Macroeconomics and financial markets

In the US NY stock market on the 6th, the Dow closed at $34.99 (0.1%) lower than the previous day and the Nasdaq at $119.5 (1.00%) lower.

The financial market, which had continued to grow since the beginning of the year due to the slowdown in interest rate hikes by the Federal Reserve (Fed), is now on a downward trend.

Last Friday’s U.S. jobs report came out much better than expected, throwing cold water on a faltering market.

This is because there is a widespread view that interest rates will continue to be raised for the foreseeable future due to concerns about the overheating of the labor market. Labor shortages lead to rising labor costs and service prices, which could lead to persistently high inflationary pressures.

At 2:00 am on the 8th, key figures such as FRB Chairman Powell and Philadelphia Federal Reserve Bank President Harker are scheduled to give speeches at the Economic Club in Washington, DC, and there is a view that this will fill the perception gap with the market.

Even though it has peaked out, the current annual inflation rate of 6.5% is well above the Fed’s inflation target of 2.0%. With the release of the US Consumer Price Index (CPI) on the 14th, the market is likely to take a wait-and-see approach.

connection:U.S. AI-related stocks perform well, dollar/yen continues to rise, expectations for early U.S. interest rate cut fall | 7th Financial Tankan

Virtual currency market

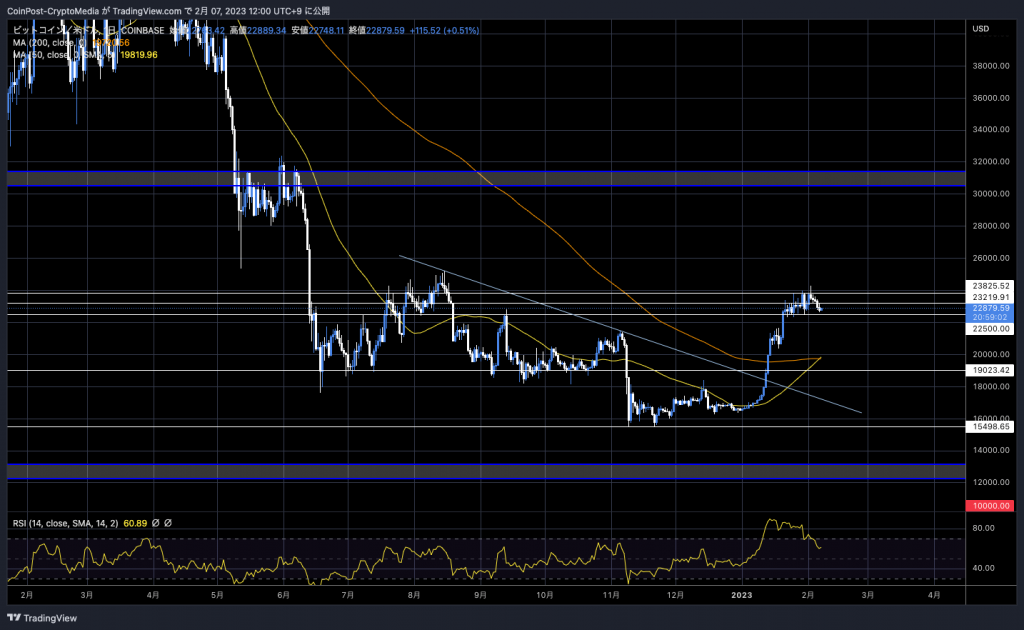

In the crypto asset (virtual currency) market, Bitcoin rose 0.22% from the previous day to $22,884.

BTC/USD daily

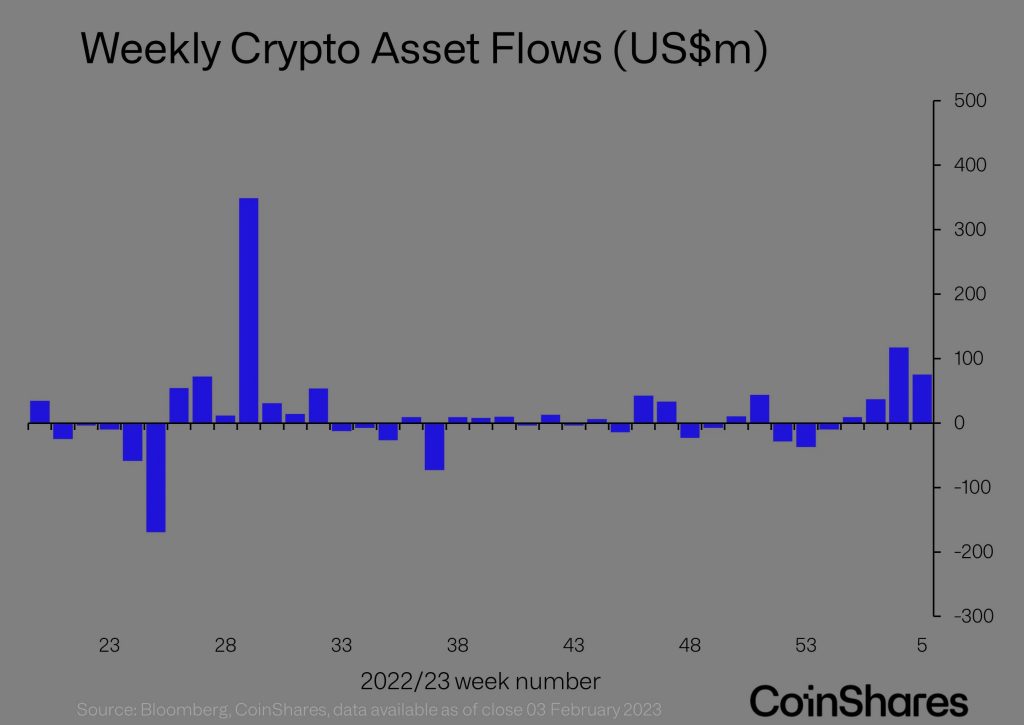

According to a weekly report by asset management firm CoinShares, institutional investors’ capital flows into digital assets such as cryptocurrency mutual funds have turned significantly positive for the second week in a row.

CoinShares

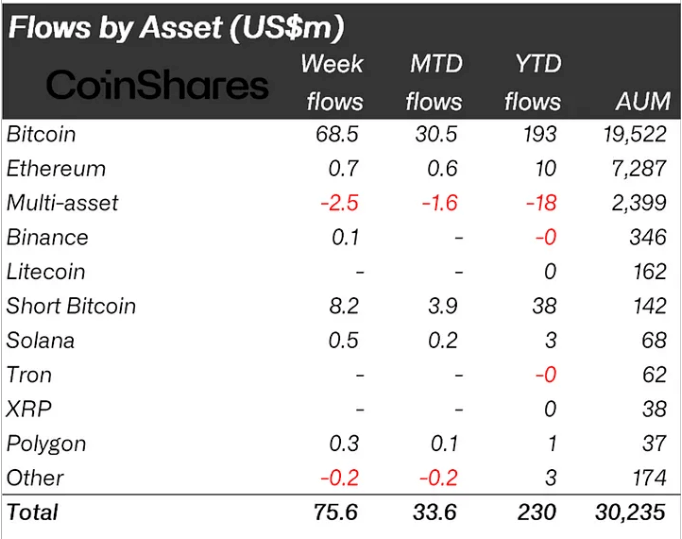

CoinShares assets under management (AuM) grew 39% year-to-date to reach $30.3 billion, the highest level since August 2022. is. Year-to-date inflows have reached $230 million.

On the other hand, the inflow to Ethereum (ETH), which is about to be upgraded in Shanghai, is limited. Ethereum received just $700,000, compared to Bitcoin, which accounted for about 90% of last week’s inflow ($69 million).

CoinShares

altcoin market

Due to the influence of OpenAI’s “ChatGPT”, in which Microsoft has invested a large amount in the United States, the stock and crypto asset markets are looking for artificial intelligence (AI)-related stocks.

In the stock market, NVIDIA and C3 AI have risen significantly, and among altcoin individual stocks, SingularityNET (AGIX) has increased by 33.8% from the previous day and by 196% from the previous week. The Graph (GRT) surged 46.7% from the previous week.

connection: 2023 where we can expect technology fields such as AI ─ US ARK Invest

SingularityNET is a blockchain-based AI-related project built on the Cardano (ADA) network. In December 2017, it raised $36 million through an ICO (initial coin offering).

On the 3rd of this month, it announced that the amount of tokens traded on the Ethereum standard “ERC-20” bridge reached the 200 million AGIX milestone.

Last month, we passed an important growth milestone on our journey toward becoming chain-agnostic, with +200m transacted tokens on the #SingularityNET ERC-20 bridge.

Thanks as ever to the amazing #CardanoCommunity for the ongoing support!

Here’s to the first billion! pic.twitter.com/rAPjzEPFc1

—SingularityNET (@SingularityNET) February 3, 2023

The Graph is a decentralized data platform on the blockchain.

It is an open source index protocol that specializes in on-chain data search functions on blockchains and is used for data collection, processing, and storage in order to improve the efficiency of information acquisition for dApps (decentralized application) developers.

In January 2022, it raised $50 million in a funding round led by investment fund Tiger Global Management.

According to a report by market intelligence provider Messari, the GRT ecosystem is experiencing significant growth, with node operator indexers, delegating network participant delegators, and curators increasing steadily each quarter. . Query (data request) fee GRT revenue increased 66% QoQ.

Recently, the movement around AI has become active, and on the 6th, Google just announced the trial introduction of chatbot “Bard” using AI. From the notable problem-solving ability of conversational natural language AI “ChatGPT”, the view that it poses a threat to the core business of the largest search engine Google has spread.

On the 3rd, Google announced a $300 million investment in AI startup Anthropic and a partnership with Google Cloud.

connection:Google Releases Conversational AI (Artificial Intelligence) Language Model “Bard”

Click here for a list of market reports published in the past

The post Bitcoin wait-and-see mood, AI-related stocks continue to be searched for in the stock and alt markets appeared first on Our Bitcoin News.

2 years ago

149

2 years ago

149

English (US) ·

English (US) ·