Macroeconomics and financial markets

On the 27th, the Dow Jones Industrial Average rose by $212 (0.6%) from the previous day, rising 7 business days amid growing speculation of further rate hikes by the Federal Reserve (Fed) and fears of a worsening economy. Backlash for the first time in days. The Nasdaq Index closed 219 points (1.65%) higher.

connection:U.S. AI and high-tech stocks selling intensifies, impact of Russian armed uprising is limited | 27th Financial Tankan

connection:Stock investment recommended for cryptocurrency investors, representative cryptocurrency stocks of Japan and the United States “10 selections”

Virtual currency market

In the crypto asset (virtual currency) market, the Bitcoin price rose 0.1% from the previous day to 1 BTC = $ 30,427.

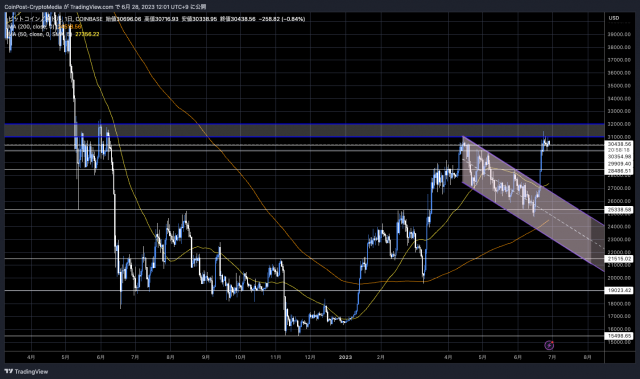

BTC/USD daily

It rebounded after touching the resistance line of $31,000 again.

The Block reports that Fidelity is preparing to apply for a Bitcoin exchange-traded fund (ETF).

connection:US Fidelity to apply for physical Bitcoin ETF Sui Foundation denies selling staking rewards | Summary of important breaking news on the morning of the 28th

It follows the physical Bitcoin ETF filings by major asset managers including BlackRock, WisdomTree, Invesco and Bitwise. Fidelity’s ETF application was previously rejected by the US SEC.

The global giant HSBC Hong Kong has also started offering its clients Bitcoin and Ethereum (ETH) futures ETFs based on CME (Chicago Mercantile Exchange) futures.

According to Meltem Demirors (@Melt_Dem), Chief Strategy Officer at CoinShares, many of the largest US financial institutions are working to provide investment opportunities in things like Bitcoin, with an estimated $27 trillion in assets under custody. There is a view that if even a small part of this is inflow, it will have a large impact.

1/ last week’s @BlackRock Spot Bitcoin ETF filing was big news!

but, it’s not the only story. many of the largest financial institutions in the US are actively working to provide access to Bitcoin and more.

a quick glance – $27 trillion of client assets here! pic.twitter.com/azmHZmUL2a

— Meltem Demirors (@Melt_Dem) June 26, 2023

connection:What is an exchange traded trust “Bitcoin ETF” | Why the application of BlackRock is attracting attention

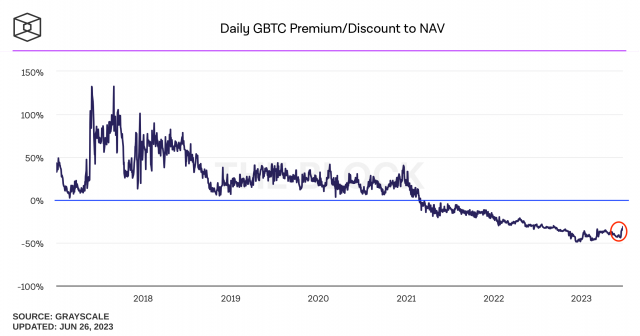

The recent changes in the situation have also affected the price of Grayscale Bitcoin Trust (GBTC), a grayscale mutual fund.

GBTC closes at $19.47, a year-to-date high. The discount to the market price (negative divergence) also shrunk to -31.3%. The low 30% range is the level since September last year.

GBTC

On the other hand, Mike McGlone, senior macro strategist at Bloomberg, said on the 23rd, “If the US recession (recession) occurs, risk assets such as the stock market will inevitably be bearish, and crypto assets (virtual currencies) are no exception. No,” he said cautiously.

Bitcoin $20,000 or $40,000? #FedRecession, Nasdaq – Potential launch of US ETFs won’t shield #Bitcoin from facing its first US #recessiona potential equity bear market and vigilant central banks. Lessons of risk-assets vs. negative liquidity & economic contraction pic.twitter.com/plM5c5ihsg

— Mike McGlone (@mikemcglone11) June 23, 2023

connection:Countdown to the next Bitcoin half-life less than a year away, market trends and expert predictions?

Click here for a list of market reports published in the past

[Recruitment]Recruitment of new personnel due to Web3 business expansion

Japan’s largest cryptocurrency media CoinPost is looking for full-time employees and interns as it expands its Web3 business.

1. Media Business (Editorial Department)

2. Marketing operations

3. Conference management and launch work

4. Open Position (students welcome)

Details https://t.co/UsJp3v8mSH pic.twitter.com/B98JZmoQbW

— CoinPost-virtual currency information site-[app delivery](@coin_post) February 14, 2023

The post Bitcoin stays within range, GBTC discount shrinks to -31% level appeared first on Our Bitcoin News.

2 years ago

125

2 years ago

125

English (US) ·

English (US) ·