Virtual currency market of this week (5/20 (Sat) – 5/26 (Fri))

Mr. Hasegawa, an analyst at the major domestic exchange bitbank, illustrates this week’s bitcoin chart and analyzes the future outlook.

table of contents

- Bitcoin on-chain data

- Contributed by bitbank

Bitcoin on-chain data

Number of BTC transactions

Number of BTC transactions (monthly)

Number of active addresses

Number of active addresses (monthly)

BTC mining pool remittance destination

Exchange/Other Services

bitbank analyst analysis (contribution: Yuya Hasegawa)

Weekly report from 5/20 (Sat) to 5/26 (Fri):

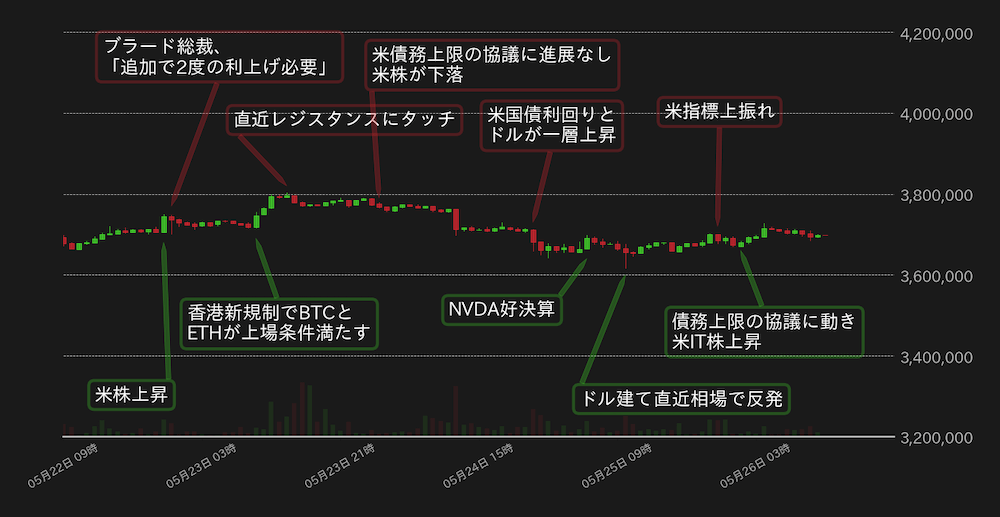

This week’s Bitcoin (BTC) vs. Yen exchange rate is almost flat. As of noon on the 26th, it is trending around 3.7 million yen.

While expectations are high that talks between the White House and the opposition Republican Party over the US debt ceiling will resume, US stocks surged at the beginning of the week, and the BTC market temporarily followed an upward trend. “we need two additional 25 basis point (bp) interest rate hikes this year,” putting pressure on the topside.

On the 23rd, it became clear that BTC and Ether (ETH) would meet the listing conditions on exchanges under the new crypto asset (virtual currency) regulations that will be enforced in Hong Kong next month, and BTC rose again.

On the other hand, after that, the price was reluctant to rise around 3,800,000 yen, which has recently become a resistance, and the market stalled as no progress was seen in the talks on the debt ceiling. When US stocks softened toward the middle of the week, BTC also performed a double decline and fell below 3.7 million yen.

On the other hand, the market price on the 25th tried to lower the price temporarily, but it rebounded slightly as it was bought back immediately after breaking below the $26,000 level. On this day, the number of new applications for unemployment insurance in the United States rose, the gross domestic product (GDP) growth rate was revised upward, and the results of indicators justifying an additional interest rate hike by the Federal Reserve Board (FRB) came out. Nvidia’s strong results yesterday and signs of progress in talks over the debt ceiling lifted risk sentiment slightly.

[Fig. 1: BTC vs Yen chart (1 hour)]Source: Created from bitbank.cc

Rep. McCarthy said last week that the debt ceiling talks could be voted on in the House next week, but this week, the White House and the Republican negotiating team have ended up talking. No deal was reached, and the deadline for the US to default is approaching next week.

Although the pattern so far has been to draw out mutual compromises until the last minute and finally reach an agreement, it is hoped that the risk appetite will improve next week with a sense of security from default avoidance. I would like to assume how the BTC market will move if it becomes.

U.S. Treasurys are said to be one of the least risky investments in the market, but a default would spur yields to rise, hurting stock valuations and hurting the economy by raising interest rates on various loans. is also assumed, and there is a risk that a risk-off mood will spread rapidly and stock prices will plummet.

In addition, if trust in the U.S. government collapses due to a default, gold and bitcoin, which have no counterparty risk, are likely to come into the spotlight.

However, if the stock market crashes, it is expected that cash demand for additional margin and loss compensation will increase in the short term, and there is a possibility that funds will be temporarily withdrawn from BTC. In other words, if the US defaults, the BTC price will fall in the short term, and then recover as the market turmoil subsides.

On the other hand, the federal funds rate futures market this week has priced in a more than 50% chance of another 25bp rate hike at the US Federal Open Market Committee (FOMC) meeting in June.

Even though several US Federal Reserve Bank presidents have hinted at the possibility of additional interest rate hikes, many expected interest rates to remain unchanged in June. It looks like the market outlook has started to be revised.

April’s personal consumption expenditures (PCE), May’s employment statistics, consumer price index (CPI), etc. are still to be announced until the FOMC in June. Even if the debt ceiling problem is resolved, BTC’s upside may be limited.

connection:bitbank_markets official website

Last report:Bitcoin’s topside is heavy but solid, and next week we expect progress in the US debt problem

The post Bitcoin stays flat, is there limited room for upside | bitbank analyst contribution appeared first on Our Bitcoin News.

2 years ago

150

2 years ago

150

English (US) ·

English (US) ·