Macroeconomics and financial markets

In the US NY stock market on the 27th, the Dow closed at $72.17 (0.22%) higher than the previous day and the Nasdaq at $72.03 (0.63%) higher.

connection:NY Dow and others are in positive territory, US Fed rate hike expectations after May | 28th Financial Tankan

connection:Stock investment recommended for cryptocurrency investors, representative cryptocurrency stocks of Japan and the United States “10 selections”

Market concerns over persistently high inflation have increased further. Last month’s Personal Consumption Expenditure (PCE) price index, released on the 24th, hit 4.7%, well above market expectations of 4.3%.

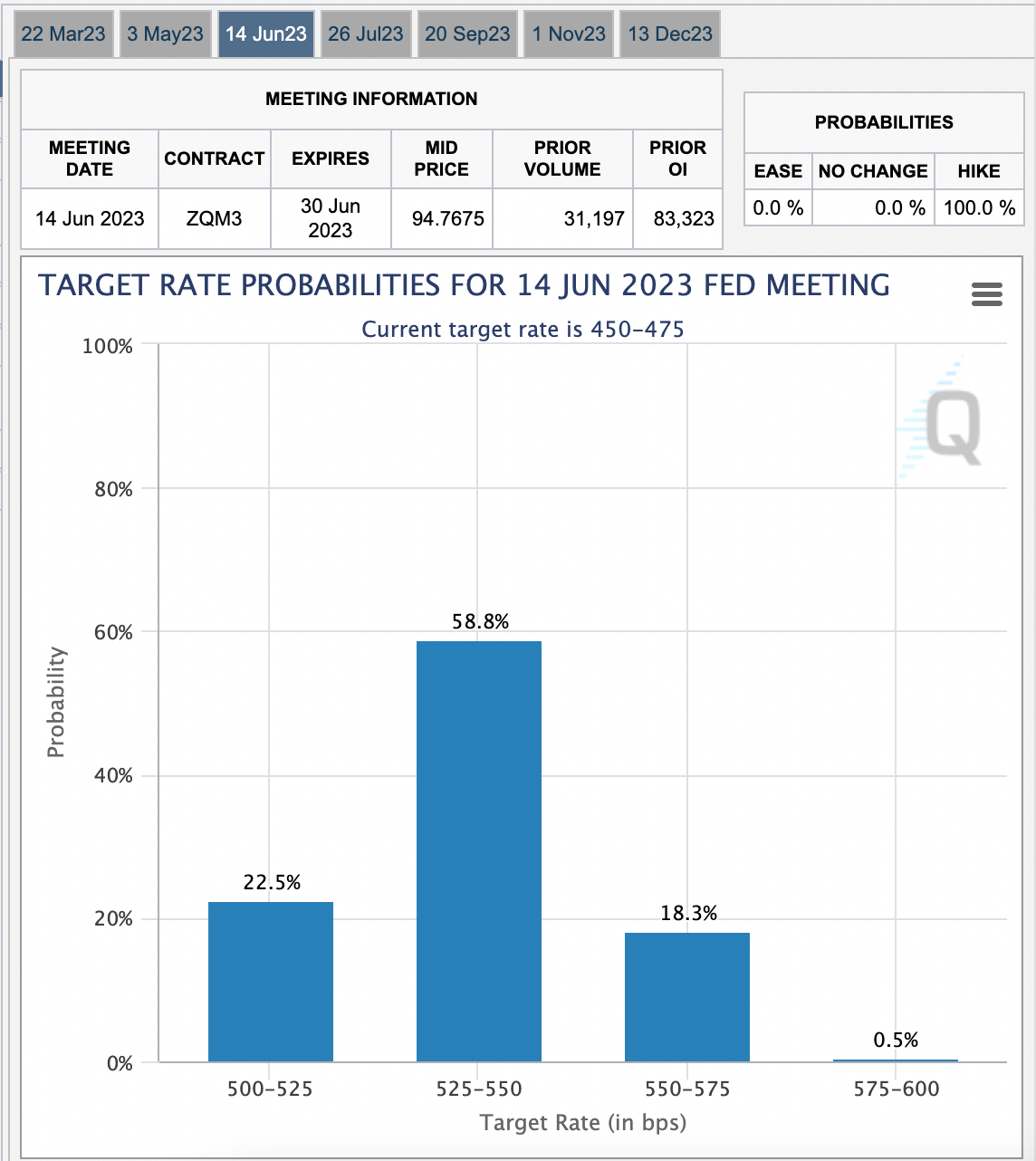

Since February, the US employment statistics and CPI (US consumer price index) figures have exceeded market expectations across the board, and a 0.5bps hike in interest rates is being factored in at the next US Federal Open Market Committee (FOMC) meeting.

Source: CME

Recently, there is also a view that the US policy rate will be raised to 6.5%, and as speculation about an early pause in US interest rate hikes has receded, stocks and Bitcoin are facing downward pressure.

According to a weekly report from asset management firm CoinShares, institutional investors’ outflows into digital assets such as cryptocurrency mutual funds totaled $12 million for the third consecutive week.

Inverse (short) products are also the main source of inflows, suggesting that investor sentiment has been eroded following the release of recent strong macroeconomic data.

Virtual currency market

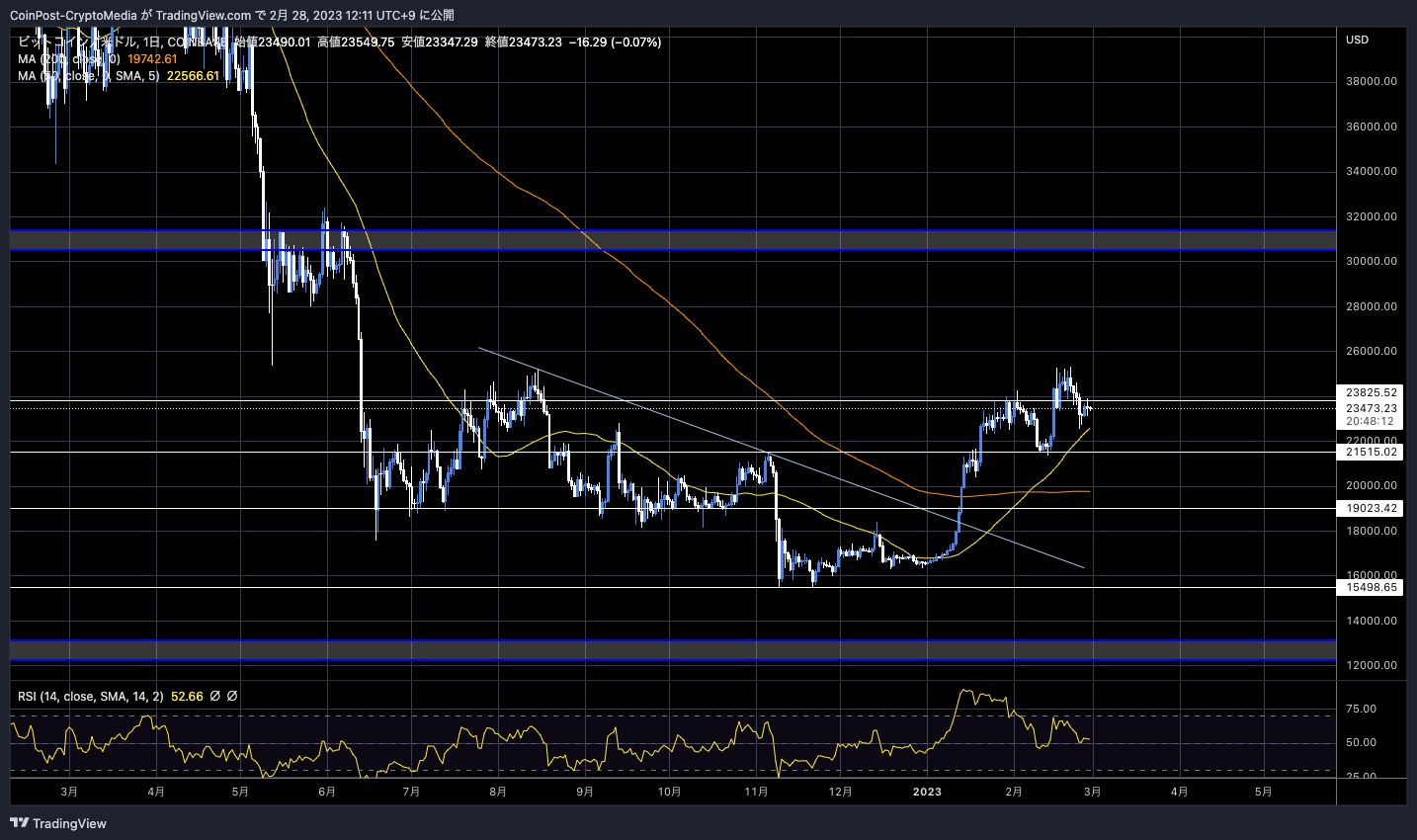

In the crypto asset (virtual currency) market, Bitcoin fell 0.46% from the previous day to $23,498.

BTC/USD daily

Selling pressure is likely to intensify at $23,800 as the resistance line.

Ethereum (ETH) fell 0.7% to $1,632. According to data from Santiment, a blockchain analytics platform, Ethereum loss-cutting behavior is becoming apparent.

#Bitcoin & #Ethereum are both having more traders sell at a loss than at a profit this week, the first such week so far in 2023. Historically, once the crowd is exiting their positions more frequently at a loss, bottoms are more likely to form. https:/ /t.co/maEg5sDHM6 pic.twitter.com/0kvPUzbTQm

#Bitcoin & #Ethereum are both having more traders sell at a loss than at a profit this week, the first such week so far in 2023. Historically, once the crowd is exiting their positions more frequently at a loss, bottoms are more likely to form. https:/ /t.co/maEg5sDHM6 pic.twitter.com/0kvPUzbTQm

—Santiment (@santimentfeed) February 26, 2023

The MVRV ratio remains positive and the long/short ratio is shrinking, so it seems that short-term holders are mainly cutting losses. The MVRV ratio is calculated by dividing the market capitalization of Bitcoin by the Realized Cap, and is one of the indicators that shows the top of the bull market and the bottom of the bear market.

Recently, due to the bankruptcy of the major crypto asset (virtual currency) exchange FTX in November last year, regulatory authorities, especially in the United States, have been facing increasing pressure.

At the G20 chaired by India, International Monetary Fund (IMF) Director Georgieva said, “The option of banning cryptocurrency trading should not be ruled out,” considering financial stability risks. US Treasury Secretary Janet Yellen has also argued that cryptocurrencies need a strong regulatory framework. On the other hand, she left a hint that she “doesn’t propose an outright ban”.

connection:India’s G20 Presidency Leads Discussions on International Cryptocurrency Policy

U.S. SEC (Securities and Exchange Commission) Chairman Gensler argued in an interview with New York Magazine that all crypto-assets other than Bitcoin could fall under the jurisdiction of the SEC. A lawyer familiar with crypto-assets has pointed out, “Some aspects lack legal grounds. The final interpretation of the law is left to the judge.”

Coinbase announced on the 28th that it will stop trading the US dollar-linked stablecoin Binance USD (BUSD) based on its internal monitoring and review process.

We regularly monitor the assets on our exchange to ensure they meet our listing standards. Based on our most recent reviews, Coinbase will suspend trading for Binance USD (BUSD) on March 13, 2023, on or around 12pm ET.

— Coinbase Assets (@CoinbaseAssets) February 27, 2023

connection:Coinbase to suspend BUSD trading

The New York State Department of Financial Services (NYDFS) ordered the issuing company Paxos to suspend new issuance of BUSD on the 13th. (Wells Notice).

In response to this, Changpong Zhao (CZ) CEO of Binance also expressed the view that “the market capitalization of BUSD will gradually decrease (due to the suspension of new issuance)”, and there is a background to mentioning the exclusion from the key currency pair. Regarding Paxos, he said, “BUSD issuance and redemption are guaranteed. Assets that are audited by multiple auditing firms and protected by bank reserves are safe.”

connection:New York State Department of Financial Services Explains Why It Ordered the Suspension of Issuance of the BUSD Stablecoin

On the 9th of this month, Kraken, a long-established crypto asset exchange, was sued by the US SEC for violating securities laws, and has suspended staking services for US customers.

connection:How to view the US SEC’s Kraken indictment and consider the impact on Ethereum staking

Click here for a list of market reports published in the past

[Recruitment]Recruitment of new personnel due to Web3 business expansion

Japan’s largest cryptocurrency media CoinPost is looking for full-time employees and interns as it expands its Web3 business.

1. Media Business (Editorial Department)

2. Marketing operations

3. Conference management and launch work

4. Open Position (students welcome)

Details https://t.co/UsJp3v8mSH pic.twitter.com/B98JZmoQbW

— CoinPost-virtual currency information site-[app delivery](@coin_post) February 14, 2023

The post Bitcoin stays at recent highs as regulatory pressure intensifies in cryptocurrency market appeared first on Our Bitcoin News.

2 years ago

136

2 years ago

136

English (US) ·

English (US) ·