Macroeconomics and financial markets

In the US NY stock market last weekend, the Dow closed at $169.39 (0.50%) higher and the Nasdaq at $71.46 (0.61%) lower than the previous day.

US long-term interest rates rose as the University of Michigan Consumer Confidence Index rose. Consumer expectations for inflation one year ahead rose from 3.9% in the previous month to 4.2%, which also led to higher long-term interest rates and dollar buying.

Rising long-term interest rates and a rising dollar index have weighed on the tech-heavy Nasdaq, leading the sell-off.

In the Tokyo stock market on the 13th of the week, selling is dominant before the CPI (US consumer price index). The official announcement of the successor to Kuroda, the governor of the Bank of Japan, is about to be announced, and last weekend it was reported that Kazuo Ueda, a former BOJ deliberative committee member and economist, would be appointed.

Although it suggests that the monetary easing policy will be maintained, there is a possibility that the Bank of Japan will be forced to change the policy so far at the decision meeting scheduled in April under the new system, and the sense of caution is smoldering.

connection:Next BOJ Governor Revealed, US CPI Next Week | 11th Financial Tankan

Virtual currency market

In the crypto asset (virtual currency) market, Bitcoin fell 0.35% from the previous day to $ 21,750.

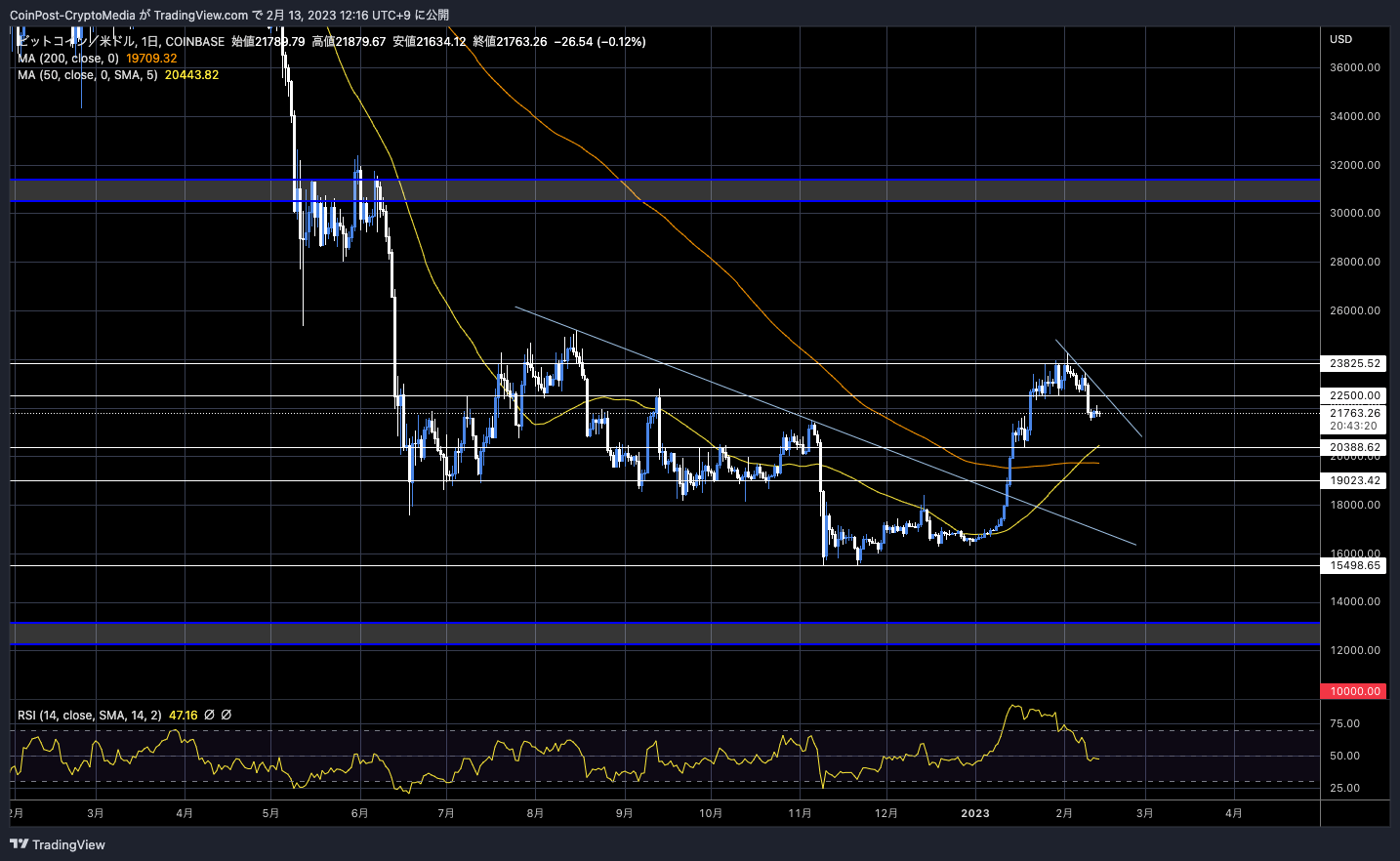

BTC/USD daily

The overall financial market is in a wait-and-see mode ahead of the US Consumer Price Index (CPI), and if it continues to fall, the main support will be the horizontal line near $20,400 and the 200-day moving average of $19,700.

The daily RSI, which had reached “89” on January 14th, showing a strong sense of overheating after the streak, is now calming down, falling below “50” one month later.

connection:Bitcoin decline led by Alto, can a big collapse be avoided | Contribution by bitbank analyst

connection:Professional Commentary on Bitcoin Derivatives Market at the Beginning of 2023 | Virtual NISHI Contribution

In the altcoin market, Ethereum (ETH), the second largest by market capitalization, fell 1.65%, XRP fell 3.08%, and Polygon (MATIC) fell 2.18%.

The U.S. SEC (Securities and Exchange Commission) sued the staking service provided by the long-established U.S. exchange Kraken for violating U.S. (unregistered) securities laws, suspending the provision of staking services to U.S. users and $30 million (about $30 million). It was reported that the Kraken side had agreed to pay a fine of 3.9 billion yen, increasing market uncertainty.

What is staking

A system in which rewards can be obtained by depositing crypto assets (virtual currency) for a predetermined period.

CoinPost: Virtual Currency Glossary

CoinPost: Virtual Currency Glossary

There are concerns about the risk of securitization issues of other major exchanges such as US Coinbase and staking PoS currencies in general such as Ethereum (ETH).

On this point, Coinbase CEO Armstrong, citing a paper by VC giant Paradigm, emphasized that “it does not fall under the Howey test investment contract.”

Experts commented, “Kraken’s staking service, which was pointed out for its lack of transparency such as timely disclosure, was essentially a yield product, but it is a staking brokerage for Coinbase, decentralized protocols Lido and Rocket Pool. It is different in nature from a service,” some point out.

UPDATE: a lot of my caveats come into play with this paragraph–the offer of a specific return, and Kraken not paying the actual network return out…this does make a big difference legally I think, and I can more see why kraken didn’ t litigate now pic.twitter.com/uab93cjNXp

— _gabriel Shapir0 (@lex_node) February 9, 2023

In September 2010, Ethereum changed its consensus algorithm from PoW (Proof of Work) to PoS (Proof of Stake) after undergoing a large-scale upgrade “The Merge”. As a result, staking became possible.

The impact on the market is detailed in the article below.

detail:How to view the US SEC’s Kraken indictment and consider the impact on Ethereum staking

Alt market sells first

The sudden deterioration in sentiment in the financial market after the release of the US employment statistics the other day and the emergence of the US regulator’s ban on staking has shaken cryptocurrency investors, who had begun to be bullish since the beginning of 2011.

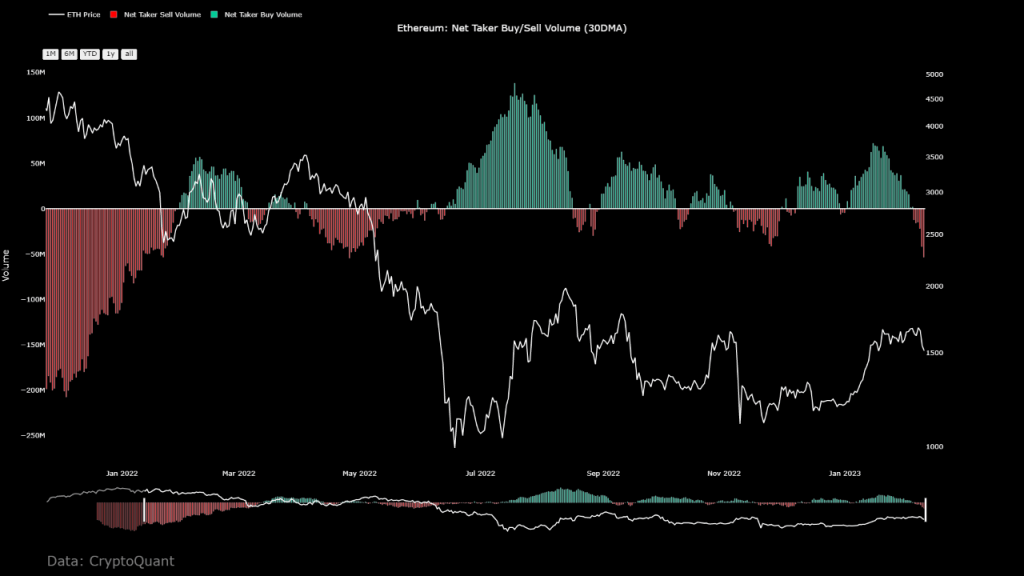

Ethereum’s “Net Taker Volume” is the highest since May 2022, when the cryptocurrency market crashed due to the Terra (LUNA) shock, according to a post by maartunn, a certified analyst at data analytics firm CryptoQuant, on the 11th. A negative scale was recorded.

Source: CryptoQuant

Net Taker Volume is on-chain data that shows the difference between “Taker Buy Volume” and “Taker Sell Volume” excluding forced liquidation (loss cut). Taker trading refers to orders that are traded before being placed on the order book (market orders), and the above chart shows a sharp increase in withdrawal behavior using Ethereum investors’ “market orders”.

Unlike a “limit order” that puts an arbitrary buy (bid) and sell (ask) price on the order book and waits for execution, in a “market order”, the execution price is secondary and you want to take profits or cut losses as soon as possible. often used.

Ethereum (ETH) is preparing for a large-scale upgrade “Shanghai” in March this year, and the launch of the testnet to check the load is proceeding smoothly. It is expected that approximately 16 million ETH, including staking rewards that have been locked up so far, will be able to be withdrawn. 13.2% of ETH supply.

connection:What impact will the Shanghai upgrade scheduled for March have on the Ethereum market?

Click here for a list of market reports published in the past

The post Bitcoin wait-and-see trend ahead of CPI, surge in “market selling” suggests Ethereum investor sentiment appeared first on Our Bitcoin News.

2 years ago

159

2 years ago

159

English (US) ·

English (US) ·