Macroeconomics and financial markets

In the US NY stock market on the 16th of the previous weekend, the Dow Jones Industrial Average fell by $108 (0.32%) from the previous day, and the Nasdaq Index fell by 93 points (0.68%).

connection:NY Dow and cryptocurrency-related stocks all fall, Apple announces MR headset | 6th Financial Tankan

connection:Stock investment recommended for cryptocurrency investors, representative cryptocurrency stocks of Japan and the United States “10 selections”

Virtual currency market

In the crypto asset (virtual currency) market, Bitcoin fell 0.23% from the previous day to $ 26,445.

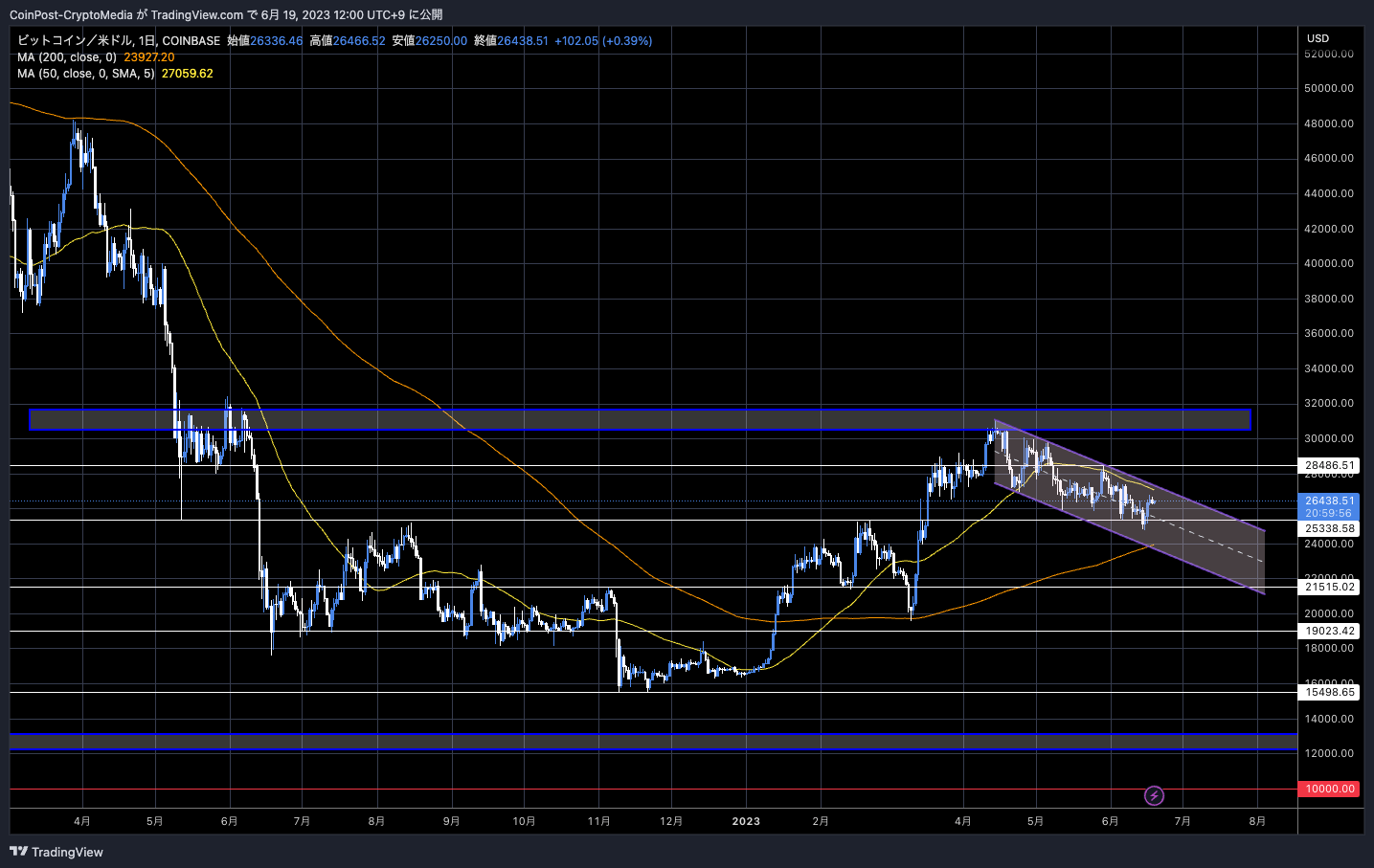

BTC/USD daily

The weekly chart is 2.1% higher than the previous week with a lower shaded positive line. Two weeks ago, the price dropped to $24,750 at one point due to the Binance lawsuit, but then rebounded as the oversold level rebounded. The application for the “Bitcoin ETF” by BlackRock, the largest asset management company, was also well received.

connection:BlackRock Submits Bitcoin ETF

However, even though the price has rebounded, since April it has been moving inside the descending channel while lowering the top, and is now below the weekly 200 MA of $26,597. Amid heightened market uncertainty, the topside is likely to remain heavy unless the $27,000 and $28,500 resistance lines are broken.

Analyst analysis

According to Pentoshi, based on past Bitcoin price trends, if the support line breaks, it is likely to fall to $19,000 to $20,000 and $22,000 to $23,000.

$BTC This area has been essentially what I’ve wanted to see price tap for the past 2 months.

*IF* we fall back into the range under this *then* I think 19-20k and 22-23k are very very likely as we’ve seen w/ similar setups. So that’s a good way to work around this price for… pic.twitter.com/T8Z0puEyHI

—Pentoshi  euroPeng

euroPeng  (@Pentosh1) June 16, 2023

(@Pentosh1) June 16, 2023

Asset allocators such as investment fund managers are unable to invest due to heightened uncertainty such as US SEC (Securities and Exchange Commission) regulations, the US Department of Justice (DOJ)’s involvement in federal criminal law and overall law enforcement, He cited the possibility of the US stock market peaking and peaking out.

Bloomberg reported on the 16th that JPMorgan Chase saw its largest rebalancing flow since the fourth quarter of 2021 in its portfolio, which includes sovereign wealth and pension funds, resulting in up to 5 We anticipate a stock price adjustment of 10%.

Rebalancing is done for risk management and tax reasons based on target asset allocations, and the recent surge in stock prices may require the sale of some overgrown asset classes.

The U.S. Department of Justice (DOJ) is stepping up surveillance of cryptocurrency exchanges to crack down on money laundering and other illegal activities. Reuters reported in May.

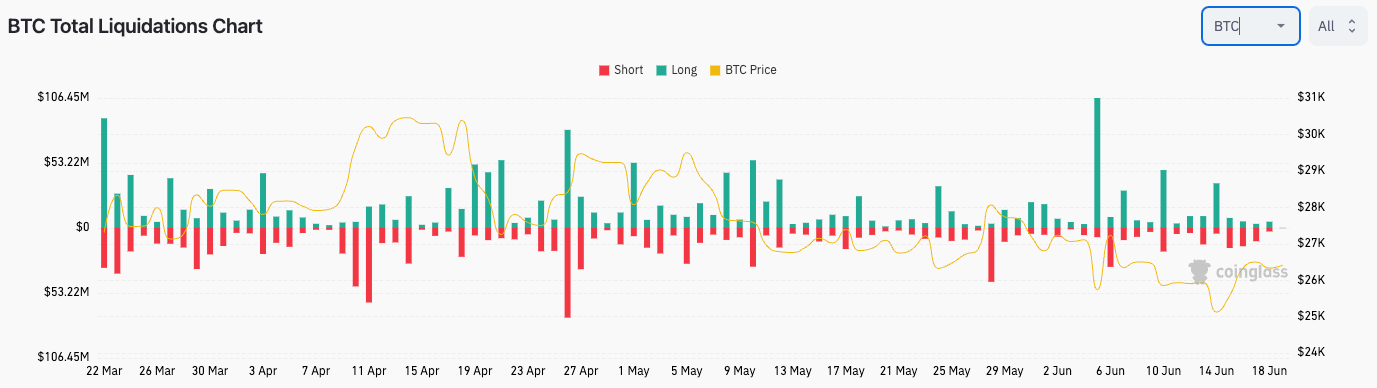

On the other hand, according to Ki Young Ju (@ki_young_ju), CEO of data analytics firm CryptoQuant, there was no large-scale short squeeze (lifting of short positions) during the Bitcoin rally last weekend.

#Bitcoin short squeeze hasn’t happened.

Most perpetual swap buying volume came from pure $BTC purchases, not forced short liquidations.

More bullets for bulls. https://t.co/gkt9JiizM3 pic.twitter.com/xxYbi0DmvD

— Ki Young Ju (@ki_young_ju) June 16, 2023

On-chain data analysis showed that perpetual futures swaps were dominated by regular buys rather than cut short positions (forced liquidations). This indicates that there is still fuel left for significant gains should prices rise further.

BTC Total Liquidations Chart (coinglass)

binance

Binance, which operates the industry’s largest crypto asset (virtual currency) exchange, has been in trouble recently, including being sued by the US SEC over crimes such as selling unregistered securities.

On Monday, it announced its withdrawal from the Dutch market after failing to obtain a virtual asset service provider (VASP) license, and was accused of failing to comply with its anti-money laundering obligations, according to a report by French newspaper Le Monde. , It is also known that it has been subject to preliminary investigation since February 2022.

We regret to announce that Binance is leaving the Dutch market as we have been unable to register as a VASP with the Dutch regulator.

We continue to be committed to working collaboratively with regulators around the world and are additionally focused on getting our business…

—Binance (@binance) June 16, 2023

Meanwhile, a compromise was reached to avoid an injunction to freeze the assets of Binance.US, sought by the U.S. SEC (Securities and Exchange Commission), allowing U.S. customers to withdraw funds from the platform.

connection:SEC and Binance US Agree to Avoid Asset Freeze

connection:Countdown to the next Bitcoin half-life less than a year away, market trends and expert predictions?

Click here for a list of market reports published in the past

[Recruitment]Recruitment of new personnel due to Web3 business expansion

Japan’s largest cryptocurrency media CoinPost is looking for full-time employees and interns as it expands its Web3 business.

1. Media Business (Editorial Department)

2. Marketing operations

3. Conference management and launch work

4. Open Position (students welcome)

Details https://t.co/UsJp3v8mSH pic.twitter.com/B98JZmoQbW

— CoinPost-virtual currency information site-[app delivery](@coin_post) February 14, 2023

The post Bitcoin weekly chart lower shadow positive line, short squeeze of rebound phase not confirmed appeared first on Our Bitcoin News.

2 years ago

148

2 years ago

148

English (US) ·

English (US) ·