Macroeconomics and financial markets

On the US NY stock market on the 24th of last week, the Dow Jones Industrial Average rose $133.8 (0.35%) from the previous day, increasing for the fourth day in a row. The Nasdaq index closed 118.1 points (0.76%) lower.

CoinPost app (heat map function)

connection:AI/semiconductor stocks AMD and Microsoft fall after financial results, FOMC interest rate announcement tomorrow | 31st Financial Tankan

connection:Ranking of recommended securities accounts for the stock market that can be used at a profitable price

NISA, virtual currency related stocks special feature

Virtual currency market conditions

In the crypto asset (virtual currency) market, the Bitcoin price fell 1.88% from the previous day to 1 BTC = $42,807.

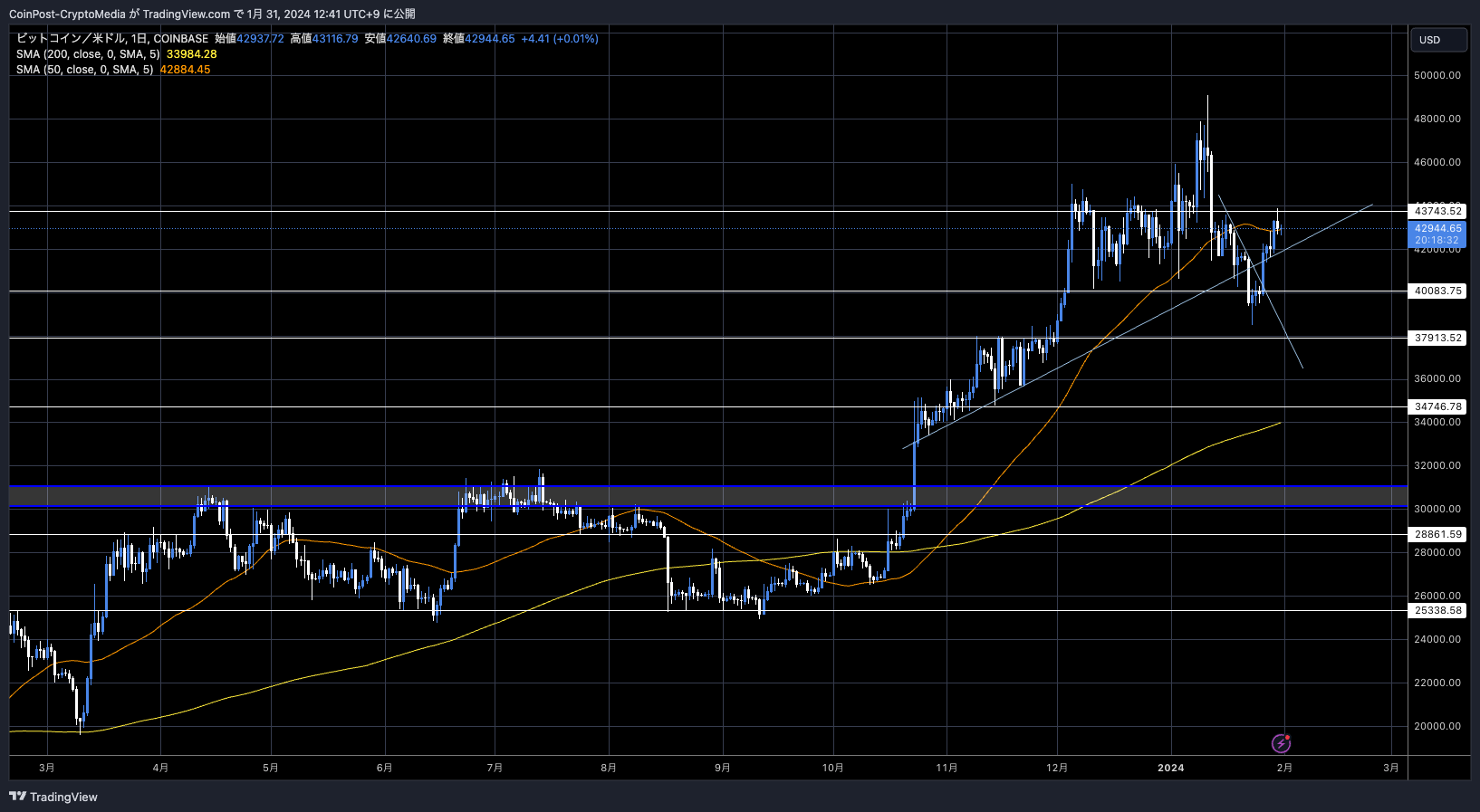

BTC/USD daily

It was blocked by the resistance level at $44,000 before the US Federal Open Market Committee (FOMC) meeting, but the decline in grayscale selling pressure also supported the rebound, and it remained above the 50 SMA at $42,884. With the halving approaching, if the stock succeeds in breaking out, will we see a new year-to-date high?

Ethereum (ETH) rose 0.75% to $2,336. Standard Chartered Bank has released a forecast for approval of the Ethereum (ETH) spot ETF (exchange traded fund) on May 23, the final approval date.

The US SEC (Securities and Exchange Commission) has avoided classifying Ethereum as a security in lawsuits against virtual currency companies, and Ethereum futures trading is already listed on the CME (Chicago Mercantile Exchange). This was cited as a basis.

Additionally, asset management company Grayscale manages an Ethereum investment trust fund that aims to convert into an exchange-traded fund similar to Bitcoin’s GBTC, which poses a risk of litigation if the SEC decides not to approve it.

connection:SCB Silver Bullish prediction that SEC will approve Ethereum spot ETF in May

On the other hand, TD Cowen predicts that if an Ethereum spot ETF is approved, it will be in the second half of next year, taking into account the political situation such as the US presidential election.

connection:U.S. investment bank TD Cowen: “Approval of Ethereum spot ETF will probably take place after the second half of next year.”

With the US Federal Open Market Committee (FOMC) meeting at a critical juncture, the US Federal Reserve (Fed) is likely to keep interest rates unchanged. The interest rate futures market has a 98% probability that interest rates will remain unchanged.

Selling pressure on Grayscale’s investment trust Bitcoin Trust (GBTC) is decreasing.

According to Arkham data, grayscale selling on the 30th was 44,000 BTC ($192.6 million), less than half of last week’s weekly average.

After GBTC was approved as a Bitcoin spot ETF (before conversion), it was operated in a closed-end fund format, and it was necessary to hold shares for at least half a year.

Many purchases were made during periods at deep discounts to market prices, and combined with the high trust fees compared to other companies, redemptions and capital outflows from GBTC seem to have accelerated, leading to selling pressure on Bitcoin.

Meanwhile, exchange-traded funds (ETFs) have already amassed holdings of more than 3% of all Bitcoin, reflecting the growing confidence of institutional investors. As of the 30th, 12 days after the US SEC (Securities and Exchange Commission) approval, the purchase amount exceeded 150,000 BTC ($6.6 billion).

The 9 new  spot #Bitcoin ETFs bought ~150,000 $BTC worth $6.5 Billion USD in 12 trading days

spot #Bitcoin ETFs bought ~150,000 $BTC worth $6.5 Billion USD in 12 trading days

10,375 bought yesterday vs 900 daily new supply

Closing in on $MSTR ‘s 189,150!

This excludes $GBTC (conversion w/ outflows)$IBIT $FBTC $ARKB $BITB $BRRR $BTCO $HODL $EZBC pic.twitter.com/0rBOBFmDh0

— HODL15Capital  (@HODL15Capital) January 30, 2024

(@HODL15Capital) January 30, 2024

Bitcoin exchange-traded funds (ETFs) are led by BlackRock with $383 million and Fidelity with $288 million. On the 29th, Invesco and Galaxy Asset Management, which are lagging far behind in getting off to a fast start, announced that they would lower their fund trust fees from 0.39% to 0.25%, and the competition to acquire new customers is becoming even more intense. .

According to Mr. Ali, who analyzes on-chain data, whales (large investors) holding 1,000 BTC or more were increasing their holdings during the correction phase of Bitcoin (BTC). It has increased by 4.50% over the past two weeks.

While some shivered with fear during the recent price correction, #Bitcoin whales were accumulating more $BTC!

Around 67 new entities now hold 1,000 #BTC or more, marking a 4.50% increase in two weeks. pic.twitter.com/tje3fhznRR

— Ali (@ali_charts) January 30, 2024

altcoin market

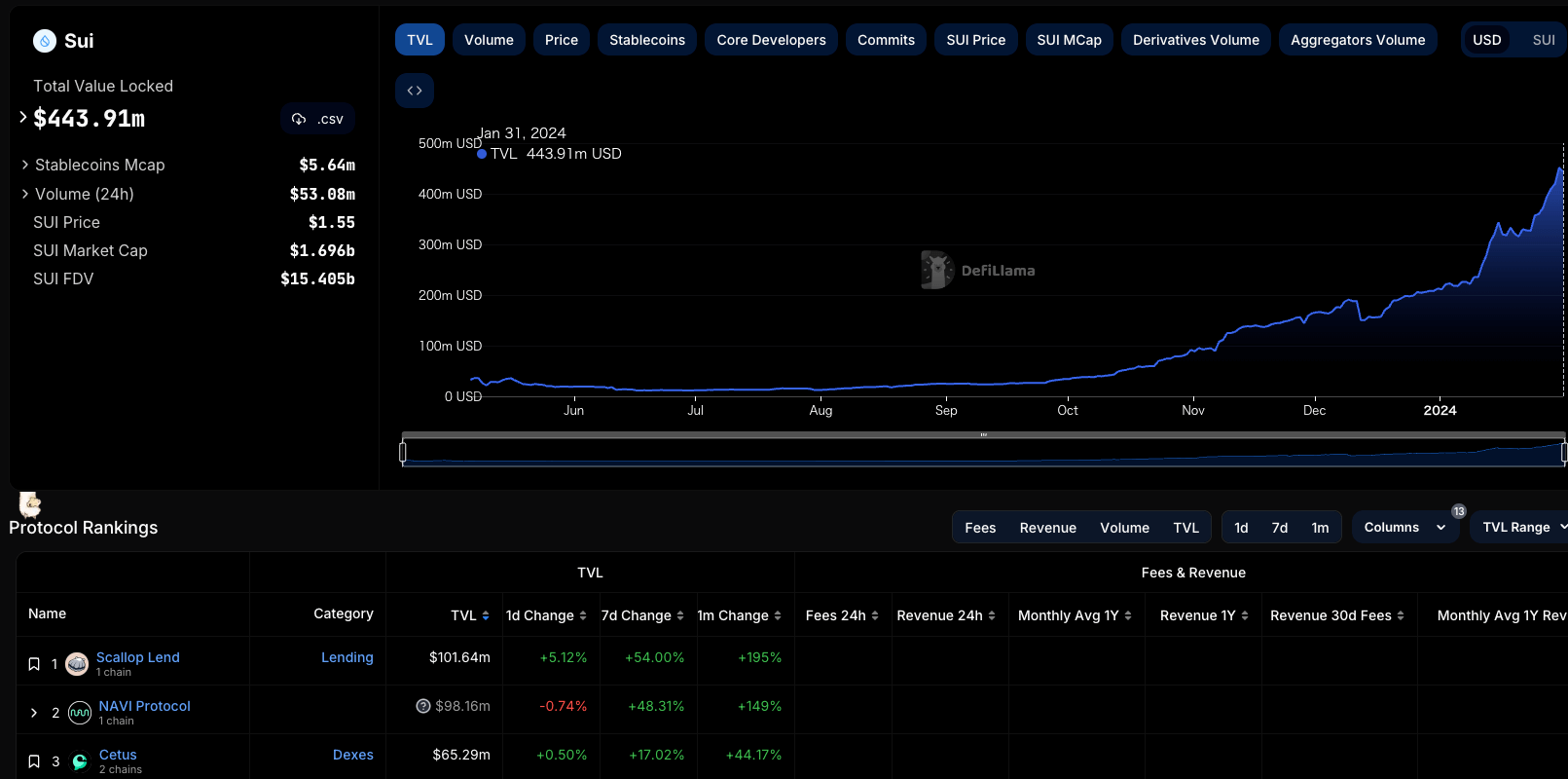

The price of Sui (SUI), a layer 1 blockchain that inherits the lineage of Diem (formerly Libra), which was led by the former Facebook, has hit a new all-time high. As of the 31st, it was up 83.7% from the previous month and 19.9% from the previous week.

Total Value Locked (TVL), which measures the total amount of deposits into the Sui network’s protocol, rose steadily, reaching an all-time high of $440 million.

defillama.com

The partnership between Banxa, an infrastructure provider that provides payment services such as the exchange of virtual currency and fiat currency, with SUI Wallet was cited as a factor.

Banxa is expanding in the #SUI community by partnering with SUI Wallet. Users can now on ramp with fiat utilizing Banxa’s payment solutions, all in-app! additional users will benefit from ZERO Gateways Fees! @SuiNetwork

— Banxa (@BanxaOfficial) January 30, 2024

Regarding Sui’s advantages in Web3 games and DeFi (decentralized finance) use cases, Evan Cheng, CEO of Sui developer Mysten Labs, said in August last year, “On the Ethereum (ETH) blockchain, it takes an average of 12 He emphasized the benefits, saying, “Compared to seconds, Sui allows you to sell NFTs in 0.5 seconds.”

Another strength is Sui’s programming language “Sui Move.”

The Move language is a programming language for smart contracts designed by the former Facebook (Meta) for the Libra (Diem) blockchain.

connection:The CEO of the Sui development company talks about the challenges of Web3 games and the advantages of Sui | WebX interview

In addition, 33 million dYdX (equivalent to $89 million), which is 6.21% of the supply of the decentralized exchange (DEX) dYdX, is scheduled to be unlocked on February 1st.

Top 7 Biggest Token Unlocks in the Next 7 Days

Monitoring of vested tokens and future unlock events is an important step to make more cautious and, in the end, better trading decisions. Let’s take a look at this and some other biggest unlocks coming in the next 7 days, including… pic.twitter.com/x0xW2x1d2r

— TOP 7 ICO | #StandWithUkraine (@top7ico) January 29, 2024

(@top7ico) January 29, 2024

“WebX2024” New IP area will be established where Kodansha, Toho and others will exhibit, ETH Tokyo and DAO Tokyo will also be held at the same time https://t.co/Gs5y7wI1Kx

Date and time: 2024/8/28 (Wednesday) – 8/29 (Thursday)

Location: The Prince Park Tower Tokyo

*The video is “WebX2023” pic.twitter.com/vHZmFbNjwM

— CoinPost (virtual currency media) (@coin_post) January 18, 2024

Bitcoin ETF special feature

We have introduced the “Heat Map” function to the CoinPost app for investors!

In addition to important news about virtual currencies, you can also see at a glance exchange information such as the dollar yen and price movements of crypto asset-related stocks in the stock market such as Coinbase.

■Click here to download the iOS and Android versions

https://t.co/9g8XugH5JJ pic.twitter.com/bpSk57VDrU

— CoinPost (virtual currency media) (@coin_post) December 21, 2023

Click here for a list of past market reports

The post Bitcoin takes a pause before FOMC, Sui rises 20% compared to the previous week appeared first on Our Bitcoin News.

1 year ago

76

1 year ago

76

English (US) ·

English (US) ·