The post Bitcoin Up by 15% , Is The Bull Run Back? appeared first on Coinpedia Fintech News

Bitcoin surprised the market by crossing the $60,000 mark on September 14. This is the second time BItcoin has crossed this price range after getting rejected from $65,500 on August 26. Even though the largest crypto was able to cross $60k now it got trapped between the former price and $60,800 which it rejected on August 29. Investors would be happy to see such a movement however, there are certain concerns about it as well. Let’s explore what caused it and what can happen next.

Microstrategy Bought More Bitcoin

On September 13, Microstrategy bought another 18,300 Bitcoin, growing the company holdings to 244,800 BTC. Microstrategy is the biggest holder public company of Bitcoin. The whole crypto market was in fear of a price plummet as September is the most bearish month in the history of BTC.

When the market panics, it is an opportunity for the whales and that’s what microstrategy did. With this latest buying, the average buying price per bitcoin for the company becomes $38,585. This huge bitcoin purchase gave the needed boost to the market and it started moving upwards.

The Movement on Charts

Last week the price of Bitcoin was around $52,000 zone and in just 7 days, it rose by more than 15% and is currently trading at $60,384. Earlier the price got tangled in various moving averages. Even though the month is not so supportive for bitcoin historically, it kept pushing limits.

One of the biggest challenges was to cross the MA 200, because it would have definitely rejected the price. However microstrategy came to the rescue. They bought 18,300 Bitcoin that let the dice rolling and the assets did not only cross the 2oo MA but also penetrated the $60,000 wall. Right now, the price is struggling to bypass the $60,800 zone as it has been a great resistance earlier. The possibility of getting rejected from this point can not be denied.

Investor’s Fear

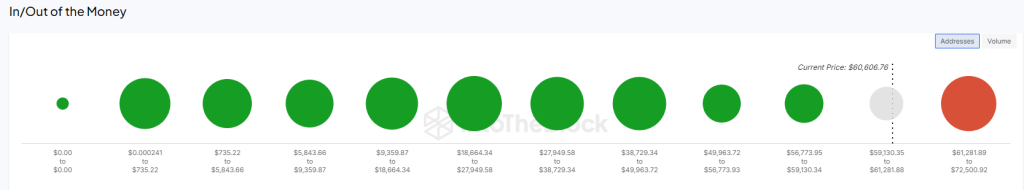

The data from “IntoTheBlock” shows that at current price there are 84% investors who are in profit and 13% are still in loss. This leaves 3% investors who bought at the current price range. A total of 75,305 Bitcoin were bought between a minimum price of $59,130 and a maximum of $61,281.88. There are 1.65 million bitcoin addresses that are still at the money. They bought at current price and hence they are neither in loss nor in profit.

Even though investors are happy that Bitcoin is up today and crossed the $60k range, huge concerns lie ahead. Between the price range of $61,281 and $82,500 there are 6.88 million bitcoin addresses holding a total volume of 3.1 million BTC. This data suggest a huge resistance for further upward movement.

Trader’s Position

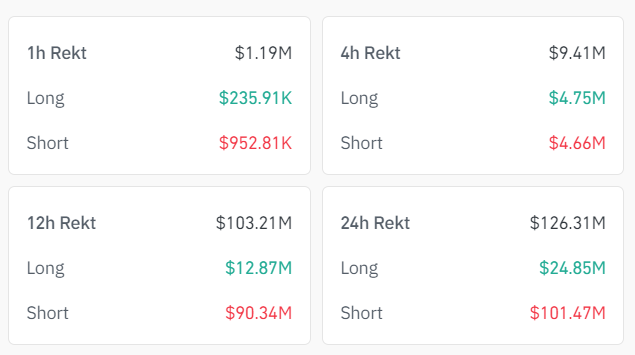

Talking about the traders, in the last 24 hours, a total of 34,678 traders were liquidated with a total liquidation of $126.40 million worth of trades. The rising movement of bitcoin price caused the short traders to lose $101.56 million worth of assets.

The open interest weighted funding rate has fallen to -0.0061% showing a short squeeze. This implies that short traders had to buy back their trades to avoid further losses.

Looking ahead!

Even though Bitcoin successfully climbed the $60,000, the path ahead is not so smooth. The retail investors who bought above this level might try to take profit when the price reaches there and that can cause Bitcoin to get support. The market sentiment at this moment is neutral, as Fear and Greed index is recorded at 50 Points. At this moment, it would be interesting to see if Bitcoin will pass the $60,800 zone to fight the next resistance or will fail and come back to $57,000.

11 months ago

87

11 months ago

87

English (US) ·

English (US) ·