Bitcoin’s rally lost steam below the psychological $120,000 threshold this week, as renewed macroeconomic uncertainty and strategic profit-taking sparked a broad risk-off move across crypto markets.

Total digital asset market capitalization contracted by roughly 4.5%, falling from $4.02 trillion to $3.84 trillion. Losses accelerated in the back half of the week, erasing gains across most major tokens and dragging sentiment lower.

The Crypto Fear and Greed Index, a widely tracked gauge of investor sentiment, shed seven points from its weekly high of 75.

While the metric remained in the “greed” range, the sharp decline underscored growing caution among traders amid shifting macro signals.

Altcoins bore the brunt of the reversal. Most large-cap tokens surrendered early-week gains, with only a select few managing to post marginal upside.

Sector breadth narrowed significantly, suggesting capital rotated out of speculative positions in favor of short-term risk mitigation.

Why is Bitcoin going down?

As of late Asian trading hours on Friday, Bitcoin had dropped nearly 3.5% from its weekly high of $119,729.

Much of the early week slowdown stemmed from investor uncertainty ahead of Wednesday’s Federal Open Market Committee (FOMC) meeting.

Traders reduced exposure to risk assets, anticipating signals from the Federal Reserve on the future path of interest rates.

Although the Fed kept rates steady at 2.25%–2.50%, it reiterated a data-dependent approach, with no clear commitment to rate cuts this year—a stance that fell short of dovish market expectations.

The situation worsened in the latter half of the week as fresh bearish catalysts emerged. Bitcoin briefly touched a three-week low of $114,917 on Friday amid a sharp downturn across the digital asset space.

According to Coinglass, more than $629 million in leveraged crypto positions were liquidated between Thursday and Friday, marking a 45% increase in forced unwinds compared to the previous day.

Broader macroeconomic developments also weighed on sentiment. Strong US economic data reduced the likelihood of imminent rate cuts, as markets began pricing in a prolonged period of tight monetary policy.

The resilience of the labor market and persistent inflation concerns have prompted investors to pivot away from high-risk assets such as cryptocurrencies, shifting instead toward safer alternatives like bonds.

Meanwhile, new US tariffs that took effect on August 1 injected additional uncertainty. The Trump administration imposed a 25% tariff on goods from India and a 50% levy on semi-finished copper.

Other nations affected include South Korea, South Africa, Brazil, and Switzerland, which face tariffs between 15% and 50% tariff on most exports.

These actions have raised fears of disrupted supply chains, especially for industries linked to crypto mining hardware and infrastructure.

The geopolitical escalation added to market jitters, reinforcing a broader retreat from speculative assets.

While the US has signed trade agreements with Japan, the UK, and the EU, the persistence of elevated tariffs means inflationary pressures could remain sticky, further complicating the Fed’s policy roadmap.

Adding to the bearish tilt, data from the Bureau of Labor Statistics showed the US. economy added just 73,000 jobs in the latest print, while the unemployment rate edged up to 4.3%.

Though modest, the softness aligns with the Fed’s projections that growth will slow in the coming months, especially as the effects of tariffs spread across sectors.

Simultaneously, institutional flows have also thinned.

Spot Bitcoin ETFs recorded net outflows of $114 million on Thursday, according to SoSoValue, continuing its downtrend from July’s peak inflows.

Ethereum ETFs reflected a similar pattern, with weekly inflows slowing to $306 million, well below the $2.1 billion recorded two weeks prior.

When institutional participation fades, it often amplifies the market’s vulnerability to downside moves.

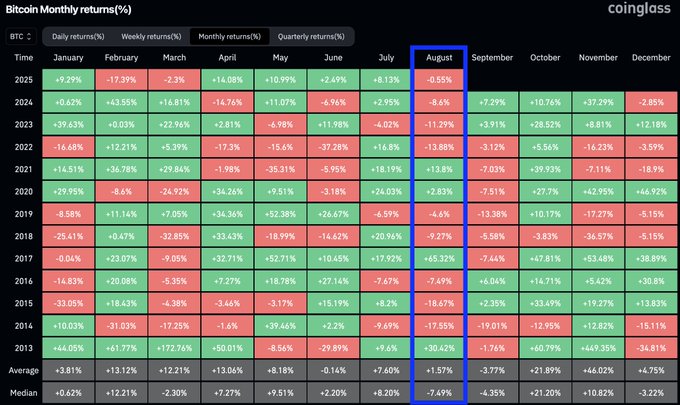

On top of that, August has historically been a weak month for crypto performance.

Bitcoin fell 8.6% in August 2024, 11.2% in 2023, and 13.8% in 2022. Ethereum has also posted consistent losses during this period, with the average August return for the asset class sitting at just 5.14% since 2015.

August is historically worst month for $BTC Will this time be any different?

While technical pullbacks following a strong rally are typical, this week’s correction appears to reflect a confluence of structural, macroeconomic, and geopolitical pressures.

Without a short-term catalyst to revive risk appetite, traders may remain cautious heading into next week.

Will Bitcoin go up?

Turning to Bitcoin’s price action, analysts have returned their focus to liquidity patterns on centralized exchanges, which may offer clues on the market’s next move.

Large blocks of short liquidations remain positioned near the $120,000 level, a zone that many believe Bitcoin has yet to fully test after a series of rallies that disproportionately targeted long positions.

Crypto investor and entrepreneur Ted Pillows stated that it is “just a matter of time before Bitcoin grabs it,” referring to the concentration of liquidity at the upper boundary.

Data from CoinGlass supports this view, showing a buildup of short interest that could trigger a squeeze if the price reclaims momentum.

Reflecting on the current price action, crypto analyst BitBull said, “There’s no way people are getting bearish on $BTC.”

BTC/USD 1-day chart. Source: BitBull.

BTC/USD 1-day chart. Source: BitBull.In an accompanying chart, the analyst pointed to a textbook breakout from an inverse head and shoulders pattern, a historically bullish formation.

He added that Bitcoin is currently retesting the breakout level around $114K–$115K, which should act as strong support.

For fellow analyst and market watcher Cas Abbé, the broader bull cycle still has room to run. He expects Bitcoin to peak in November or December 2025, following the typical post-halving cycle structure.

$BTC will likely peak in November/December 2025. I know people are talking about supercycle, but they said the same thing last cycle. So far, there haven’t been big signs on why this cycle will extend. Maybe we could get a few months delay, but not more than that. But before

“Before a cycle top, there’ll be euphoria. Make sure you don’t panic sell before that big move,” he wrote on X.

Traders need to keep an eye on the current support level, pseudonymous analyst The Boss added.

BTC/USD 1-day price chart. Source: The Boss on X.

BTC/USD 1-day price chart. Source: The Boss on X.According to the analyst, Bitcoin has returned to the $114,000 range, which has historically marked a battleground between buyers and sellers.

If Bitcoin fails to hold above the $114,000 level, a deeper correction may follow, with Fibonacci support levels coming into play around $105,000 and $92,000.

However, if BTC manages to hold above this support over the upcoming trading sessions, The Boss believes the upside structure remains intact, with Fibonacci-based targets still pointing to higher levels.

With the CME gap from $114,380 to $115,600 now closed, The Boss believes a key technical objective has been met, reducing the likelihood of further downside targeting that range.

“Price action around this level should be closely monitored, as it could define the next market move,” he concluded.

As of press time, Bitcoin was trading at $115,122, erasing earlier losses and ending the week flat.

Altcoin market recap

This week, the total market capitalization of all altcoins rose 5.5% to over $1.71 trillion before retreating to $1.5 trillion, ending the week with a 7.4% decline.

Ethereum (ETH), the largest altcoin by market cap, staged a rally earlier in the week and made an attempt to break above the key $4,000 resistance level, but the move failed to hold as profit-taking set in.

Selling pressure pushed the price back to $3,600 at the time of writing, effectively wiping out the week’s gains and signaling a loss of short-term bullish momentum.

Other large-cap crypto assets such as XRP (XRP), Solana (SOL), Dogecoin (DOGE), and Cardano (ADA) recorded losses ranging from 1% to 8%, while Tron (TRX) was an exception, managing to hold onto gains of around 4% during the same period.

Story (IP), Conflux (CFX), and Toncoin (TON) were among the top-performing altcoins this week, supported by project-specific catalysts.

Source: CoinMarketCap

Story: Story rallied this week as two major developments drew fresh attention to its growing ecosystem.

First, ip.world V2 went live in late July, transforming the platform into a full-stack SocialFi launchpad with support for remixable IP.

It debuted with the launch of its first programmable meme token, “Evil Larry,” which quickly reached a $13 million market cap.

Then on July 22, Poseidon debuted with $15 million in seed funding led by a16z, marking Story’s expansion into tokenized AI training data.

Built on top of Story Protocol, Poseidon enables the registration and licensing of real-world datasets, such as robotics, autonomous driving, and medical imaging, as on-chain IP assets, extending the protocol’s reach beyond creative content into the AI infrastructure layer.

Conflux: CFX gained traction as anticipation grew around the upcoming Conflux 3.0 upgrade, which promises major technical enhancements and new real-world applications.

Investors reacted positively to a preview of the network’s second-quarter activity, which outlined a hard fork and performance overhaul scheduled for August.

For the uninitiated, the Conflux upgrade is expected to significantly boost throughput, up to 15,000 transactions per second, while also implementing a hybrid proof-of-work and proof-of-stake consensus model to enhance both scalability and decentralization.

The upgrade will also add support for AI agents, allowing developers to build AI-integrated applications natively on-chain.

Conflux’s rally also gained support from plans to launch a yuan-backed offshore stablecoin (CNH), which aims to improve cross-border payments and enable the settlement of tokenized real-world assets.

Toncoin: TON gained momentum this week following news that the TON Foundation and Kingsway Capital plan to raise $400 million for a new treasury company to support the ecosystem.

The token’s rally was also supported by rising NFT activity, including Snoop Dogg’s NFT drop on Telegram in early July, which generated $12 million in sales within 30 minutes.

The post Bitcoin struggles below $120K as macro risks rise, altcoin market turns red appeared first on Invezz

English (US) ·

English (US) ·