Bitcoin (BTC)’s rise to $52,000 appears to have been driven by strong demand from American investors, according to trading data.

While the massive inflow into Bitcoin ETFs has been a hot topic, Bitcoin is trading at the highest premium in the past nine months on the U.S. cryptocurrency exchange Coinbase.

According to data from analytics firm CryptoQuant, the so-called “Coinbase Premium Index” (the price difference between the largest exchange Binance and Coinbase by trading volume) rose to 0.12 on the 15th, and is expected to rise to 5.5 in 2023. This is the highest level since March.

“The high premium could indicate strong buying pressure from American investors on Coinbase.” (CryptoQuant)

Meanwhile, on Coinbase, institutional brokers seem to be fulfilling client purchase orders for #Bitcoin.https://t.co/CBvH58cfIG pic.twitter.com/Opl3rAoCuR

— Ki Young Ju (@ki_young_ju) February 15, 2024

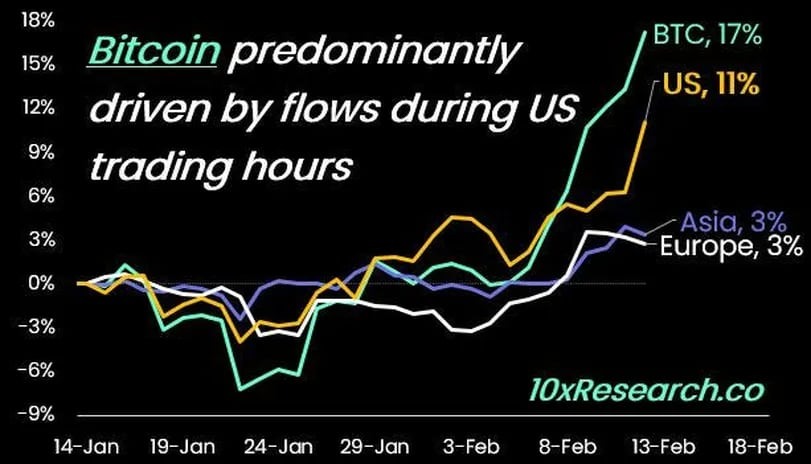

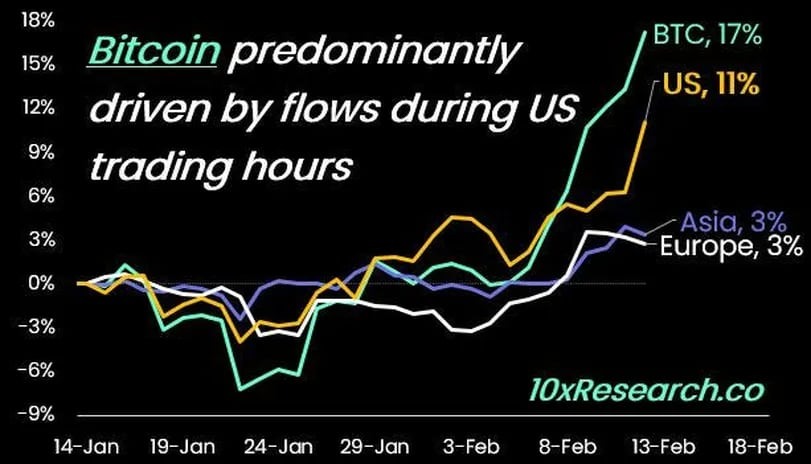

Markus Thielen of 10x Research pointed out that most of Bitcoin's price increase occurred during American trading hours.

“Over the past 30 days, Bitcoin has appreciated by 17%, of which 11% occurred during American trading hours,” he said in a report on Tuesday, adding that the price increase during Asian and European hours was 3%. He went on to say that it was too late.

(10x Research)

(10x Research)Bitcoin surpassed $52,000 this week, regaining a market cap of $1 trillion for the first time since December 2021. Bitcoin ETFs attracted approximately $500 million in net inflows each day. Bitcoin is up 22% in the past month, outpacing the CoinDesk20 (CD20), which reflects broader market trends, of 15%, according to CoinDesk data.

|Translation/Editing: CoinDesk JAPAN Editorial Department

|Image: 10x Research

|Original text: Bitcoin's Rise to $52K Is Driven by Strong US Demand, the Coinbase Price Premium Suggests

The post Bitcoin's rise is driven by American demand — Coinbase's price premium rises | CoinDesk JAPAN appeared first on Our Bitcoin News.

1 year ago

118

1 year ago

118

English (US) ·

English (US) ·