Cryptocurrency traders are increasingly interested in altcoins as 2023 draws to a close.

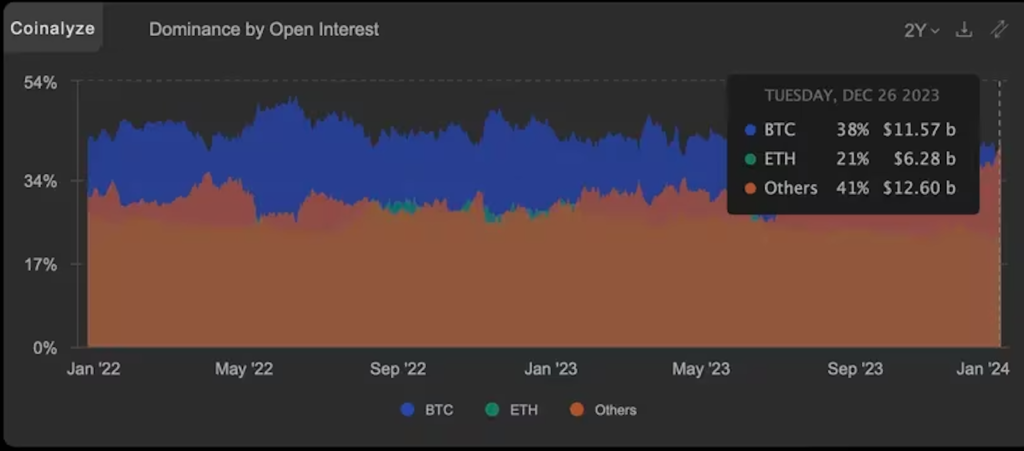

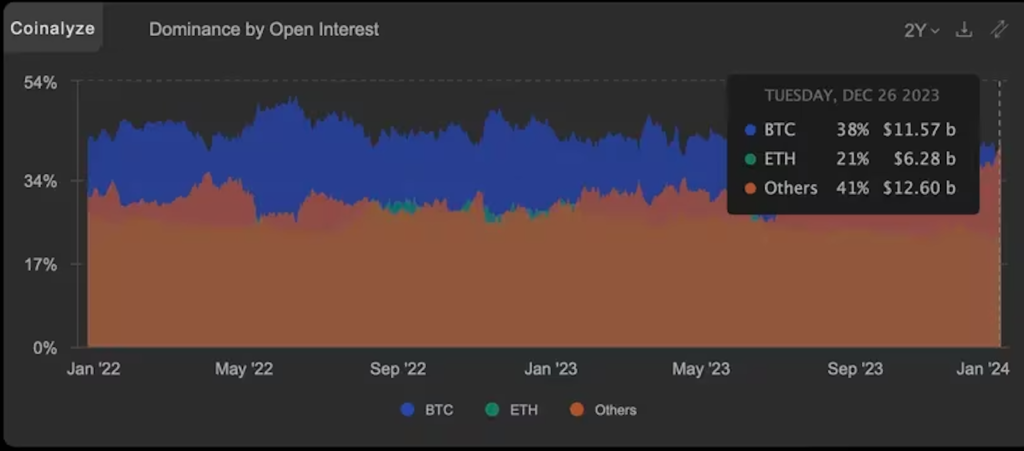

The dollar value locked in active futures contracts related to Bitcoin (BTC) is currently 38% of the total market’s notional futures open interest of $30.45 billion (approximately 4.26 trillion yen, at an exchange rate of 1 dollar = 140 yen). occupies . This is the lowest in two years, according to data tracked by Coinalyze.

“It seems like all the money is going to altcoins,” Coinalyze told CoinDesk, explaining BTC’s dominance in futures open interest is declining.

This data points to a resurgence of risk appetite in the crypto asset market, which is usually seen after a significant uptrend in Bitcoin.

Bitcoin, the top cryptocurrency by market capitalization, has soared more than 60% since October 1st. This is primarily due to lower federal funds rates and expectations that the US Securities and Exchange Commission (SEC) will approve one or more spot BTC exchange traded funds (ETFs).

As of this writing, BTC is up 156% year-to-date, while Ethereum (ETH), the second-largest cryptocurrency by market cap, is up 85%.

BTC’s dominance in open interest has declined from about 50% to 38% in two months. (Coinalyze)

BTC’s dominance in open interest has declined from about 50% to 38% in two months. (Coinalyze)As shown above, BTC’s share of futures open interest has fallen to 38% from nearly 50% in late October. While ETH has remained stable at nearly 21%, altcoins’ share has increased from 32% to 41%.

|Translation: CoinDesk JAPAN

|Edited by: Toshihiko Inoue

|Image: Coinalyze

|Original text: Bitcoin’s Share in Crypto Futures Trading Slides as Altcoin Profits Allure Traders

The post Bitcoin’s share in futures trading declines – funds flow to altcoins | CoinDesk JAPAN appeared first on Our Bitcoin News.

1 year ago

67

1 year ago

67

English (US) ·

English (US) ·