Macroeconomics and financial markets

In the US NY stock market last weekend, the Dow Jones Industrial Average was 22 dollars (0.07%) higher than the previous day, and the Nasdaq Index was 12.9 points (0.11%) higher.

connection:Tesla and virtual currency-related stocks fall sharply, concerns about recession rise | 21st Financial Tankan

connection:Stock investment recommended for cryptocurrency investors, representative cryptocurrency stocks of Japan and the United States “10 selections”

Virtual currency market

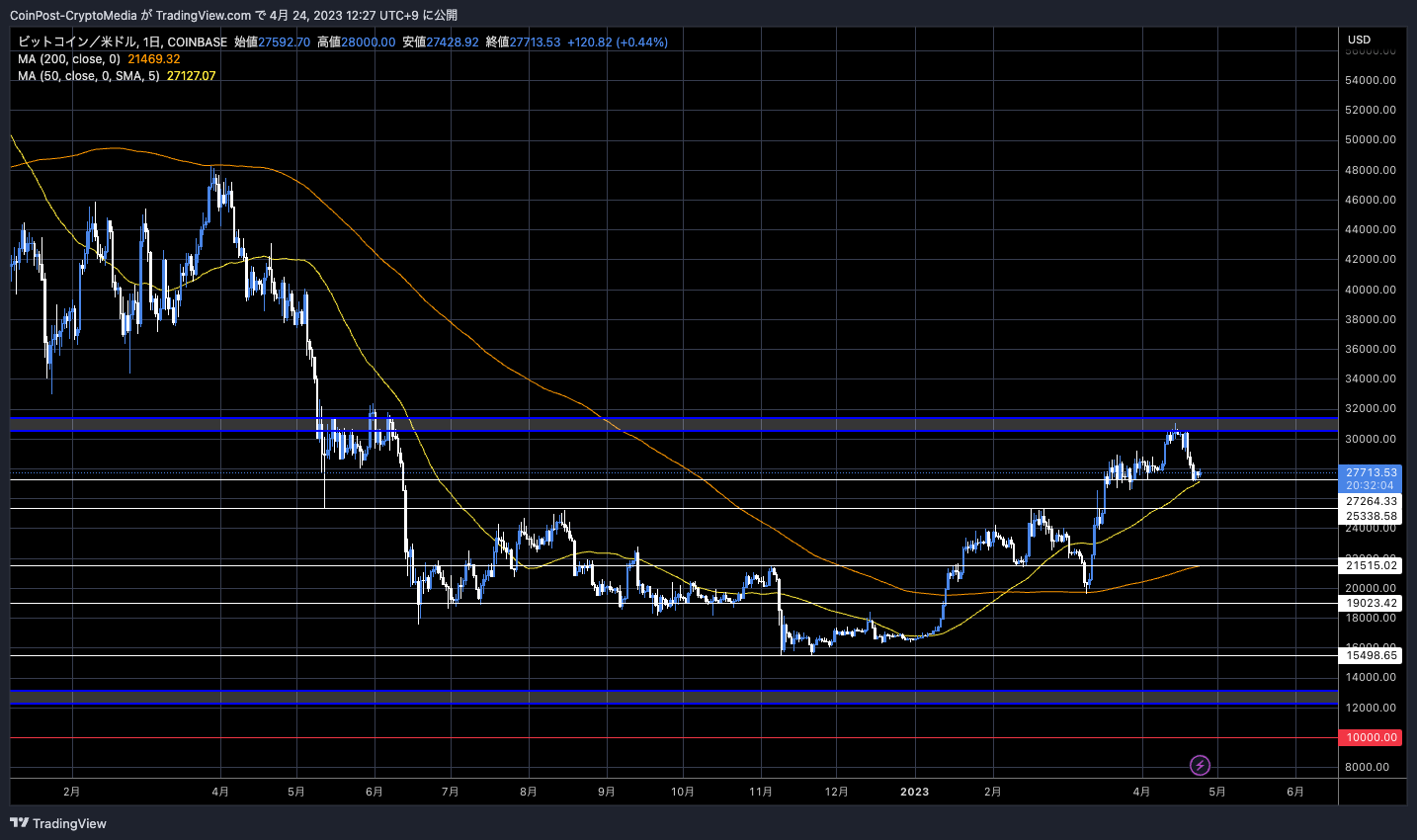

In the crypto asset (virtual currency) market, Bitcoin rose 0.6% from the previous day to $27,733.

BTC/USD daily

Although it is a support line that is easy to buy once, if the bottom breaks, $ 25,300 and $ 21,500 where the 200-day moving average line overlaps with the horizontal line will be in sight.

With the recent U.S. SEC (Securities and Exchange Commission) and CFTC (U.S. Commodity Futures Trading Commission) increasing pressure on the cryptocurrency industry, it is difficult to move ahead of the U.S. Federal Open Market Committee (FOMC). .

connection:US lawmakers call for Gensler to be fired and SEC reorganized

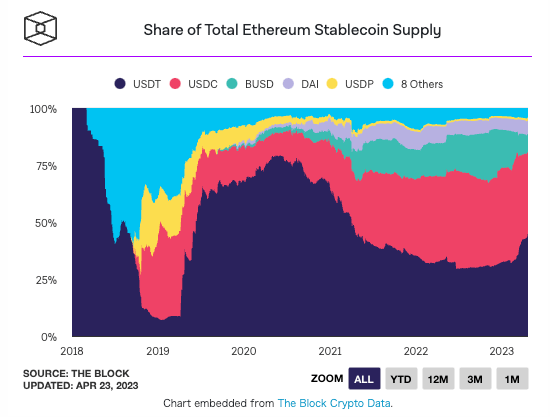

The US dollar-backed stablecoin Tether (USDT) has reached a market capitalization of $81.5 billion. With over $15 billion minted from 2023 onwards, Tether’s market share has risen nearly 15% to 63%, the highest in the past two years.

Analysts at BDC Consulting have concluded that, based on the results of a correlation test that looked at more than 20 indicators, USDT supply increases and decreases have a “statistically significant correlation” with bitcoin prices.

In this regard, the report notes that research by researchers at the University of California and Warwick Business School found no evidence of “market manipulation,” but that “when big investors prepare to buy cryptocurrencies at the moment of a trend reversal. , tend to issue new USDT.”

Most recently, a $1 billion USDT token was issued on the Ethereum network.

1,000,000,000 #USDT (1,000,400,000 USD) minted at Tether Treasuryhttps://t.co/Tpsakud9df

1,000,000,000 #USDT (1,000,400,000 USD) minted at Tether Treasuryhttps://t.co/Tpsakud9df

— Whale Alert (@whale_alert) April 20, 2023

For a while, USDT was robbed of its market share by latecomers USD Coin (USDC) and Binance USD (BUSD) due to concerns about creditworthiness of the operating company and collateral assets, but it has expanded again in the past few weeks.

USDT

In December 2022, in response to a Wall Street Journal report that “Tether poses a wide range of risks by increasing its lending amount,” Tether decided to reduce the amount of collateral in its USDT reserves to dispel concerns about secured lending. Announced that it will reduce the loan amount to zero.

Prior to that, it removed commercial paper from its reserves and replaced it with safer US Treasury bills.

BUSD was issued, stored and managed by Paxos under the authorization and supervision of the New York State Department of Financial Services (NYDFS), but the SEC (U.S. Securities and Exchange Commission) claims that it is an unregistered security. and issued a warning letter (Wells Notice) from the perspective of violating the Investor Protection Act.

In February, the NYDFS ordered Paxos to stop issuing new BUSD.

Also, in March of this year, Circle, a US company that issues USDC, announced that it was storing 8% of its reserves at the bankrupt Silicon Valley Bank. It caused a sharp price divergence (dipeg) in USDC.

Since then, market sentiment has improved with the acquisition offer to SVB, Circle’s official statement, and the policy of protecting customer assets with an emergency loan line by the financial authorities, and the 1:1 peg against the US dollar has recovered.

altcoin market

BNB/USD

The launchpad for the 31st “IEO (Initial Exchange Offering)” for the pre-sale of Binance’s newly listed stock “Open Campus (EDU)” has been announced. Buying was due to the design, in which the maximum amount of BNB that can be committed to the token sale is determined by the average amount of BNB held during the aggregation period.

Open Campus (EDU) is a proprietary token for a decentralized education platform. It enables teachers to earn revenue for their contributions by using a protocol that allows educational content to be created, shared and promoted by the community.

The unsecured creditors committee of crypto lender Voyager Digital announced today that it has reached an agreement with the U.S. government over a pending acquisition offer by Binance.

1/ Voyager, the UCC, and the Government reached a resolution that will allow the Plan to move forward and go effective shortly.

—Voyager Official Committee of Unsecured Creditors (@VoyagerUCC) April 19, 2023

The Binance acquisition was opposed by the New York Department of Financial Services (NYDFS) and the US Securities and Exchange Commission (SEC). Voyager filed for bankruptcy under Section 11 of the US Bankruptcy Code (Chapter 11) due to the impact of a huge loan to Three Arrows Capital (3AC), which went bankrupt in July last year.

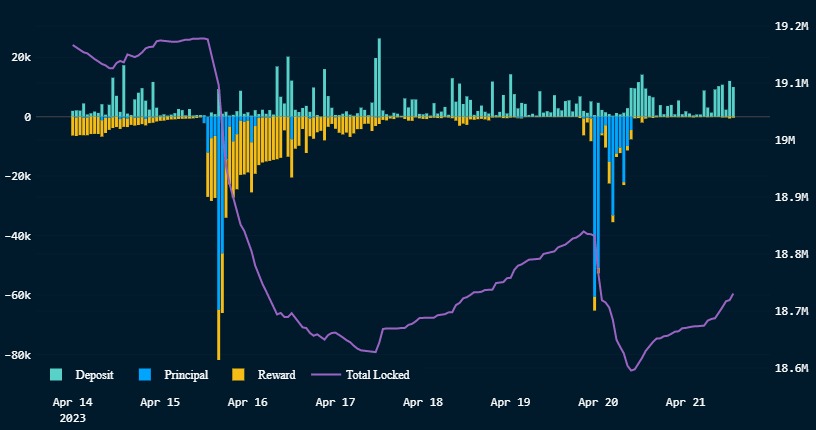

The US exchange Kraken, which received an order to stop providing staking services from the US SEC (Securities and Exchange Commission), is leading full-stake withdrawals involving Ethereum (ETH) validator cancellation.

According to Martin Lee, a data journalist at Nansen, it has already withdrawn over 330,000 ETH, leaving 175,000 ETH remaining, mostly for the principal amount.

nansen

Click here for a list of market reports published in the past

[Recruitment]Recruitment of new personnel due to Web3 business expansion

Japan’s largest cryptocurrency media CoinPost is looking for full-time employees and interns as it expands its Web3 business.

1. Media Business (Editorial Department)

2. Marketing operations

3. Conference management and launch work

4. Open Position (students welcome)

Details https://t.co/UsJp3v8mSH pic.twitter.com/B98JZmoQbW

— CoinPost-virtual currency information site-[app delivery](@coin_post) February 14, 2023

The post Bitcoin Takes a Break, Tether (USDT) Market Share Hits Highest in Two Years appeared first on Our Bitcoin News.

2 years ago

157

2 years ago

157

English (US) ·

English (US) ·