Bitcoin (BTC)’s exchange rate against the US dollar has been affected by financial turmoil triggered by the U.S. bank collapse in March, and by the U.S. Federal Reserve’s (Fed) Emergency Lending Facility (Bank Term Funding Program). In the second half of March, it returned to the 2021 low of $28,800, supported by expansion and receding expectations of aggressive interest rate hikes.

On the other hand, although it remained firm thereafter, the US Federal Open Market Committee (FOMC) in March denied the possibility of starting an interest rate cut within the year, and the US Commodity Futures Trading Commission (CFTC) filed a lawsuit against Binance. weighed on the market, and the price struggled around $28,000 for about three weeks.

However, in April, the Ethereum (ETH) market surged ahead of the Shanghai (Chapella) update, reaching $ 1,900 for the first time in August last year, and the Litecoin (LTC) market, which will be halved this summer, will also rise. With the rise of altcoins, the BTC market also rose, and it succeeded in recovering to $ 30,000 with a short loss cut. Furthermore, BTC touched $31,000 for the first time in June last year when the ETH price hit $2,100 after passing the Shanghai update.

On the other hand, at the moment, $31,000 is the resistance of the BTC market, and the price has stalled due to FRB Governor Waller’s remarks that he would support an additional interest rate hike in May. Some profit bookings were seen on the 17th, with the market failing to hold onto the psychological milestone of $30,000.

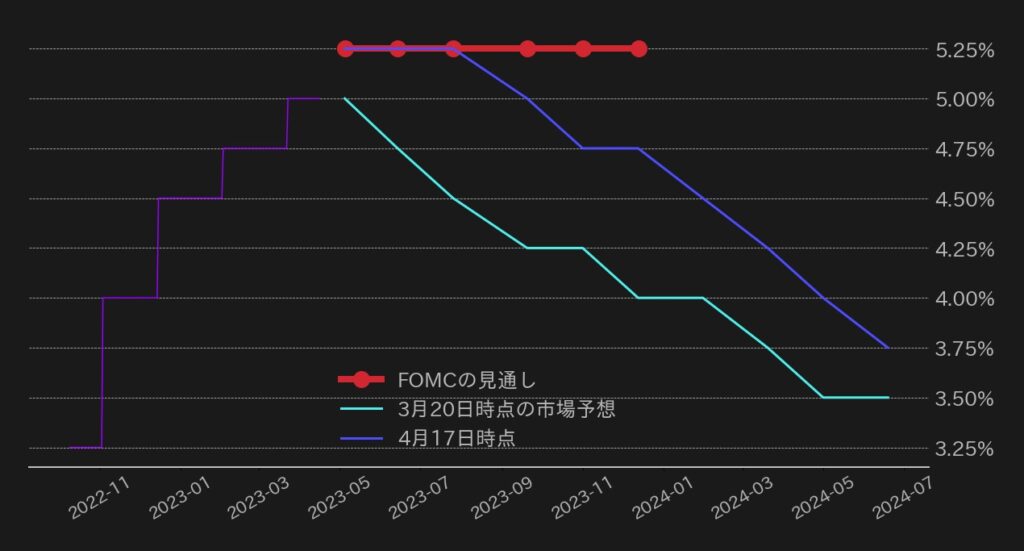

With the bankruptcy of the U.S. banks in March, the Fed Funds futures market has priced in the start of interest rate cuts from June. It has risen to the same level as the FOMC forecast (Figure 2). It is pointed out that the reason why BTC remains firm even in this situation is that, in addition to the rise in the altcoin market, there are expectations that interest rate hikes will be halted in May.

The FOMC decided to raise the interest rate in March amidst smoldering financial instability, and denied the possibility of starting an interest rate cut within the year. It has become clear that he was concerned about the impact of changes in the economy on the economy, and a more cautious stance than ever has been glimpsed.

In addition, in the FOMC statement, the phrase “ongoing interest rate hikes are appropriate” has been changed to vague phrases such as “some tightening may be appropriate,” and preparations are steadily progressing toward stopping rate hikes. I could see that I was there.

Figure 2: U.S. policy interest rate target upper limit (purple), FOMC outlook (red), Fed funds futures market expectations (FRED, created from fedwatch/bitbank)

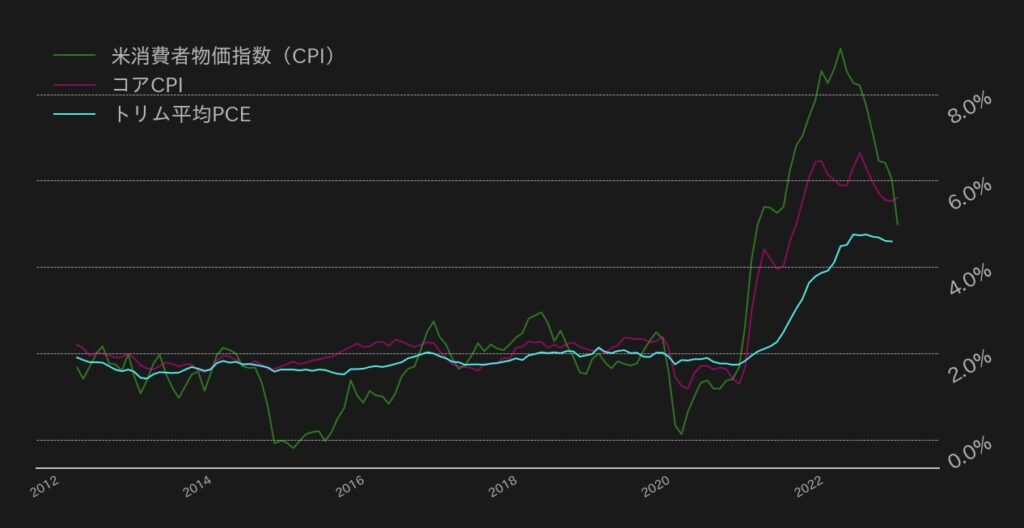

Figure 2: U.S. policy interest rate target upper limit (purple), FOMC outlook (red), Fed funds futures market expectations (FRED, created from fedwatch/bitbank)Meanwhile, the U.S. consumer price index (CPI) in March was down 1 percentage point to 5.0% in the headline from 6.0% in February, while the core index, which excludes food and energy, rose from 5.5% to 5.6%. (Fig. 3). The trimmed average PCE inflation rate, which indicates the medium- to long-term inflation trend, peaked out in October last year, but since then it has been steadily declining in the upper 4% range, and the inflation rate has remained high. .

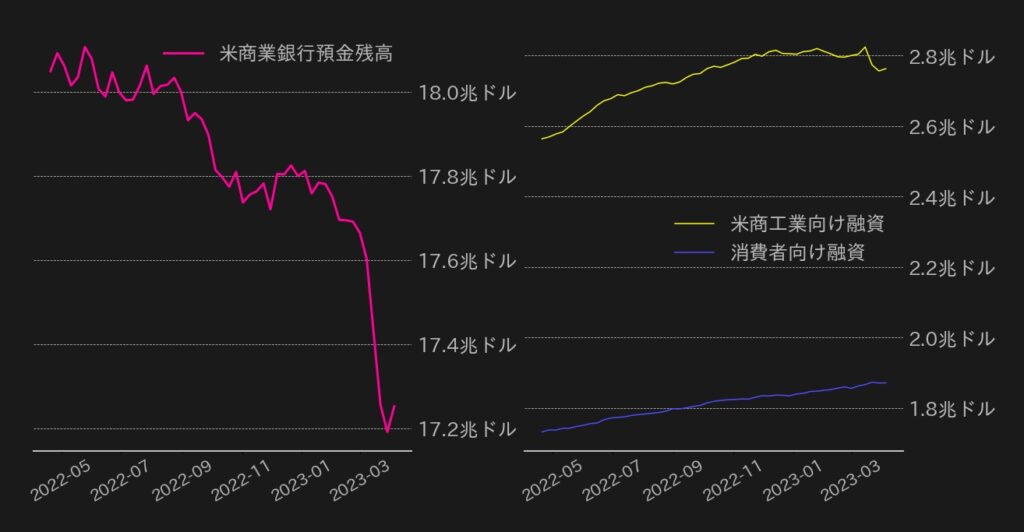

Under these circumstances, there remains some doubt as to whether the interest rate hikes will really come to an end in May, but it is expected that changes in the bank credit environment will take the place of interest rate hikes and put pressure on aggregate demand. As is well known, there was a huge withdrawal of deposits from US commercial banks in March, and along with that, bank lending has begun to slow down.

Loans for general consumers were steadily rising even in the phase of aggressive interest rate hikes, but recently leveled off. rice field. Such a credit crunch will encourage consumption to slow down and companies to cut costs, and as a result, it is possible that upward pressure on prices will be restrained. deaf.

Fig. 3: US CPI and Trimmed Average PCE (Created by FRED/bitbank)

Fig. 3: US CPI and Trimmed Average PCE (Created by FRED/bitbank) Figure 4: U.S. Commercial Bank Deposit Balance, Commercial and Industrial Loans, Consumer Loans (Created by FRED/bitbank)

Figure 4: U.S. Commercial Bank Deposit Balance, Commercial and Industrial Loans, Consumer Loans (Created by FRED/bitbank)The current FF interest rate futures market has priced in the possibility of an interest rate hike in June at just over 20%, so if the rate hike is tentatively announced in May, it will be a tailwind for BTC. In addition, the possibility of an interest rate hike in May is already factored in at just under 90%, and selling ahead of the FOMC meeting on May 2nd and 3rd is likely to be limited.

The BTC market is currently loose, but a slight technical overheating was confirmed at the time of the $30,000 mark, so further adjustments will be necessary to extend the topside. The market has turned upwards after hitting a dip this year, and the $30,000 level is in sight in May.

Fig. 5: Bitcoin vs. dollar daily chart (created from Glassnode/bitbank)

Fig. 5: Bitcoin vs. dollar daily chart (created from Glassnode/bitbank)Yuya Hasegawa: Bitbank Market Analyst ── After completing a graduate school in the UK, he worked as an analyst in the FinTech industry and the virtual currency market at a venture consisting of people from financial institutions. Market analyst at Bitbank Co., Ltd. since 2019. He has a track record of providing comments to major domestic financial media and contributing to overseas media.

|Editing: Takayuki Masuda

| Top image: bitbank

The post Bitcoin temporarily hits $30,000 but stalls — Will it be the last interest rate hike at the FOMC in May?[bitbank monthly report] appeared first on Our Bitcoin News.

2 years ago

195

2 years ago

195

English (US) ·

English (US) ·