Macroeconomics and financial markets

In the US NY stock market on the 30th of the previous weekend, the Dow Jones Industrial Average rose 285 dollars (0.84%) from the previous day, and the Nasdaq index closed at 196 points (1.45%) higher.

U.S. Personal Consumption Expenditure (PCE) results fell slightly below market expectations, pushing U.S. Treasury yields lower. Inflation concerns have eased.

The market capitalization of Apple Inc., on a closing price basis, exceeded 3 trillion dollars (430 trillion yen) for the first time in the world, which also attracted the attention of the market. The Nasdaq stock market, which is centered on high-tech stocks, recorded a historical increase of +31.7% in the first half of this year, the highest rate in the past 40 years.

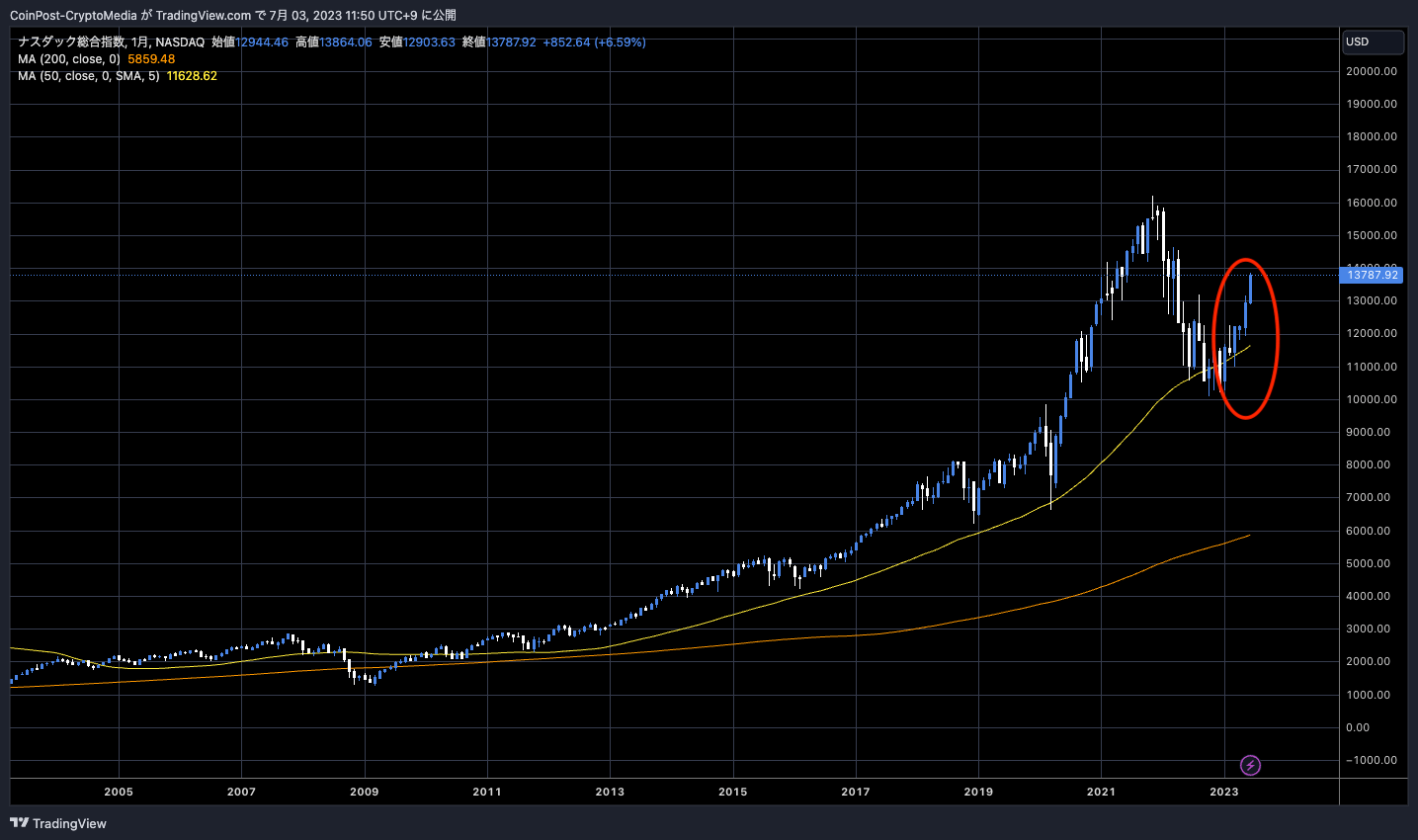

Nasdaq Index (Weekly)

Although there was a reaction to the risk-off trend and strong sales during the financial tightening phase last year, the AI (artificial intelligence) boom such as ChatGPT is also a tailwind.

connection:Bitcoin plummets on SEC comment, US Apple’s market capitalization tops $3 trillion for the first time at closing | 1st Financial Tankan

connection:Stock investment recommended for cryptocurrency investors, representative cryptocurrency stocks of Japan and the United States “10 selections”

Virtual currency market

In the crypto asset (virtual currency) market, the Bitcoin price rose 0.72% from the previous day to 1 BTC = $ 30,764.

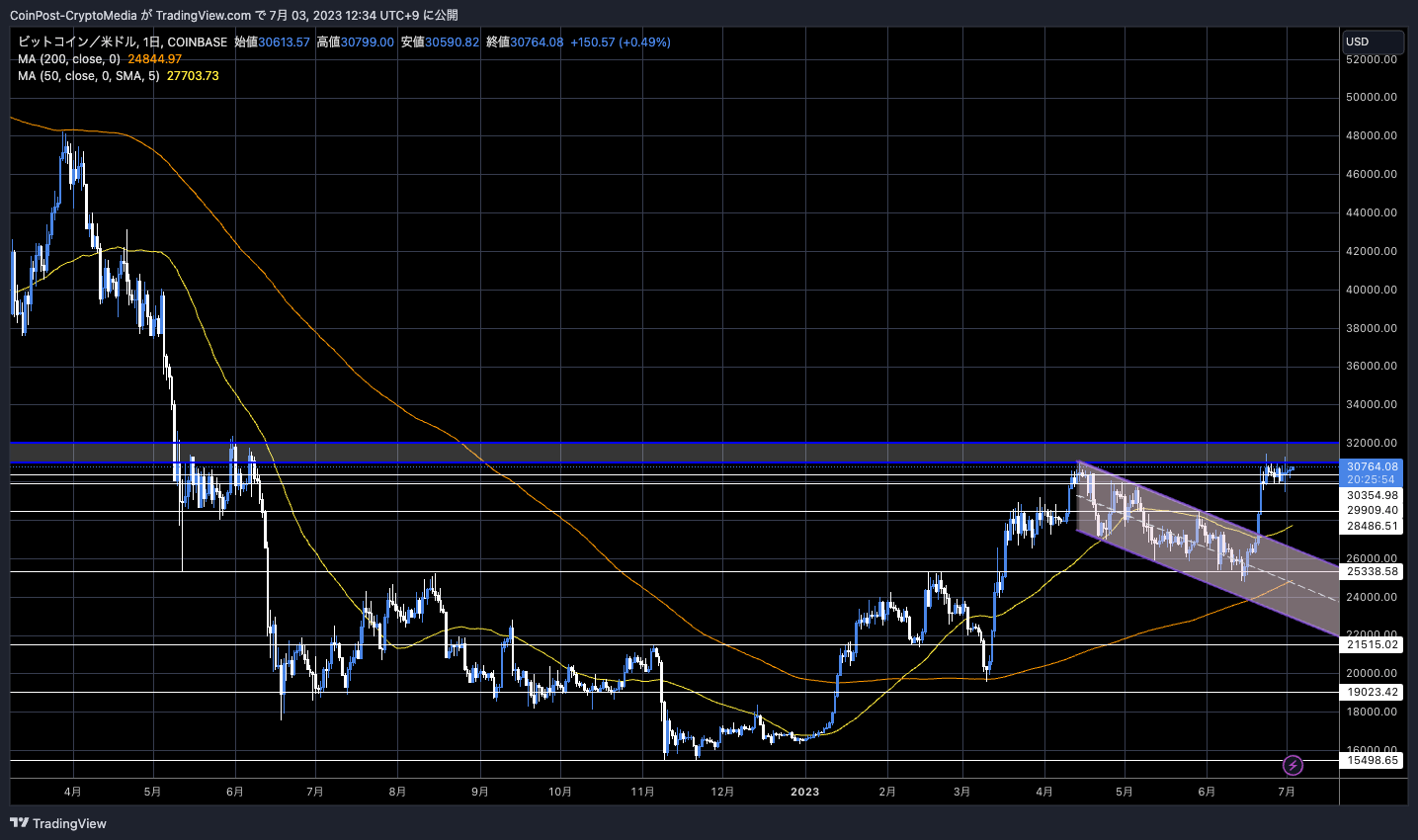

BTC/USD daily

Bitcoin’s year-to-date (first half of 2023) rate of change was +83.8%, which greatly outperformed the Nasdaq’s +31.7%.

Data shows that in the first half of 2023, Bitcoin increased by 83.8%, ranking first, far exceeding other major assets in the world.

The Nasdaq index rose 31.7%, ranking second, and other major national stock markets rose. The price of natural gas fell by 37%, ranking the… pic.twitter.com/bou05S8aH0

— Wu Blockchain (@WuBlockchain) July 2, 2023

altcoin market

Among major alts, Litecoin (LTC) soared over the weekend.

connection:Cryptocurrency Litecoin surpasses $ 100, background of soaring

In addition to the Bitcoin ETF (exchange traded fund) application by the largest asset management company BlackRock, the launch of “EDX Markets” invested by major financial institutions such as Citadel Securities, Fidelity Digital, Sequoia Capital, etc. .

On the other hand, the Wall Street Journal reported on June 30 that the SEC pointed out to officials of the Nasdaq and the Chicago Board Options Exchange (CBOE) that “there are inadequacies in the application documents for the Bitcoin ETF.” There was a time when the

After that, asset management companies applying for bitcoin ETFs filled in the necessary items and promptly resubmitted the screening documents, and after the plunge, BTC also rebounded with buybacks.

connection:SEC “Insufficient application for spot-type Bitcoin ETF”, Cboe updates documents such as Fidelity | Summary of important bulletins on the morning of the 1st

One of the reasons for the SEC’s findings is believed to be that it did not state who signed the “surveillance sharing agreement” to protect the products. Wise Origin, WisdomTree, VanEck, and Invesco Galaxy all list Coinbase Custody Trust Company as part of their surveillance sharing agreements.

It was not rejected, and in past cases, the examination of “Bitcoin ETF” was usually extended multiple times until the final decision deadline of 240 days.

At the time of 2019, former SEC Commissioner Jay Clayton was concerned about the “insufficient regulation of the crypto asset (virtual currency) industry and the lack of institutional investor-level custody services.” However, along with the expansion of the market size, the Bitcoin market has also matured in terms of regulations.

Winklevoss, founder of U.S. cryptocurrency exchange Gemini, said the U.S. SEC (Securities and Exchange Commission) continues to reject applications for physical Bitcoin exchange-traded funds (ETFs) on the grounds of investor protection. As a result, they have turned to riskier alternatives such as Grayscale Bitcoin Trust (GTBC), which charges higher fees.

Bitwise’s Matthew Hougan, reported by The Block, believes the first physical bitcoin ETF (exchange-traded fund) to be approved will dominate initial liquidity and could even become a share-winner. .

In the case of gold, SDPR’s Gold Trust boasts roughly twice the assets of its second-largest competitor’s financial products, he said. On the other hand, he stressed that specialist ETF providers like Bitwise also have advantages.

Investor interest in EDX stocks

The US SEC (Securities and Exchange Commission) has filed a lawsuit against Binance and Coinbase and pointed out that many PoS (proof of stake) altcoins are “unregistered securities”, but Bitcoin (BTC) have previously been defined as commodities rather than security (securities).

Therefore, it is possible that Bitcoin Cash (BCH) and Litecoin (LTC), which were born from hard forks from Bitcoin, were recognized as having superiority in terms of regulatory risk, and were, so to speak, endorsed by major U.S. financial institutions. are regarded.

Only four crypto assets, BTC, BCH, ETH, and LTC, were selected at the time of EDX Markets launch. Jamil Nazarali, CEO of EDX Markets, suggested that the company would be selected after carefully monitoring the movements of the SEC, showing confidence in its compliance with the SEC. Some see it as a vote of confidence.

Litecoin (LTC), which surged over the weekend, fell 6.1% month-on-month as of noon on June 30, despite being the same EDX stock, lagging far behind Bitcoin Cash (BCH), which rose 132%. However, it seems that the spearhead of the circular hunt was directed.

connection:EDX Markets, a virtual currency exchange funded by Wall Street Financial, opens in the United States

connection:What is an exchange traded trust “Bitcoin ETF” | Why the application of BlackRock attracts attention

connection:Countdown to the next Bitcoin half-life less than a year away, market trends and expert predictions?

Click here for a list of market reports published in the past

[Recruitment]Recruitment of new personnel due to Web3 business expansion

Japan’s largest cryptocurrency media CoinPost is looking for full-time employees and interns as it expands its Web3 business.

1. Media Business (Editorial Department)

2. Marketing operations

3. Conference management and launch work

4. Open Position (students welcome)

Details https://t.co/UsJp3v8mSH pic.twitter.com/B98JZmoQbW

— CoinPost-virtual currency information site-[app delivery](@coin_post) February 14, 2023

The post Bitcoin’s rise and fall rate in the first half of 2023 recorded 83.8%, No. 1 in all financial products appeared first on Our Bitcoin News.

2 years ago

165

2 years ago

165

English (US) ·

English (US) ·