Macroeconomics and financial markets

In the US NY stock market on the 15th, the Dow closed at $38.78 (0.11%) higher than the previous day and $110.45 (0.92%) higher.

Following the U.S. employment statistics and the CPI (U.S. consumer price index), the U.S. retail sales figures announced earlier this morning also exceeded market expectations, smoldering concerns about further interest rate hikes by the Fed (Federal Reserve). With the US Producer Price Index (PPI) coming up this evening, we can see a glimpse of the market sentiment that is trying to ascertain the trend of the index.

December’s PPI, which was announced last month, marked the sharpest decline since the corona shock that occurred in March 2020, and is one of the evidences supporting the disinflationary process.

As for individual stocks, cryptocurrency-related stocks rebounded sharply as the cryptocurrency (virtual currency) market soared. Coinbase rose 17.46% from the previous day, MicroStrategy rose 10%, and mining company Marathon Digital rose 18.3%.

connection:Cryptocurrency-related stocks such as coinbase overall rise U.S. retail sales in January exceeded expectations | 16th Financial Tankan

connection:Stock investment recommended for cryptocurrency investors, representative cryptocurrency stocks of Japan and the United States “10 selections”

Virtual currency market

In the crypto asset (virtual currency) market, Bitcoin soared to $24,632, up 11.39% from the previous day.

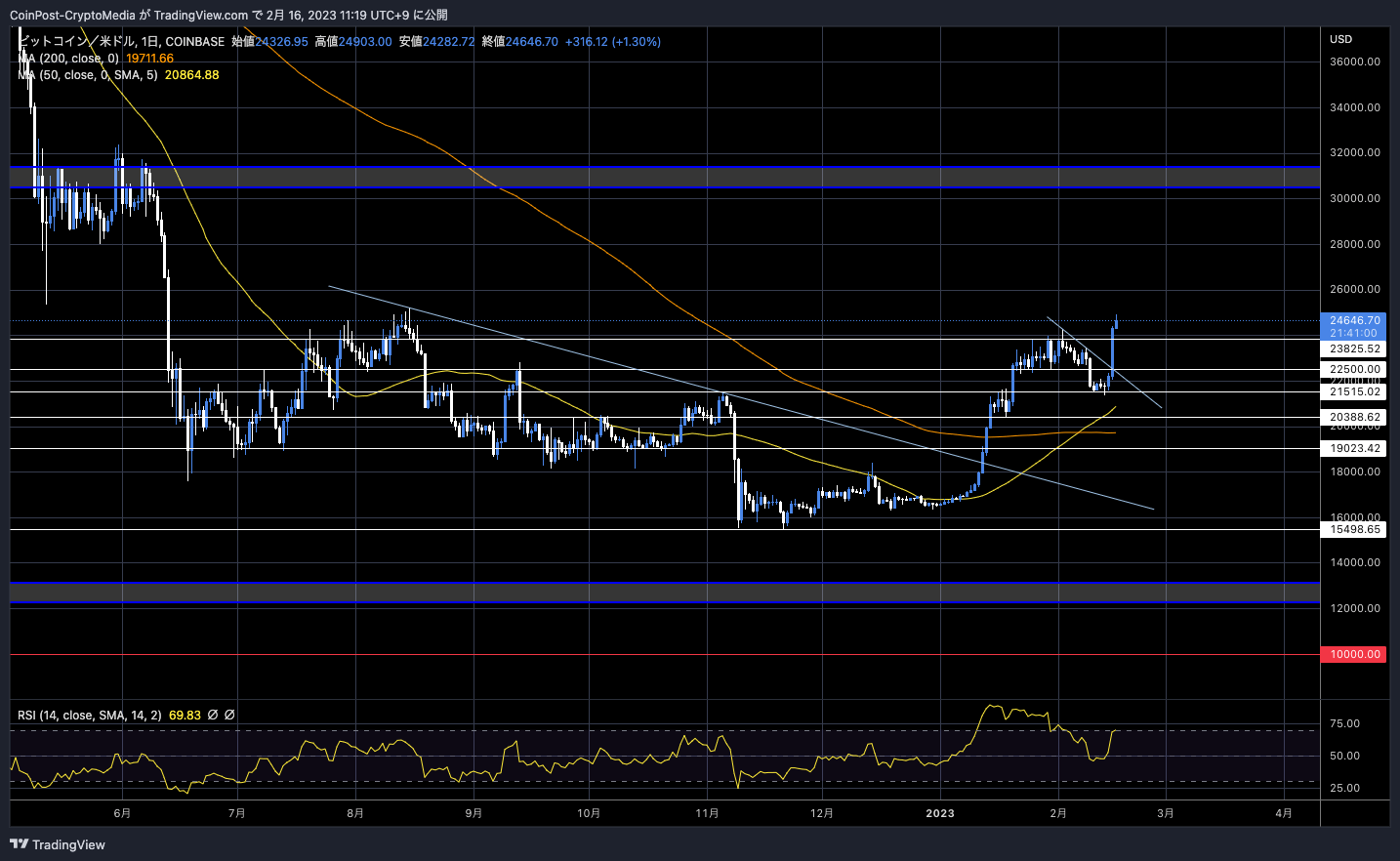

BTC/USD daily

It reached the $24,000 level, the highest price in six months since August 2010. It outperforms major alts Ethereum (ETH), up 9.5%, BNB, up 8.74%, and XRP, up 6.04%.

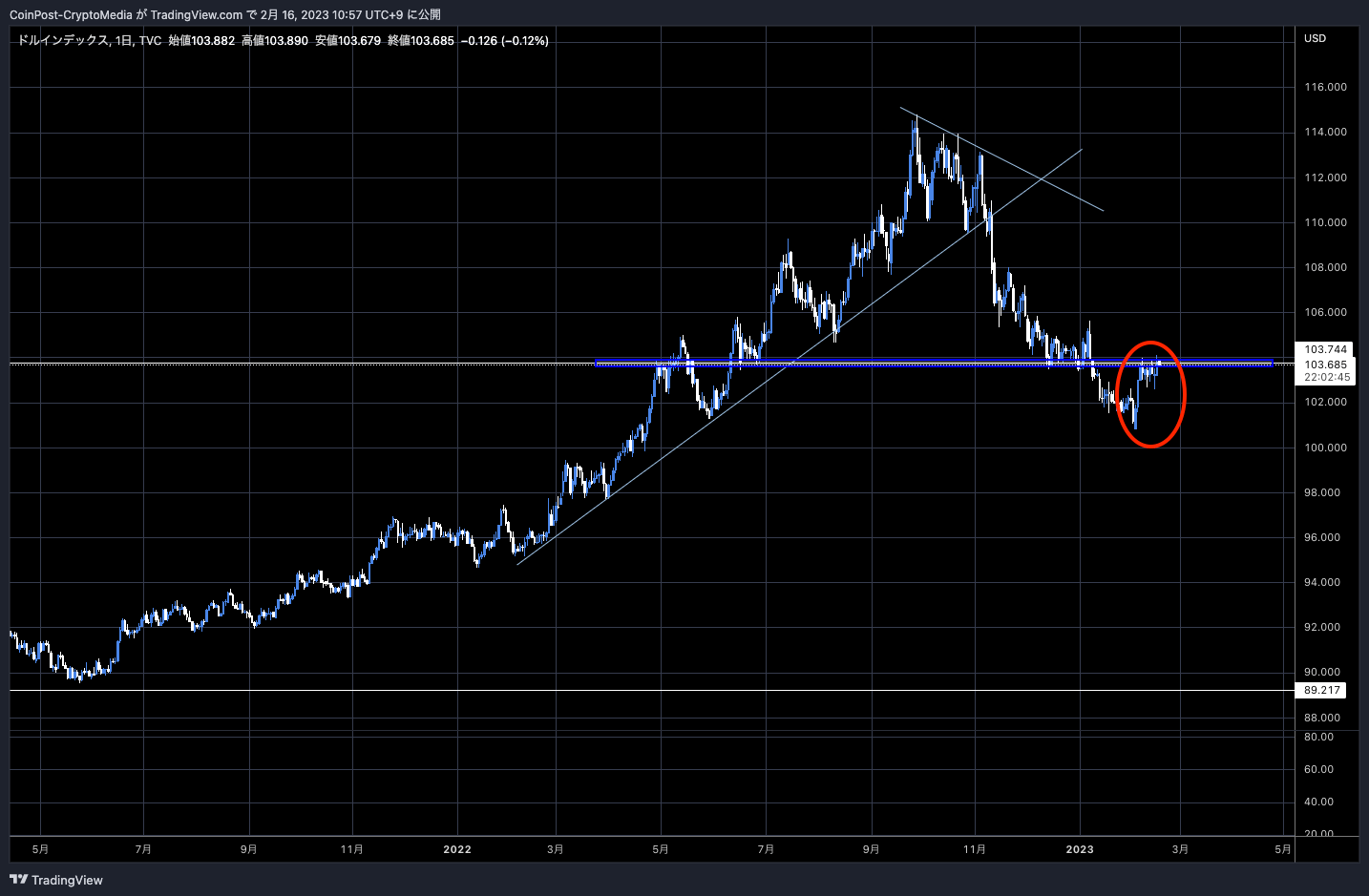

The fact that the “dollar index”, which had rebounded sharply since the employment statistics, took a break at the resistance line (upper resistance line) also boosted the rise in risk assets.

DXY/USD Weekly

After the U.S. employment statistics greatly exceeded market expectations, the fact that the CPI (U.S. Consumer Price Index), which had been wary of, passed without incident brought a certain amount of relief, and negative factors such as regulations by the financial authorities plunged one after another. Invited buyback of crypto assets (virtual currency).

The U.S. SEC (Securities and Exchange Commission) has targeted securities issues surrounding altcoins, such as Ripple, which issues XRP, and PoS currency staking services, including Ethereum (ETH). There are indications that they are gathering.

Has anyone considered that #BTC is pumping because people are converting their #ALTs back to #BTC? pic.twitter.com/ESLlaoTpnw

— Benjamin Cowen (@intocryptoverse) February 15, 2023

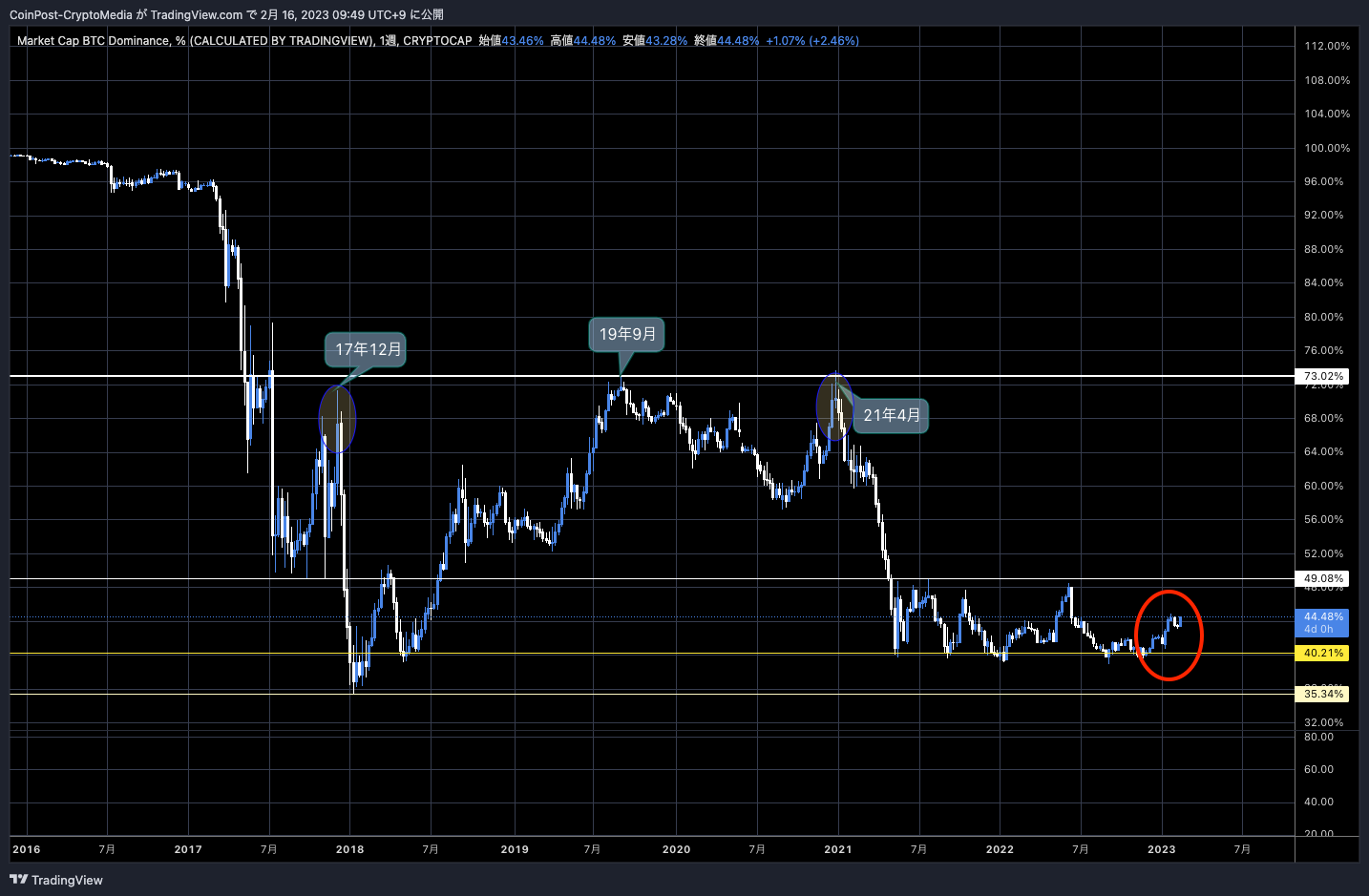

On the other hand, the altcoin market is circulating, centering on new issues, and BTC dominance has risen to nearly 45%, so the “alt drain” phenomenon has not appeared.

BTC Dominance Weekly

As a background to the rise, since February 2011, “Ordinal Punks (Bitcoin Punks)”, a clone version of “Cryptopunks”, which is traded at a high price as the original collectible of Ethereum (ETH), has gained speculative popularity, and the active address of Bitcoin One of the reasons is said to be the rapid increase in the number of wallets (excluding wallets with a balance of 0).

connection:Bitcoin version of “CryptoPunks” soars in price, trading at 27 million yen

Ordinal Punks are issued on the Ordinals Protocol, which launched in January this year. Ordinal is a protocol designed by former Bitcoin Core developer Casey Rodarmor that allows NFTs (digital artifacts) to be stored directly on the Bitcoin chain without going through sidechains, Layer 2, etc.

Specifically, by assigning a serial number to the smallest unit “satoshi” that represents 1/100 million in Bitcoin, it is possible to search, transfer, and receive satoshi units, and it is also possible to include video and image data in satoshi. It became possible.

connection:Biggest 4MB Bitcoin NFT Ever Minted, Community Controversial

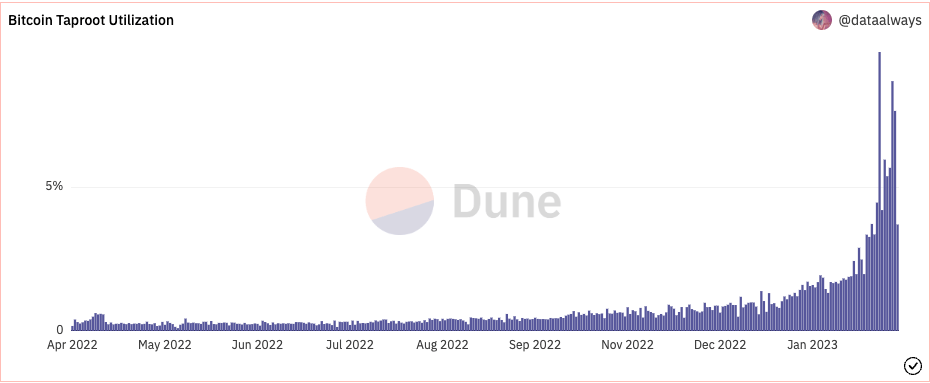

Bitcoin’s NFT (Digital Artifact) introduced an algorithm called Schnorr signature in November 2021, about four years after Segwit, and was implemented for the purpose of improving network privacy and efficiency. It was realized by using the new functions introduced in the large-scale upgrade “Taproot”.

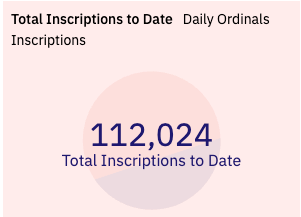

Ordinal NFTs are trading at high prices through OTC trading, and according to data from Dune Analytics, the number of NFTs inscribed directly onto the Bitcoin blockchain through the protocol was Feb. 6. It was about 7,000 as of today, but it rapidly expanded to about 50,000 as of February 11th. As of the 16th, it exceeded 112,000.

Dune Analytics

In addition to Ordinal Punks, collections such as Bitcoin Shrooms and Astral Babes are attracting attention, and NFTs are different from their original development use. It will lead to soaring prices,” some said.

On the other hand, there is also a positive opinion that “it creates new network value and economic effects.” Taproot usage has skyrocketed since February.

Dune Analytics

Projects moving to Ordinals include the popular DeGods from the Solana NFT collection. On the 15th, Coinbase’s Bitcoin-based digital wallet Xverse added support for Ordinal.

Ready to inscribe BTC Ordinal NFTs?

For the past year, we’ve focused on building the most advanced Bitcoin wallet.

Today, we’ve launched 1st class support for ordinals.

Try it for yourself using our quick guide below! pic.twitter.com/Lx3Ey5aZV0

—Xverse (@xverseApp) February 15, 2023

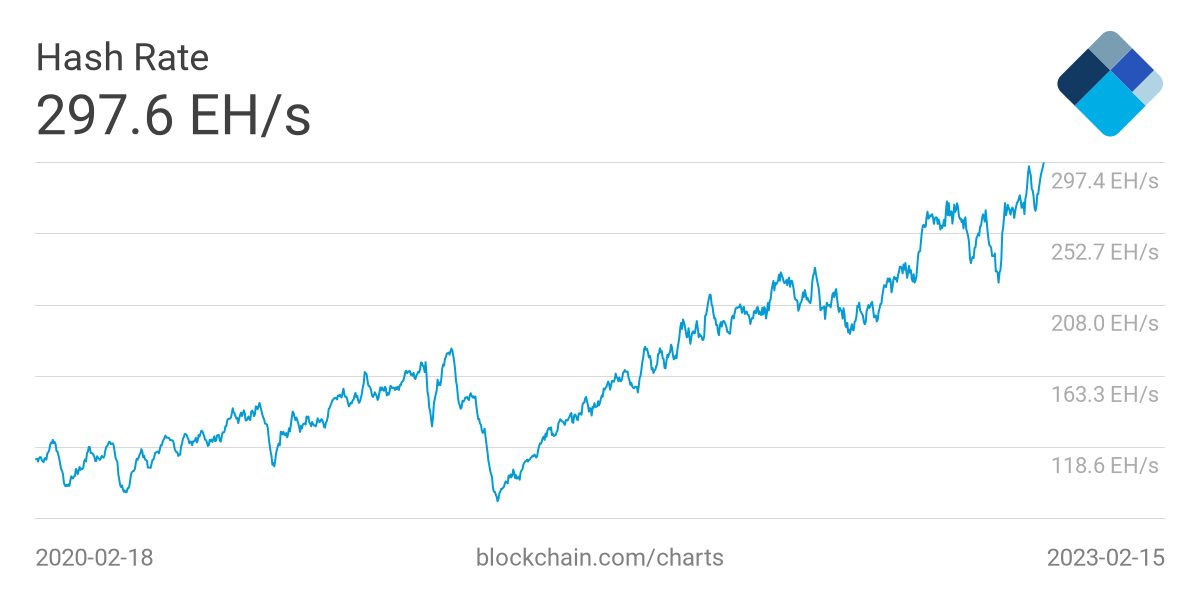

Hashrate hits all-time high

Bitcoin hash rate (mining speed) hits all-time high. Temporarily reached 300TH/s.

Hashrate

According to TheMinerMag’s head of research, mining companies have been heavily financed and have significantly increased their mining capacity since the middle of the bull market in late 2021. Several companies went bankrupt due to the crash.

The re-rising of the hash rate suggests that the unprofitable weak miners have been weeded out and the generational change has progressed. It has been pointed out that recent declines in natural gas prices have led to lower electricity costs for miners. Natural gas futures prices fell on improved supply prospects. Record high energy prices are easing.

Click here for a list of market reports published in the past

The post Bitcoin soared to $ 24,000, the background of the rise appeared first on Our Bitcoin News.

2 years ago

157

2 years ago

157

English (US) ·

English (US) ·