Macroeconomics and financial markets

In the US NY stock market on the 28th, the Dow Jones Industrial Average fell 74 dollars (0.22%) from the previous day, and the Nasdaq Index closed at 36 points (0.27%) higher.

In addition to concerns about additional interest rate hikes by the Fed (Federal Reserve), there was disgust that the Biden administration was planning to tighten China’s export restrictions on semiconductors for artificial intelligence (AI). Friction concerns reignited. Semiconductor stocks such as Nvidia, which has led the market in the AI (artificial intelligence) boom, pushed down the index.

connection:US Apple continues to update high prices Stricter export restrictions on US semiconductors to China affect AI-related stocks | 29th Financial Tankan

connection:Stock investment recommended for cryptocurrency investors, representative cryptocurrency stocks of Japan and the United States “10 selections”

Virtual currency market

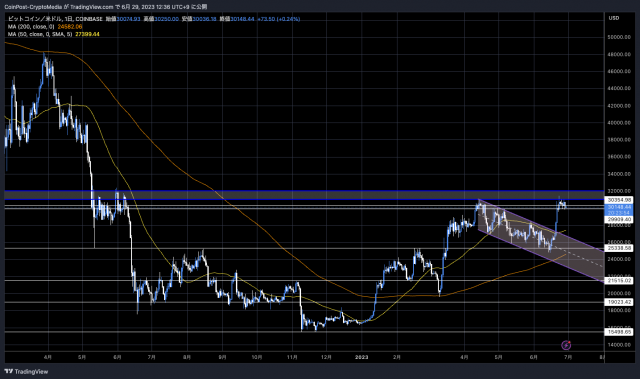

In the crypto asset (virtual currency) market, the Bitcoin price fell 1.04% from the previous day to 1 BTC = $ 30,151.

BTC/USD daily

Altcoins fell by 1.68% for Ethereum (ETH), 2.93% for XRP and 4.59% for Polygon (MATIC).

Volatility Shares 2x Leveraged Bitcoin Strategy ETF (BITX) began trading on the Cboe BZX exchange today. Trading volume was about $5.5 million on the first day, according to FactSet data.

Although the scale is above average, it is about 1/200 compared to the trading volume of “ProShares Bitcoin Strategy ETF (BITO)”, the first Bitcoin futures ETF approved by the U.S. SEC in October 2021. Staying.

Interest in BITO has grown rapidly in recent times, recording the largest weekly inflow for the year.

The Bitcoin Futures ETF $BITO had its biggest weekly inflow in a year as assets top $1b again. It also traded half a billion in shares on Friday, which it’s only done about 5 times before via @SirYappityyapp pic.twitter.com/Xrq0lUaaTO

— Eric Balchunas (@EricBalchunas) June 25, 2023

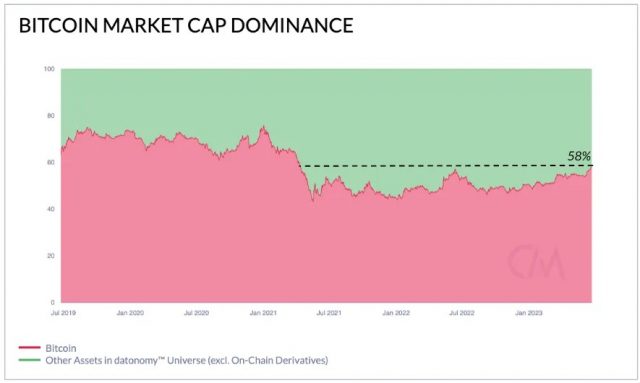

Dominance does not stop rising

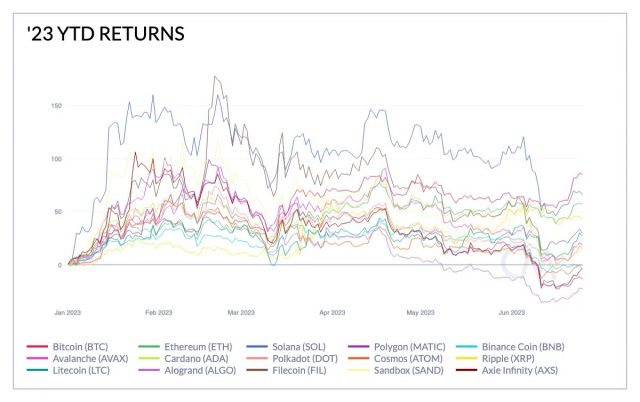

According to a report by data analytics firm Coin Metrics, Bitcoin (BTC) is up 85% year-to-date.

The market price of BTC once again surpassed the $30,000 level as a result of buying after the application for a Bitcoin ETF (exchange-traded fund) by BlackRock, the largest asset management company.

On the other hand, the U.S. SEC (Securities and Exchange Commission) sued a major crypto asset (virtual currency) exchange and designated many altcoins as “securities.” market dominance reached 58%, the highest level in two years.

Coin Metrics

Bitcoin is well decentralized and is seen as a commodity rather than a security.

Of the tokens above $1 billion in market capitalization, only two stocks, Bitcoin Cash (BCH) 102% and Lido (LDO) 104%, outperformed BTC in year-to-date returns. .

Ethereum (ETH), the second largest market capitalization, +57%, and Solana (SOL), which crashed last year due to the bankruptcy of FTX and Alameda Research, showed a relatively strong +65% since the beginning of the year, partly due to the reactionary surge. , The impact of the lawsuit by the US SEC (Securities and Exchange Commission) is still strong, and many altcoins are lagging behind.

Coin Metrics

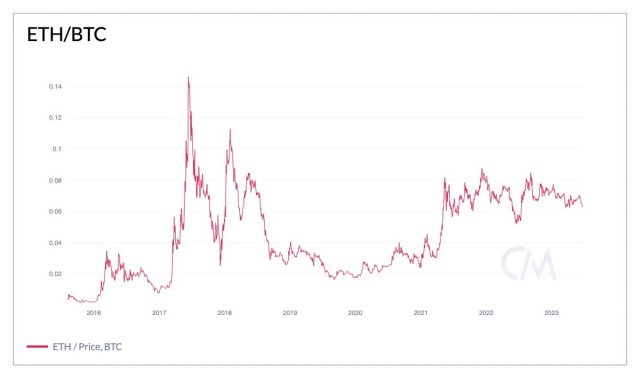

Comparing the performance of BTC and ETH, ETH/BTC rose to 0.087 in December 2021 near the peak of the bull market, but fell to 0.061 as of June 2023.

Coin Metrics

This is the lowest level since the summer of 2010, and currently it is calculated that about 16 ETH can be obtained with 1 BTC.

Around 21:00 on the 28th, it was found that Micro Strategy, a listed company that holds a large amount of Bitcoin (BTC), bought 12,333 BTC worth 50 billion yen ($347 million).

MicroStrategy has acquired an additional 12,333 BTC for ~$347.0 million at an average price of $28,136 per #bitcoinAs of 6/27/23 @MicroStrategy hodls 152,333 $BTC acquired for ~$4.52 billion at an average price of $29,668 per bitcoin. $MSTR https://t.co/joHo1gEnR0

— Michael Saylor (@saylor) June 28, 2023

(@saylor) June 28, 2023

This brings MicroStrategy’s average acquisition price to $29,668 and total holdings to reach 152,333 BTC, worth $4.52 billion.

connection:What is an exchange traded trust “Bitcoin ETF” | Why the application of BlackRock attracts attention

connection:Countdown to the next Bitcoin half-life less than a year away, market trends and expert predictions?

Click here for a list of market reports published in the past

[Recruitment]Recruitment of new personnel due to Web3 business expansion

Japan’s largest cryptocurrency media CoinPost is looking for full-time employees and interns as it expands its Web3 business.

1. Media Business (Editorial Department)

2. Marketing operations

3. Conference management and launch work

4. Open Position (students welcome)

Details https://t.co/UsJp3v8mSH pic.twitter.com/B98JZmoQbW

— CoinPost-virtual currency information site-[app delivery](@coin_post) February 14, 2023

The post Bitcoin’s $30,000 Knot Continues, MicroStrategy Buys BTC Worth $500 Million appeared first on Our Bitcoin News.

2 years ago

120

2 years ago

120

English (US) ·

English (US) ·