Macroeconomics and financial markets

In the US NY stock market on the 24th, the Dow Jones Industrial Average rose 66 dollars (0.2%) from the previous day, and the Nasdaq Index closed 35 points (0.29%) lower.

connection:Stock investment recommended for cryptocurrency investors, representative cryptocurrency stocks of Japan and the United States “10 selections”

Virtual currency market

In the crypto asset (virtual currency) market, Bitcoin fell 1.22% from the previous day to $27,411.

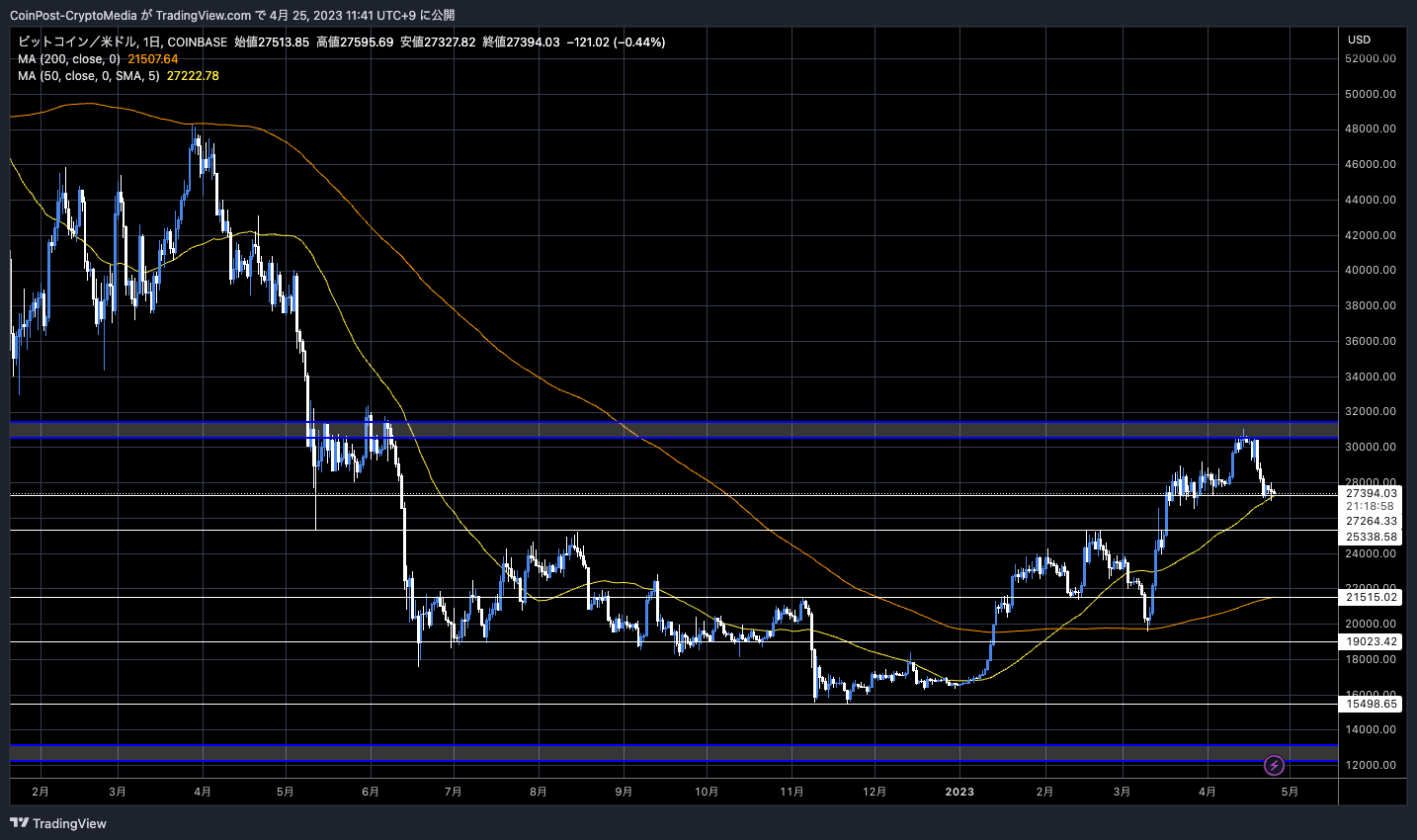

BTC/USD daily

The bullish mood until the other day, when the price climbed to the $31,000 level, has turned around, and the bearish trend continues.

The US Personal Consumption Expenditure (PCE) price index on the 28th, the US Federal Open Market Committee (FOMC) statement from 2:30 on May 3 (Japan time) and the announcement of the US Federal Open Market Committee (FOMC) and Chairman Jerome Powell’s press conference, the crypto asset market will also be on the lookout. The tone is getting stronger.

Recently, U.S. regulators have stepped up pressure on cryptocurrency exchanges, and unexplained outflows of funds from digital wallets have been raised as a cause for concern. Funds have been transferred from wallets that have been dormant for many years, and some are wary of selling pressure at the moment.

connection:Unexplained asset outflow from cryptocurrency wallet, total damage estimated at 1.3 billion yen (5,000 ETH)

connection:Bitcoin that has not moved for more than 9 years has been moved Equivalent to a total of 9 billion yen in 2 days

Optimistic scenarios are also deeply rooted in the medium- to long-term perspective. Researchers at Standard Chartered Bank have predicted that Bitcoin price could reach $100,000 by the end of 2024. The all-time high was $60,000 in October 2022.

The main reasons given were the global credit (financial) instability surrounding the banking sector, the end of the Fed’s (US Federal Reserve) interest rate hike cycle (stabilization of risky assets), and the improvement in profitability of cryptocurrency mining. .

connection:“Bitcoin could rise to $100,000 by the end of 2024,” Standard Chartered Bank analysis

Bitcoin will undergo a “half-life” once every four years around May 2024.

In the next half-life, the mining reward for miners will be halved from 6.25 BTC to 3.125 BTC, and the scarcity as a currency will increase as the supply decreases. In past market cycles, there has been a tendency to move into a bull market around the time of the halving.

connection:What is Bitcoin Halving?Explain the impact on virtual currency prices and caution points

On-chain data show good progress. According to data released by data analytics firm Glassnode, the Bitcoin network recorded a third-highest total of 430,000 transactions on the 23rd. This is the second highest number after 450,000 in May 2019.

Glassnode

The surge in network activity suggests a strong demand for using the Bitcoin network as a payment layer.

altcoin market

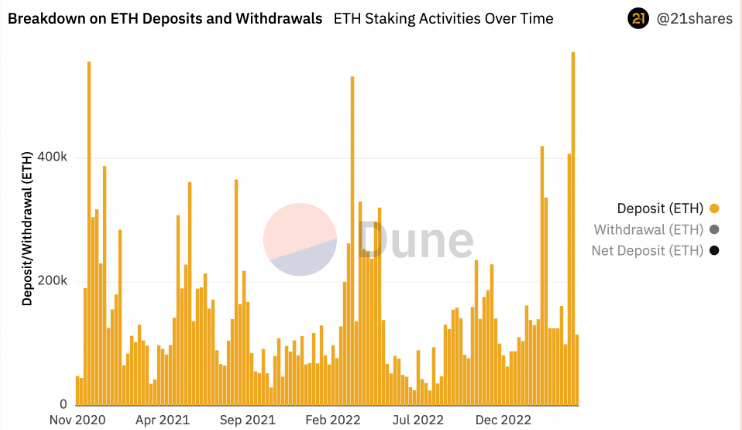

New deposits surged to 571,950 ETH last week after the Shanghai (Shapella) upgrade of Ethereum (ETH). It is equivalent to more than $1 billion in weekly inflows, the largest ever.

21shares

With the upgrade, it is possible to withdraw stake rewards over two and a half years, and it seems that reinvestment is the main thing.

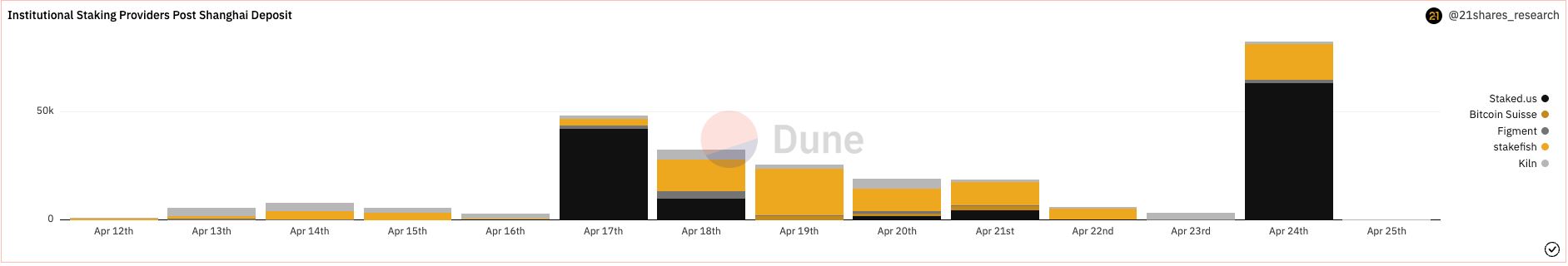

Leading analytics firm IntoTheBlock looks at the post-Shapella landscape. “The staking share of staking service providers for institutional investors and crypto asset (virtual currency) exchanges in Asia has increased more than expected,” he said.

Following the Ethereum Shapella upgrade, the share of deposits by staking providers has changed significantly. Most notably, we see an unexpected staking share increase for institutional staking providers and Asian CEXs.#ETH #Staking pic.twitter.com/RI5OU5qzZ4

— IntoTheBlock (@intotheblock) April 21, 2023

Hong Kong-based cryptocurrency exchange Huobi has jumped from 0.6% of all staked ETH to 5.4% after Shapella. OKX also expanded from 0.69% to 3.71%.

Staked.us and Stakefish are the top staking providers that also offer services to institutional investors.

21Shares

On the other hand, the staking share of Kraken and Coinbase, which were forced to suspend services due to enforcement actions and warning letters from the US SEC (Securities and Exchange Commission) for violating securities laws, decreased sharply.

As the United States strengthens regulations on the crypto asset (virtual currency) industry and moves to shut it out of the country, such as compulsory enforcement measures to suspend services, Hong Kong, which China positions as a special administrative region, has a budget proposal for fiscal 2023. , 6.8 billion yen is posted for Web3 ecosystem development, showing contrasting movements.

connection:Hong Kong government’s 2023 budget proposal, 6.8 billion yen for Web3 ecosystem development

Click here for a list of market reports published in the past

[Recruitment]Recruitment of new personnel due to Web3 business expansion

Japan’s largest cryptocurrency media CoinPost is looking for full-time employees and interns as it expands its Web3 business.

1. Media Business (Editorial Department)

2. Marketing operations

3. Conference management and launch work

4. Open Position (students welcome)

Details https://t.co/UsJp3v8mSH pic.twitter.com/B98JZmoQbW

— CoinPost-virtual currency information site-[app delivery](@coin_post) February 14, 2023

The post Bitcoin weakens at the $27,000 level, wait-and-see trend ahead of May FOMC appeared first on Our Bitcoin News.

2 years ago

121

2 years ago

121

English (US) ·

English (US) ·