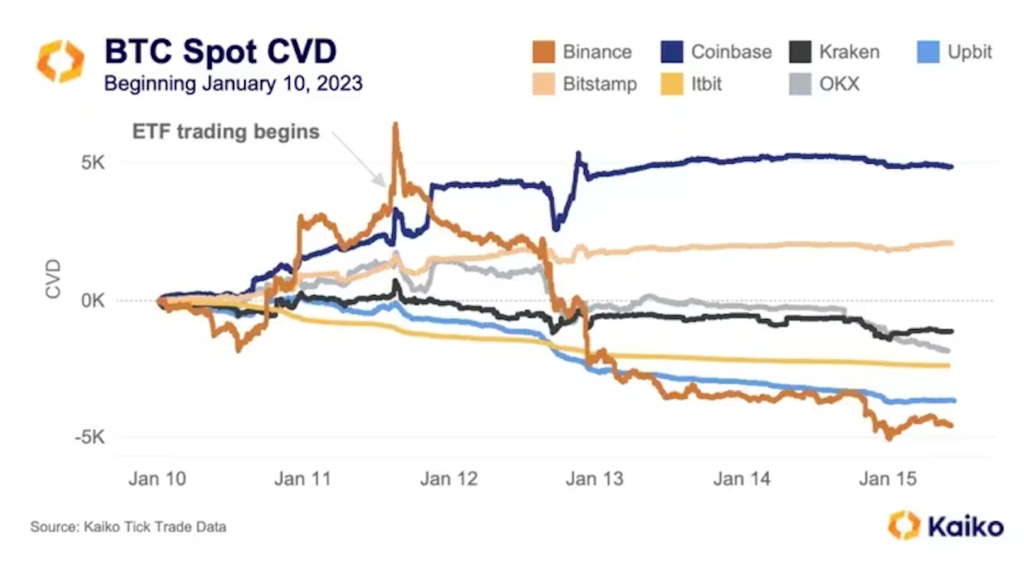

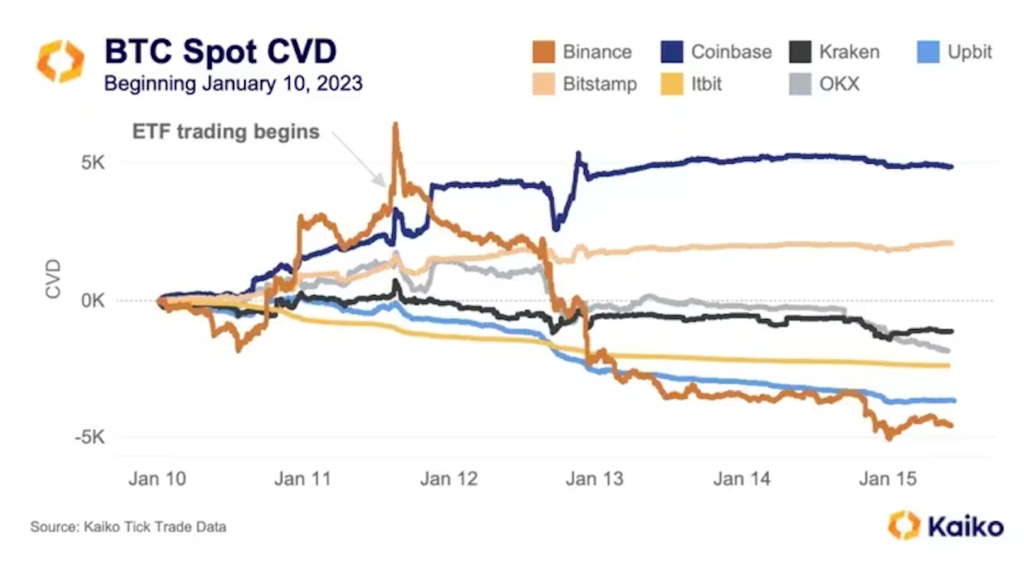

Bitcoin (BTC) has been under selling pressure since exchange-traded funds (ETFs) began trading in the United States on January 11 last week. Data tracked by Paris-based Kaiko shows selling pressure is concentrated on the top crypto exchanges by volume: Binance, OKX and Upbit. There is.

Bitcoin, the cryptocurrency with the highest market capitalization, was trading at around $42,800 at the time of writing, down 12% from its all-time high of $48,975 on the 11th. The drop in price appears to be due to traders taking profits on long positions initiated in anticipation of the ETF’s debut.

An indicator called Cumulative Volume Delta (CVD) shows that traders on Binance led the so-called “selling on news” pullback in Bitcoin. CVD tracks the net difference between buy and sell volumes over time and is the sum of the net bullish and bearish pressure in the market. Positive values indicate excessive purchases; negative values suggest otherwise.

Binance’s spot market CVD turned positive on the 11th, but has continued to fall since then, resulting in capital outflows worth almost 5,000 BTC, according to Kaiko data. South Korea’s Upbit has seen the second-largest capital outflow, followed by Itbit and OKX.

“The ETF began trading last Thursday and saw a significant increase in Cumulative Volume Delta (CVD) on all major exchanges. In the hour before and after the US market opened, nearly 3000 BTC was bought on the market on Binance. , as some feared, this news led to a sell-off and Binance’s CVD quickly went negative, similar to OKX,” Kaiko said in its weekly report published on Monday.

“ItBit, another institutional exchange, showed consistent selling, albeit with lower volumes, and Upbit also showed consistent selling with little reversal,” Kaiko added.

Bitcoin spot CVD measures net capital flows on major exchanges since January 10th. (Kaiko)

Bitcoin spot CVD measures net capital flows on major exchanges since January 10th. (Kaiko)Coinbase and BitStamp, the custodial partners for most ETFs, have maintained positive CVDs, suggesting net capital inflows amid weak prices.

According to some analysts, BTC price could fall below $40,000 before the sell-off loses momentum. This fell far short of Bloomberg analysts’ predictions of $4 billion (approximately $580 billion, equivalent to 145 yen = 1 dollar) inflows on the first day alone, underscoring the possibility that prices could fall further.

On the second day of trading, #BTC ETFs (Jan 12th) saw inflows of USD677mn (ex-Grayscale). The cumulative first two trading days of the BTC ETFs have a balance of $1.4bn ex-Grayscale and $0.8bn including grayscale.

More than half of the flows went to the iShares Bitcoin ETF… pic.twitter.com/vtVXdXfvvN

— Exante Data (@ExanteData) January 15, 2024

|Translation: CoinDesk JAPAN

|Edited by: Toshihiko Inoue

|Image: Kaiko

|Original text: Bitcoin’s ‘Sell The Fact’ Pullback Came From Binance, OKX: Kaiko

The post Bitcoin “selling on news” is led by Binance and OKX: Silkworm | CoinDesk JAPAN appeared first on Our Bitcoin News.

1 year ago

114

1 year ago

114

English (US) ·

English (US) ·