Macroeconomics and financial markets

On the US NY stock market on the 2nd, the Dow closed at $39 (0.1%) lower than the previous day.

Among crypto assets (virtual currency) related stocks, Coinbase surged 15.7% from the previous day.

US long-term interest rates have fallen due to the FRB (US Federal Reserve System)’s expectation of a reduction in interest rate hikes. In addition to the unwinding of short sales centered on NASDAQ high-tech stocks, the market has been pushed up, and since the beginning of the year, Bitcoin (BTC) and Ethereum (ETH) have rebounded sharply, so it is expected that the sluggish business performance will recover. rice field.

In addition, the withdrawal of the class action lawsuit in the US district court seems to have been favorably received. The plaintiffs, including individual investors, claimed that “Coinbase suffered losses in token (virtual currency) trading due to unfair sales of unregistered securities,” but the judge dismissed the plaintiffs’ claims.

detail:U.S. District Court Dismisses Class Action Lawsuit Against Coinbase

ARK Invest, an investment management company in the United States led by CEO Kathy Wood, increased its purchases of Coinbase stocks by hundreds of millions of yen from December 2010 to January 2011. etc., in large quantities.

ARK Invest analyst Yassine Elmandjra said, “Bitcoin has experienced five sharp declines in the last five years, more than -75% from its peak, but it still has a three to five-year compound annual growth rate (investment In terms of return), it has significantly outperformed global stocks, bonds and gold.”

Bitcoin has experienced five price declines of over 75% and has still outperformed equities, bonds, and gold. pic.twitter.com/nIzNXlLbPx

— Yassine Elmandjra (@yassineARK) February 1, 2023

Virtual currency market

In the crypto asset (virtual currency) market, Bitcoin fell 1.55% from the previous day to $23,540.

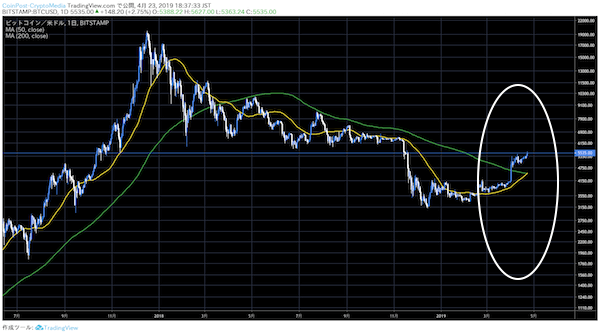

The golden cross between the 50 SMA (50-day moving average) and 200 SMA (200-day average) is approaching. (red circle)

BTC/USD daily

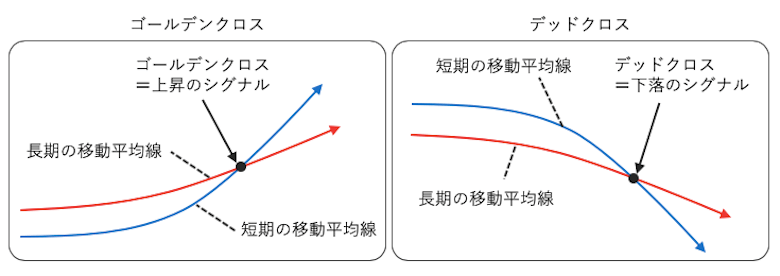

A moving average line is a line that connects the average closing prices of candlesticks over a certain period of time. It is also widely used in the global stock market and foreign exchange (FX) market, and is one of the major indicators that many investors refer to.

Due to their nature, golden crosses and dead crosses are “buy signals (sell signals)” that are likely to occur at market turning points, but they do not necessarily promise a price rise or fall after they are established, so I would like to use them only as a reference. In the Bitcoin market, the number of golden crosses between 50MA and 200MA is only 7 times in the last 10 years.

Created by: CoinPost

Relation:What is a moving average?

In the bear market after the collapse of the previous virtual currency bubble, 1BTC = the golden cross was established in April 2019 when it rebounded from the bottom of the $3,000 range to the $5,000 range. Afterwards, a succession of positive factors also boosted the market, rising to $13,680 in just two months.

April 2019 BTC/USD daily chart

Although the current Bitcoin market sentiment is recovering rapidly, it is hard to say that the negative effects of the global economic recession and the FTX bankruptcy have been wiped out. Uncertainty in the market is still smoldering, such as the situation of the digital currency group (DCG) that went bankrupt by the small company Genesis and the fate of the Ripple trial.

The Dow, which had continued to rise before the FOMC, has fallen and stalled at the $24,000 to $25,000 resistance line (upper resistance line), and some are wary of entering a correction phase.

Click here for a list of market reports published in the past

The post Bitcoin struggling with resistance, approaching the golden cross of the moving average line appeared first on Our Bitcoin News.

2 years ago

188

2 years ago

188

English (US) ·

English (US) ·