametheorizing) January 18, 2023

Capital-efficient mechanisms such as liquid staking protocols such as Lido and Rocket Pool are also prevalent, and the week saw the most stake inflows since November 2020.

Crypto Quant

MetaMask, the most popular digital wallet, has also released an Ethereum staking feature. Support liquid staking on Lido and Rocket Pool.

Relation:Cryptocurrency wallet MetaMask implements Ethereum staking function

In preparation for the Shanghai upgrade, Ethereum’s core development team will sequentially operate a test net such as “Zhejiang” to test withdrawal and deposit functions, and plan to use it for load and security checks and improving user experience.

The Zhejiang public testnet is going live tomorrow (1st of Feb 15:00 UTC, 2023). Shanghai+Capella will be triggered 6 days later (at epoch 1350). You will be able to deposit validators, practice BLS change and exit without risk All links are here: https://t.co/XNlsDIG0cm pic.twitter.com/sKKDJmolt2

— Barnabas Busa (@Barnabas Busa) January 31, 2023

Relation:What impact will the Shanghai upgrade scheduled for March have on the Ethereum market?

Click here for a list of market reports published in the past

The post Bitcoin rises to the $24,000 level on FOMC favorable impression, Ethereum exceeds 5% from the previous day appeared first on Our Bitcoin News.

2 years ago

160

2 years ago

160

English (US) ·

English (US) ·