Macroeconomics and financial markets

On the US New York stock market on the 23rd of last week, the Dow Jones Industrial Average closed 39,131 points (0.16%) higher than the previous day, while the Nasdaq index closed 44.8 points (0.28%) lower.

In the Tokyo stock market, the Nikkei Stock Average, which hit a record high for the first time in 34 years, continued to rise to 39,340 yen, an increase of 227 yen (0.58%) from the previous day.

Among US stocks related to crypto assets (virtual currency), Coinbase fell 2.99% from the previous day, and MicroStrategy fell 3.6%.

CoinPost app (heat map function)

connection:Why Sumitomo Mitsui Card Platinum Preferred is rapidly gaining popularity as a new NISA savings investment

Virtual currency market conditions

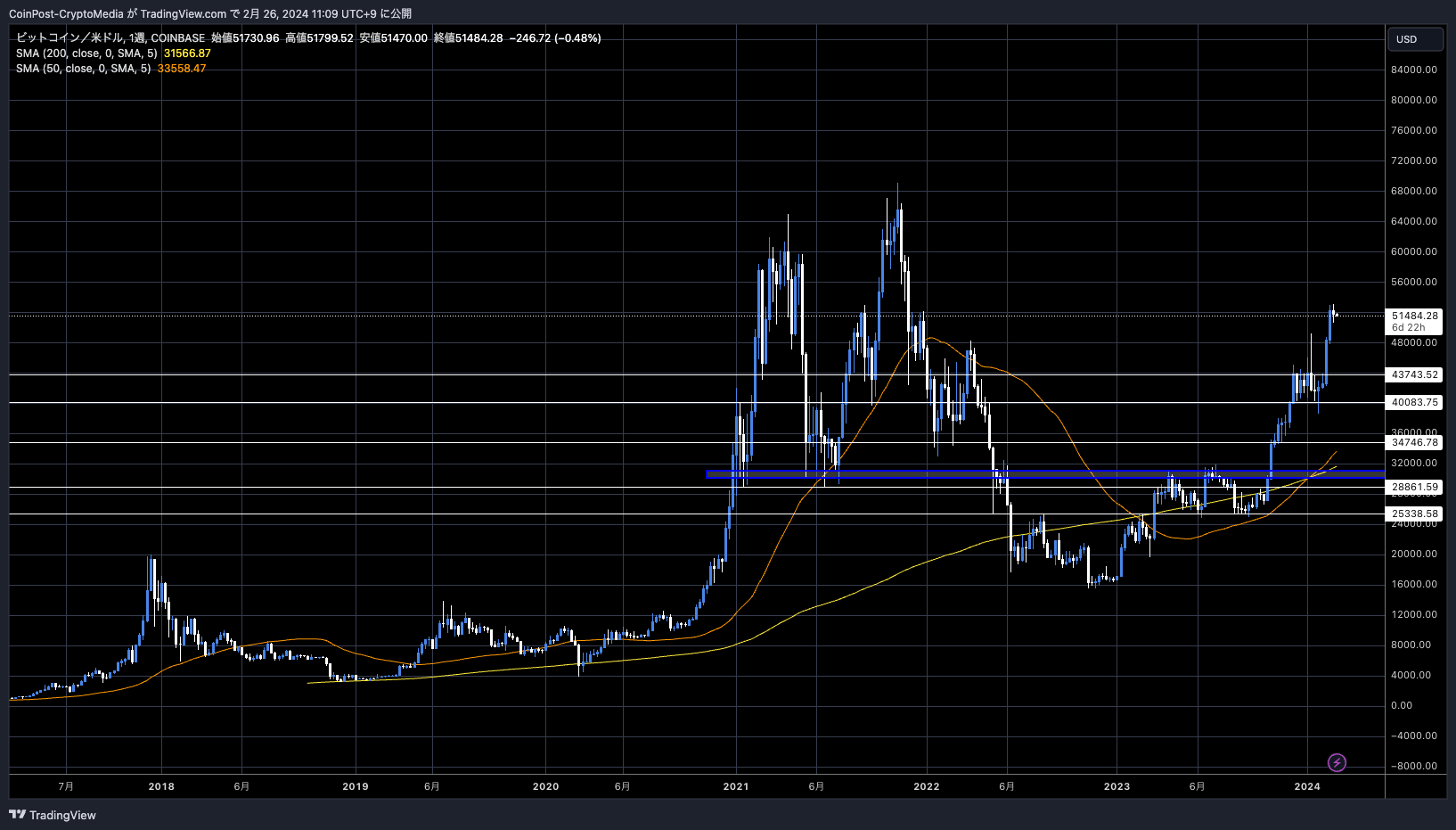

In the crypto asset (virtual currency) market, Bitcoin (BTC) fell 0.37% from the previous day to 1 BTC = $51,484.

BTC/USD weekly

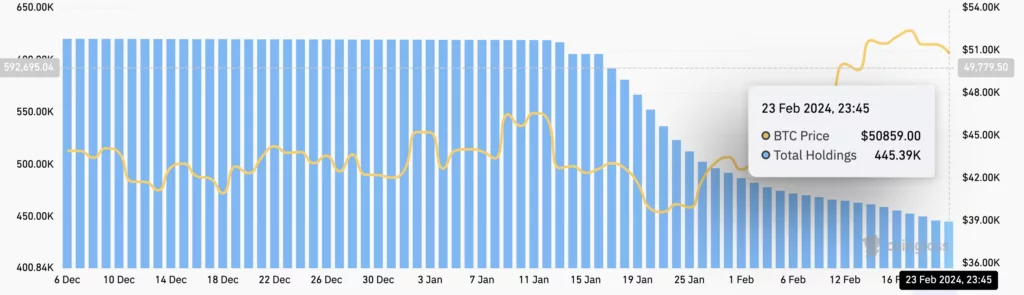

Grayscale Bitcoin Trust (GBTC) outflows slowed to $44.2 million on February 23rd, the lowest since converting to a Bitcoin spot ETF on January 11th. .

Bitcoin ETF Flow – 24 Feb 2024

All data now in, except perhaps for the Galaxy/Invesco product

Friday was a strong day, with +$232.3m of net inflow. Also, the outflow for GBTC was just $44m, lowest level since 11th Jan pic.twitter.com/1Q0OtjEJLt

— BitMEX Research (@BitMEXResearch) February 24, 2024

With BlackRock's Bitcoin ETF IBIT raising $6.6 billion and Fidelity's FBTC raising $4.7 billion, it can be said that excess demand is pushing up the price of Bitcoin.

Grayscale's holdings have already been halved.

Additionally, $540 million worth of Bitcoin was withdrawn from major cryptocurrency exchanges, the largest weekly net outflow since June 2023. This indicates a major change in investor sentiment as it suggests remittance to cold wallets and long-term holding rather than sale.

$540M worth of Bitcoin was withdrawn from CEXs, the largest weekly net outflows since June 2023 pic.twitter.com/L8uG9k43RZ

— IntoTheBlock (@intotheblock) February 23, 2024

connection:What is Bitcoin halving?Outlook for 2024 based on past market price fluctuations

connection:How to make money with virtual currency IEO investment. Domestic and international success stories and how to participate.

altcoin market

UNI has seen a surge following new governance proposal upgrades at Uniswap, the leading decentralized finance (DeFi) protocol.

As of the 26th, UNI price was 43.5% higher than the previous week.

The governance proposals aim to strengthen the protocol's decision-making process, implement a fee-sharing mechanism, and pro-rata reward incentives to UNI token holders who delegate staking.

Biggest week in Uniswap Protocol Governance… ever?

Biggest week in Uniswap Protocol Governance… ever?

I just proposed a large-scale upgrade to the system. Specifically, I believe we should upgrade the protocol so that its fee mechanism rewards UNI token holders that have staked and delegated their tokens.

— Erin Koen (@eek637) February 23, 2024

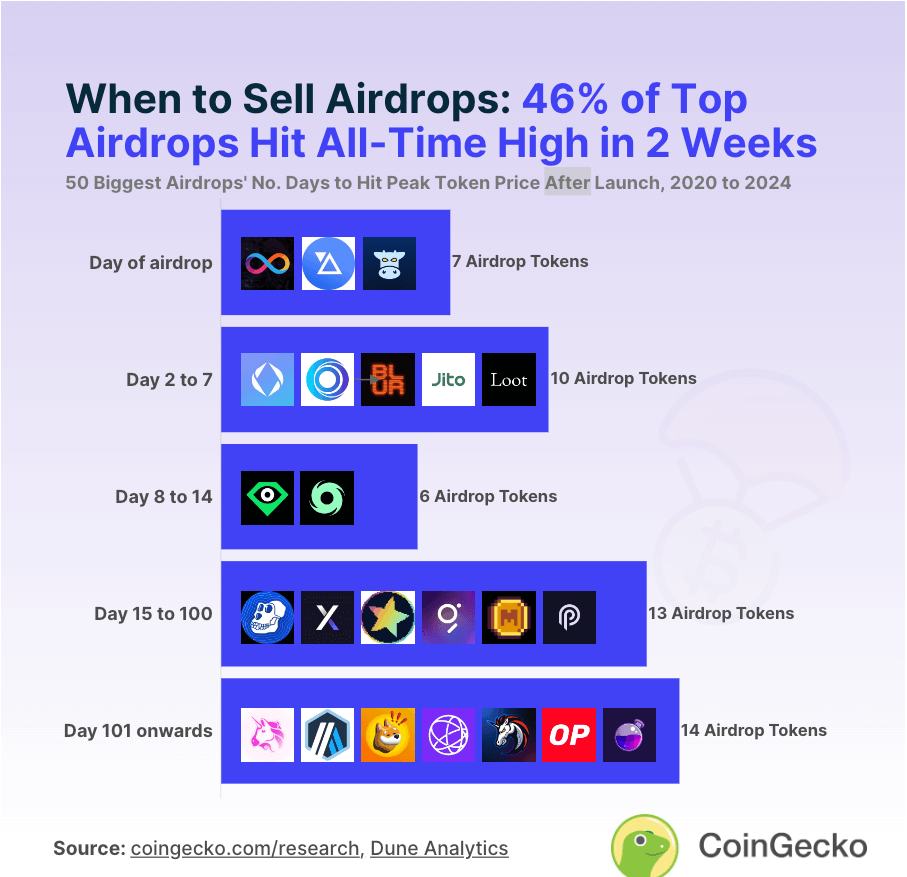

Research by data aggregator CoinGecko has shown that airdropped tokens tend to reach all-time highs within a few weeks.

This study investigated large-scale airdrops from January 1, 2020 to February 20, 2024.

As a result, 23 tokens, or 46% of the 50 tokens, reached an all-time high within two weeks after Airdro.

coingecko

The rate of increase and decrease included multiple items that soared between 37% and 425%. Seven of these tokens reached their highest price on the first day of listing and continued to fall. Regarding this point, CoinGecko said, “While token airdrops are proven to be an effective marketing and growth strategy, they tend to peak out in the first round.''

For example, Solana aggregator Jupiter's airdropped token JUP started trading at $0.66 on its first day of listing, but has since fallen by up to 28% and remains below its initial price.

Although it is largely influenced by market sentiment, examples of revaluations reaching record highs more than 100 days after the airdrop include Uniswap (1,145%), 1inch (216%), and Gitcoin (242%). ).

connection:Compare the benefits of recommended virtual currency exchanges with illustrated explanations

connection:Explaining the advantages of staking and accumulation services and the advantages of virtual currency exchange “SBI VC Trade”

We have introduced the “Heat Map” function to the CoinPost app for investors!

In addition to important news about virtual currencies, you can also see at a glance exchange information such as the dollar yen and price movements of crypto asset-related stocks in the stock market such as Coinbase.

■Click here to download the iOS and Android versions

https://t.co/9g8XugH5JJ pic.twitter.com/bpSk57VDrU

— CoinPost (virtual currency media) (@coin_post) December 21, 2023

Click here for a list of past market reports

The post Bitcoin struggles at $51,000 level, weekly net outflows from exchanges are largest since June 2023 appeared first on Our Bitcoin News.

1 year ago

127

1 year ago

127

English (US) ·

English (US) ·