The post Bitcoin Set to Crash to $50K: Are You Ready for the Fall? appeared first on Coinpedia Fintech News

Bitcoin has been trapped in a downtrend since it touched the $73,000 mark. It has been struggling to break the road to bear for almost six months now. There have been a lot of factors that canned the uprising of Bitcoin including the German government selling seized BTC, Mt. Gox creditors repayments, wars in the Middle East and a lot more events. Even if we exclude these reasons, August and September have been bearish months for Bitcoin for over a decade. I have previously covered why the September crash is helpful in bringing bullishness for Bitcoin in next months. Let’s uncover some reasons why there is a chance Bitcoin can go down to $50,000.

Profit Vs Loss

Bitcoin is trading at $56,685 at the time of writing. There are 1.51 million bitcoin addresses with a combined holding of 618,430 BTC who bought the asset between the price of $55,852 to $58,305. These wallets are at the breakeven point.

However, just above this mark, there are more than 4.50 million addresses that hold 1.81m bitcoins. There is a high chance that most of these addresses will take profit as soon as the price reaches there. Why would they take profit? Because overall market sentiment is bearish and traders might believe the price will go down further. Data from IntoTheBlock shows that 78% of BTC investors are sitting at a profit. There are 19% people who bought bitcoin above current price level and hence they are in loss. 3% investors bought BTC at the current price.

Bitcoin Liquidation and Position Trends

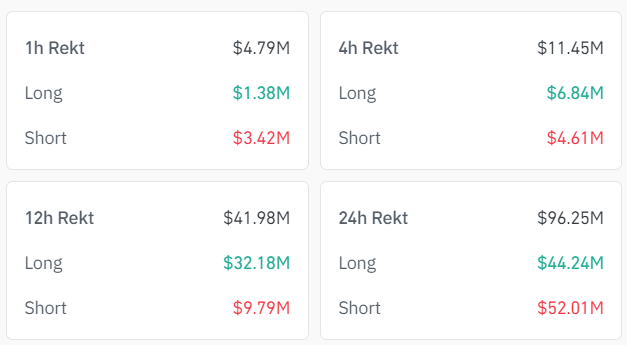

Bitcoin in the last 24 hours has moved between a confined zone of $56,388 to $58,315. During this movement a total of $96.25M worth of trades are liquidated.

If we see the 24 hour data, it looks like btc is bullish however 12 and 4 hourly data says otherwise. In the last 12 hours a total of $41.98 million worth of Bitcoin trades were liquidated with a majority of long trades that constituted $32.18m.

Market Sentiment

More than 88% of the people invested in bitcoin are retail, meaning they are short term investors or just traders. On the other hand 10.48% investors are long term holders and around 1.26% are the whales. The retail investor gets scared if there is a red on the chart, a long term investor knows that it is a correction while a whale sees it as an opportunity.

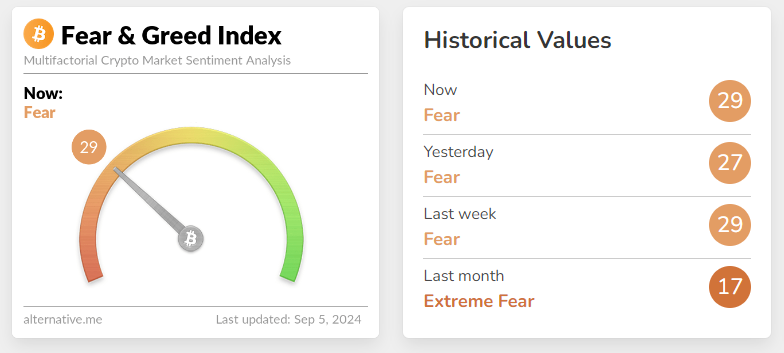

A common strategy that makes whales uncommon is that they start to buy when others sell at losses. Recent on-chain data suggests that a number of whales have sold some part of their bitcoin at a loss. They did it because they are aware the market is in fear, and they will get a buy opportunity soon. The fear and greed index has been on the fear side for over a month. In the previous weeks, we have seen bitcoin falling to up to 15% in a single day. The nearest solid support for BTC lies at $50,520. Bitcoin has validated this support just last month.

Looking Ahead

Analyzing all the data from various sources and market sentiment, Bitcoin drop to $50k looks imminent. Bitcoin has a full month of historical bearishness to compete. This is an open opportunity for all who understand the value and movement of BTC, however most of the investors will stay scared until BTC reclaims at least $65,000. This is not financial advice, you should take decisions based on your due diligence.

What are you going to do, Buy, Sell or HODL?

11 months ago

50

11 months ago

50

English (US) ·

English (US) ·