Macroeconomics and financial markets

In the US NY stock market on the 10th, the Dow closed at $101 (0.3%) higher than the previous day and the Nasdaq at 0.03% lower.

While buybacks took precedence in response to the doldrums in the US employment statistics announced last weekend, the topside is heavy due to deep-rooted concerns about an economic recession.

The US SEC (Securities and Exchange Commission) issued a warning letter (Wells Notice) that increased pressure on crypto asset (virtual currency) exchanges. Mining companies such as blockchain soared across the board.

connection:Stock investment recommended for cryptocurrency investors, representative cryptocurrency stocks of Japan and the United States “10 selections”

In the Tokyo stock market, the new governor of the Bank of Japan, Ueda, who was appointed as the governor of the Bank of Japan for the first time in 10 years, indicated his intention to continue the conventional “negative interest rate policy” and control the yield curve. Mr. Buffett’s mention of “additional investment in Japanese stocks” in an interview also supported buying.

He revealed that he has increased his stake in Japan’s five largest trading companies to 7.4%.

Virtual currency market

In the crypto asset (virtual currency) market, Bitcoin rose 6.49% from the previous day to $30,148.

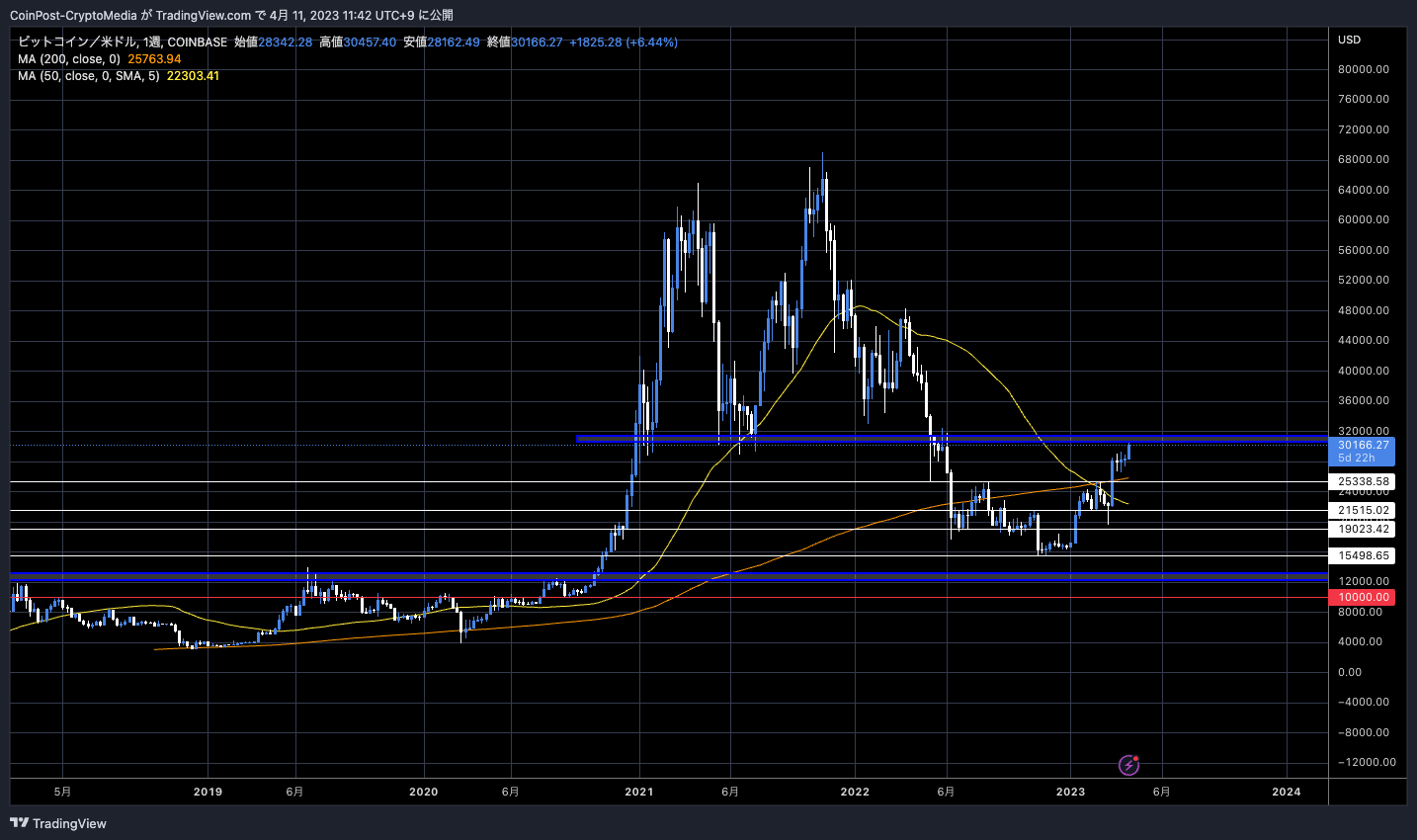

BTC/USD Weekly

BTC has risen sharply from the $16,000 range at the beginning of the year to reach the psychological milestone of $30,000. Since it is also a strong resistance line (upper price resistance line), it seems necessary to sell accordingly, but a full-fledged trend change is also in sight.

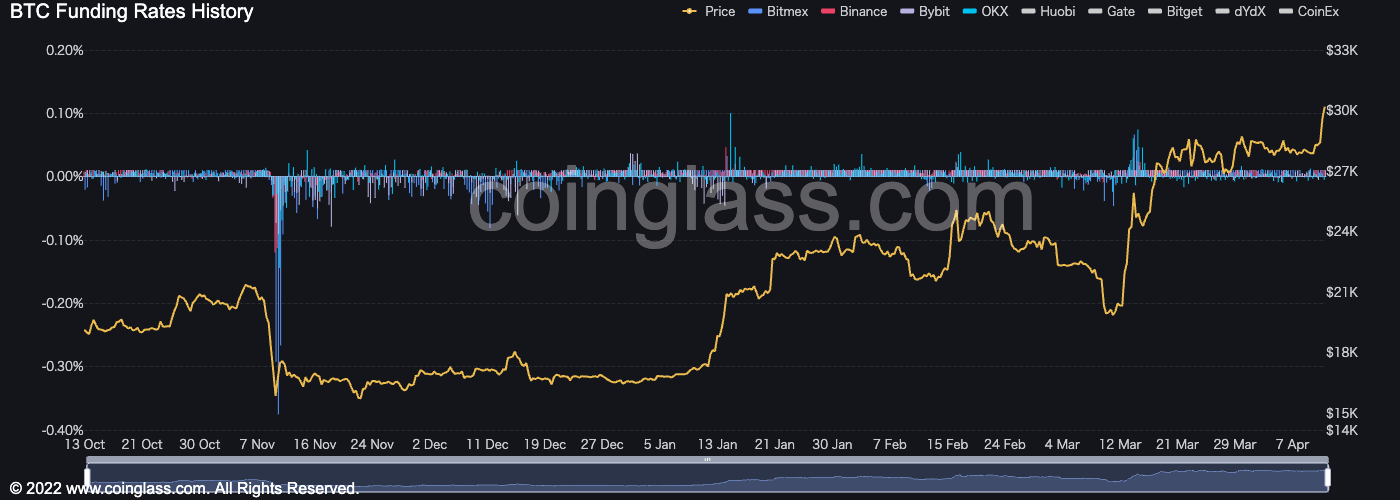

There is no overheating in the FundingRate in the futures market, and no big loss cuts have been observed in Total Liquidations, so it seems highly likely that buying is mainly driven by physical products.

coin glasses

As the CPI (U.S. Consumer Price Index) is scheduled to be released on the 12th, there is growing speculation that the U.S. Federal Open Market Committee (FOMC) meeting in May this year will bring an unprecedented pace of interest rate hikes to an end. It’s getting

According to the CME FedWatch Tool, 74.3% expect a 0.25bps rate hike in the futures rate market. If interest rate hikes are actually suspended, risky assets such as stocks and bitcoin will become easier to buy in anticipation of future pivots (money policy changes) and monetary easing phases.

The depreciation of the dollar is also a tailwind for bitcoin, which has turned around from the depreciation of each country’s currency due to the global appreciation of the dollar last year.

DXY Weekly

As financial and economic uncertainties such as global inflation (high prices) and bankruptcies of major banks increase, funds are likely to be suitable for gold and bitcoin, which have issuance limits.

According to Santiment’s analysis, the rate of increase in long-term holders over the past two months is similar to the 2021 bull market.

There is a rising rate of #Bitcoin #hodlers as traders seem to have become increasingly content in keeping their bags unmoved for the long-term. We saw a similar trend from January, 2021 through April, 2021 when $BTC rose above $64k for the first time. https://t.co/xrwNhcqVLo pic.twitter.com/wYFBsx6Css

There is a rising rate of #Bitcoin #hodlers as traders seem to have become increasingly content in keeping their bags unmoved for the long-term. We saw a similar trend from January, 2021 through April, 2021 when $BTC rose above $64k for the first time. https://t.co/xrwNhcqVLo pic.twitter.com/wYFBsx6Css

—Santiment (@santimentfeed) April 9, 2023

altcoin

The altcoin market also rose across the board, as if it was pulled by the rise of bitcoin.

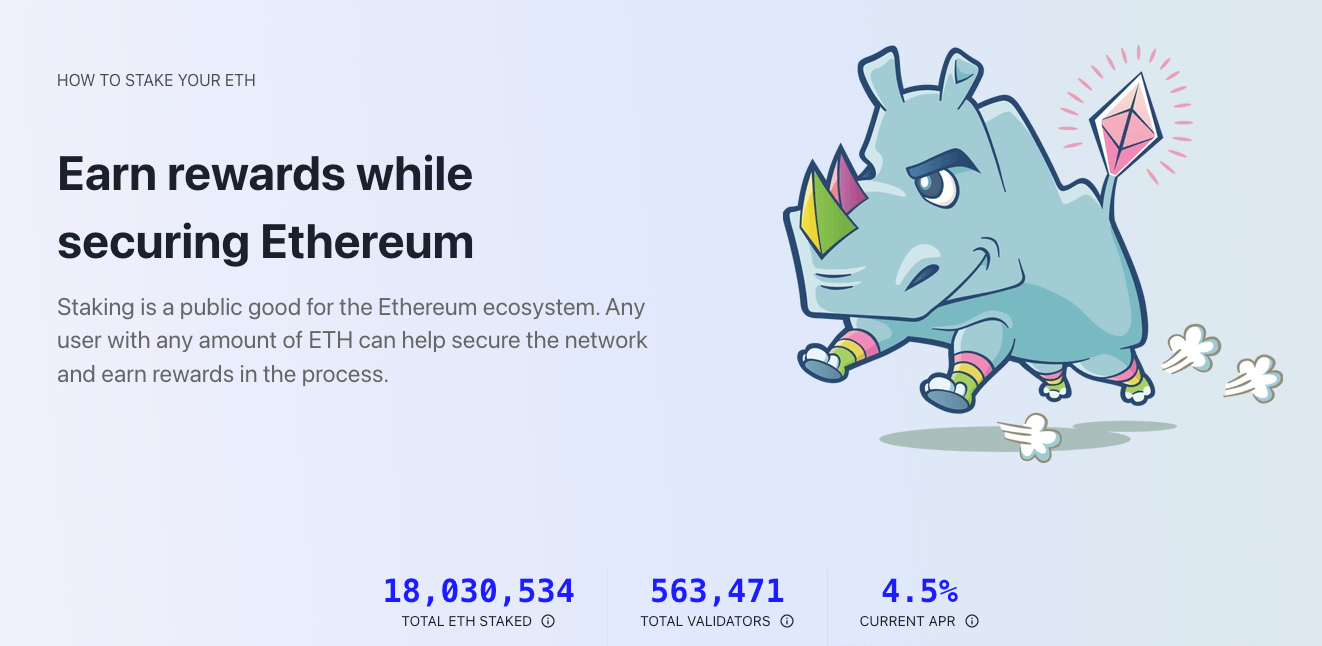

With the Shanghai upgrade, the staking reward of the beacon chain, which has been locked for about two years, will be released, so it is expected that there will be considerable selling pressure.

Regarding this point, the CEO of French digital asset company Flowdesk said, “There is a limit to the number of withdrawal requests per day, and Lido and coinbase pools may take weeks to months to process. Therefore, it is unlikely that selling pressure will spike any time soon.”

The amount locked in the Ethereum contract amounts to 18 million ETH, and more than 1 million ETH has been accumulated as validator rewards. There are many predictions that it will turn into an investment.

As of April 10, 2023

Competition for Liquidity Staking Token (LST) protocols is heating up with different Automated Market Makers (AMMs) and maximizing incentives for liquidity pools.

As of April 2023, the “Total Value Locked” (TVL) of liquid staking tokens surged to over $14 billion, according to DeFiLlama data. TVL indicates the total amount deposited into the DeFi protocol.

Among ETH LSDs, Lido accounts for the majority at 74.1%.

DeFi Llama

connection:Explaining “LSD (Liquid Staking Derivatives)” that enables operation while staking Ethereum

Click here for a list of market reports published in the past

[Recruitment]Recruitment of new personnel due to Web3 business expansion

Japan’s largest cryptocurrency media CoinPost is looking for full-time employees and interns as it expands its Web3 business.

1. Media Business (Editorial Department)

2. Marketing operations

3. Conference management and launch work

4. Open Position (students welcome)

Details https://t.co/UsJp3v8mSH pic.twitter.com/B98JZmoQbW

— CoinPost-virtual currency information site-[app delivery](@coin_post) February 14, 2023

The post Bitcoin surges to $30,000 mark appeared first on Our Bitcoin News.

2 years ago

132

2 years ago

132

English (US) ·

English (US) ·