Macroeconomics and financial markets

In the US NY stock market on March 31, the Dow closed at $415 (1.3%) lower than the previous day. US Personal Consumption Expenditures (PCE) price index fell below market expectations, easing fears of prolonged inflation and monetary tightening.

Related: Nasdaq and AI-related stocks rise sharply Favorable slowdown in US inflation | 1st Financial Tankan

connection:Stock investment recommended for cryptocurrency investors, representative cryptocurrency stocks of Japan and the United States “10 selections”

Virtual currency market

In the crypto asset (virtual currency) market, Bitcoin fell 2.67% from the previous day to $27,715.

BTC/USD daily

The top price is heavy around $ 30,000, which was the bottom of the bull market in 2021, and the market continues to struggle in the latest high range while selling.

connection:Altcoin, with XRP at the top of the list, is Bitcoin still bullish | Contribution by bitbank analyst

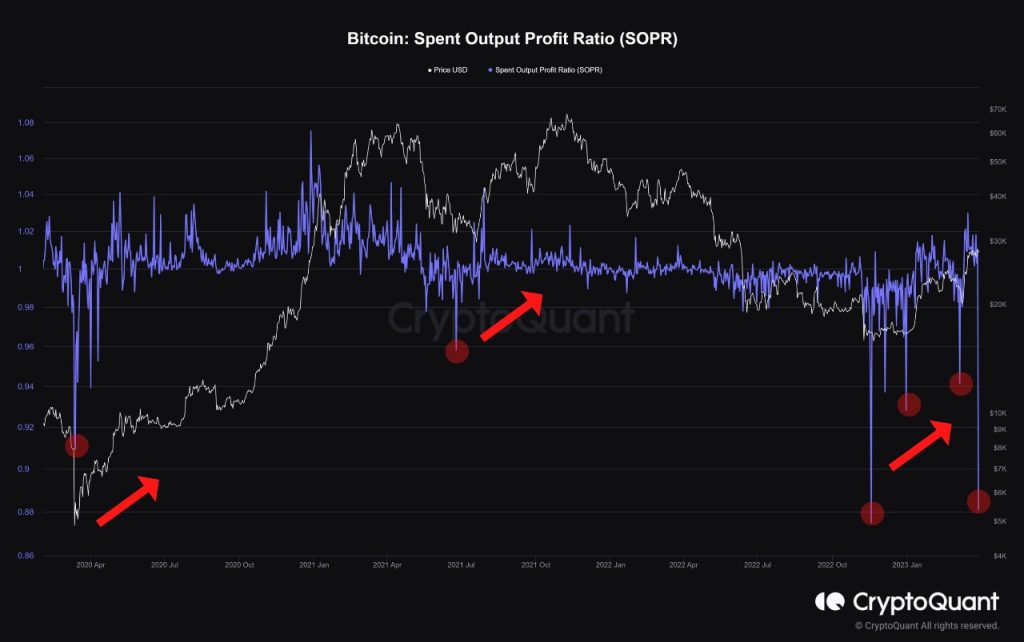

Bitcoin’s Spent Output Profit Ratio (SOPR) is at an all-time low, signaling a tipping point for the next cycle in history, said Tarekonchain, a chartered analyst at data analytics firm CryptoQuant.

Tarekonchain

SOPR is an index that evaluates the history of coins on the blockchain and calculates the difference between the purchase price at the time of receipt and the sale price at the time of remittance. A high SOPR suggests that many investors have taken profits, and a low SOPR suggests that many investors took losses and sold (cut losses).

In the past, strong reversal signals were confirmed in the March 2020 corona shock, the collapse of the second cryptocurrency bubble in May 2021, and the FTX shock in November 2022.

altcoin market

Arbitrum (ARB) prices plummeted by just under 20% at one point.

Before the 750 million ARB (approximately $1 billion) special grant budget proposal (AIP-1), which was first proposed in the token holder governance vote, was approved or disapproved by the Foundation. I found out that I was selling tokens. The foundation’s position that the governance vote was “ratification (formal)” highlighted the discrepancy in perception with the community.

Arbitrum foundation made a proposal (AIP-1) to allocate 750M ARB tokens for admin and op costs, but $ARB holders voted against it

Now they said the vote was just a formality, and they have already spent 50.5M (6.7%) of the proposed 750M $ARB

your vote is not vote pic.twitter.com/lvhBbBesum

— Eden Au (@0xedenau) April 2, 2023

connection:ARB Holders Voting Begins to Form Arbitrum Foundation

Arbitrum is Ethereum’s largest Layer 2 blockchain with Optimistic rollup technology. Last week, 12.75% of the total supply of 10 billion coins was airdropped and distributed to nearly 300,000 digital wallets.

42.78% of 4.278 billion ARB will be allocated to treasury managed by Arbitrum DAO.

Eden Au, head of research at The Block Research, points out that the foundation has 700 million dollars, even though about 70% of the community voted against the attribution, citing “opaque use”. It is suspected that 50 million ARB, which is 6.7% of the 50 million ARB, has already been used.

In response to community turmoil over centralized decision-making, which seemed to disregard the rights of governance tokens, the foundation said, “At the moment, a complete transition to DAO is unrealistic, and it is necessary to raise funds to cover operating costs. However, the communication was inadequate.In the short term, we have no plans to sell any more tokens.”

In order to put an end to the situation, we decided to re-vote by dividing into segments, changed the name to the “ecosystem development fund” instead of special subsidies, and disclosed a report that ensures transparency regarding where the funds are used. expressed.

Thanks to all the DAO participants and delegates for their feedback on AIP-1.

More details in the thread

— Arbitrum ( ,

,  ) (@arbitrum) April 2, 2023

) (@arbitrum) April 2, 2023

Click here for a list of market reports published in the past

[Recruitment]Recruitment of new personnel due to Web3 business expansion

Japan’s largest cryptocurrency media CoinPost is looking for full-time employees and interns as it expands its Web3 business.

1. Media Business (Editorial Department)

2. Marketing operations

3. Conference management and launch work

4. Open Position (students welcome)

Details https://t.co/UsJp3v8mSH pic.twitter.com/B98JZmoQbW

— CoinPost-virtual currency information site-[app delivery](@coin_post) February 14, 2023

The post Bitcoin scrambled in the latest high price range, Arbitrum fell 20% from the previous day appeared first on Our Bitcoin News.

2 years ago

132

2 years ago

132

English (US) ·

English (US) ·