Macroeconomics and financial markets

Last weekend, on the 19th, the Dow Jones Industrial Average closed 395.1 points (1.05%) higher than the previous day, and the Nasdaq index closed 255.3 points (1.7%) higher.

In the Tokyo stock market, the Nikkei Stock Average rose 393.7 yen (1.0%) from the previous day. The rise in U.S. high-tech stocks, including semiconductor-related stocks related to the AI (artificial intelligence) market, helped push prices to new highs since the bubble burst.

CoinPost app (heat map function)

connection:Ranking of recommended securities accounts for the stock market that can be used at a profitable price

NISA, virtual currency related stocks special feature

Virtual currency market conditions

In the crypto asset (virtual currency) market, the Bitcoin price increased by % from the previous day to 1 BTC = USD.

connection:Bitcoin is developing without a sense of direction, with a heavy top price and limited downside room | Contributed by a bitbank analyst

Analyst Rekt Capital said, “Weekly closing prices are bearish and could lead to further correction.”

#BTC has indeed dropped into the Weekly Range Low after flipping black into new resistance

Weekly Close below the Range Low would be bearish and could begin the breakdown process$BTC #Crypto #Bitcoin https://t.co/ZIgcdyyiIe pic.twitter.com/SXQ5BfQ4Ds

— Rekt Capital (@rektcapital) January 19, 2024

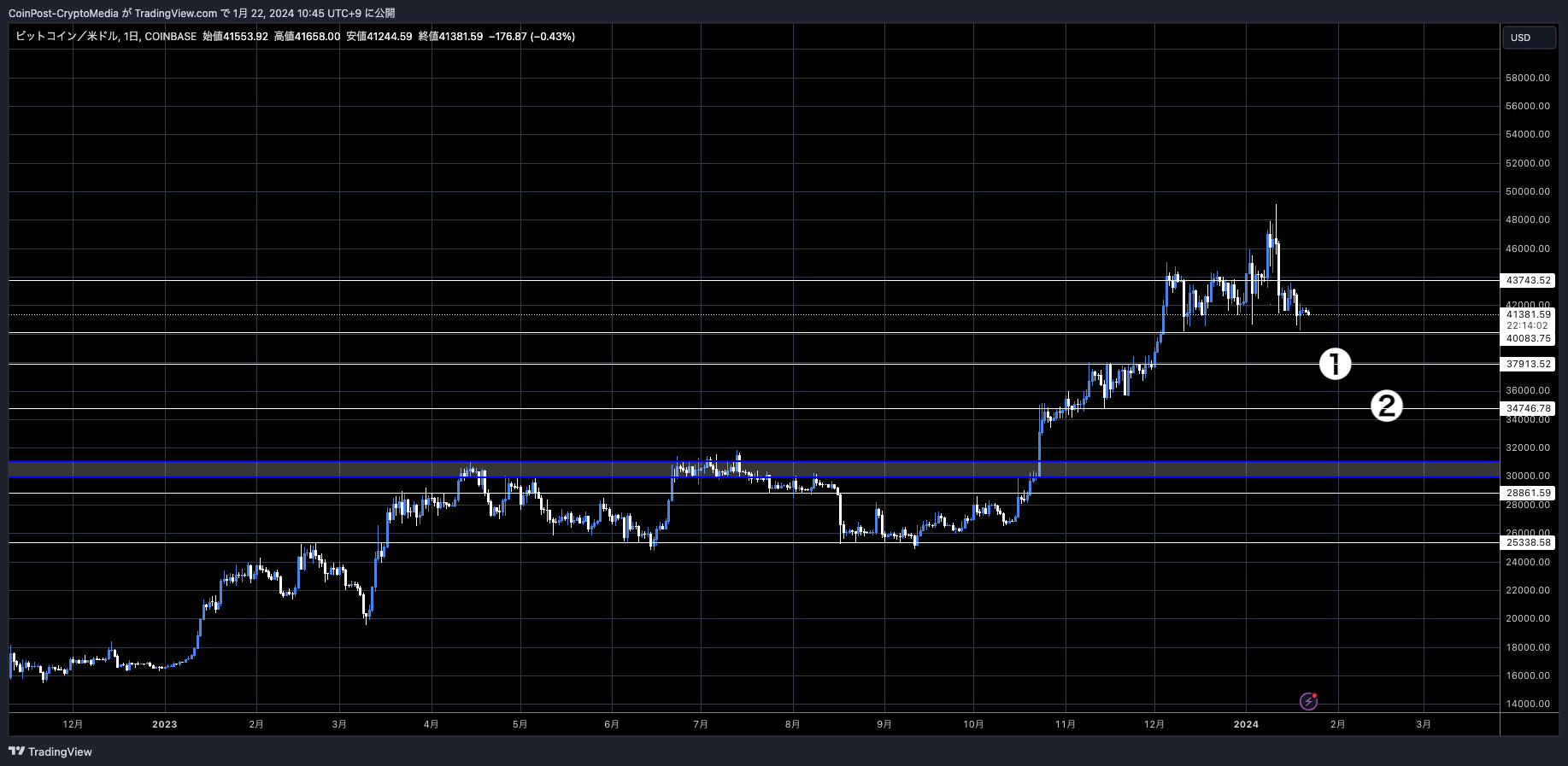

While we can confirm the stability of the $40,000 level, the strength of the rebound is weakening. There is a view that the weekly upper bearded line indicates a near-term peak, and if the price breaks below the $40,000 level, support at $38,000 (1) or $34,700 (2) will likely be considered as a downside prospect.

BTC/USD weekly

The background is that outflows from the Grayscale Bitcoin Trust (GBTC) are putting downward pressure on Bitcoin prices.

Following the conversion of a Bitcoin ETF (exchange traded fund), holders who purchased it at a discount (negative deviation) are exercising open redemption options, resulting in an outflow of $1.17 billion since the conversion to an ETF, according to QCP Capital. was recorded.

Grayscale’s Bitcoin ETF has a management fee of 1.5%, the highest in the industry, and it has been pointed out that it has a low competitive advantage compared to BlackRock and Fidelity’s management fees.

QCP Capital believes that the crypto asset (virtual currency) market is facing a lack of material until there is talk of the Bitcoin (BTC) halving scheduled for mid-April and the possibility of approval of the Ethereum spot ETF expected around May this year. pointed out the possibility of falling into

connection:As GBTC profit selling continues, Grayscale CEO predicts that “other Bitcoin ETFs will hardly survive”

Another headwind is that recent strong economic indicators have diminished expectations for an early interest rate cut by the Federal Reserve, and the US dollar and US bond interest rates have soared. In the NY foreign exchange market, the US dollar index (DXY) hit its highest level in about a month, approaching the milestone of 103.50-104.56.

dollar index weekly

connection:Learn about Bitcoin ETFs from the beginning: Explaining the advantages and disadvantages of investing and how to buy US stocks

altcoin market

The debt consolidation of crypto asset (virtual currency) financing company Celsius, major exchange FTX, and Alameda Research, which went bankrupt in 2022, is also putting selling pressure on the market. Celsius recently transferred $125 million worth of Ethereum (ETH) to multiple crypto exchanges to begin repaying creditors. The amount held is said to be approximately 550,000 ETH ($1.36 billion).

“WebX2024” New IP area will be established where Kodansha, Toho and others will exhibit, ETH Tokyo and DAO Tokyo will also be held at the same time https://t.co/Gs5y7wI1Kx

Date and time: 2024/8/28 (Wednesday) – 8/29 (Thursday)

Location: The Prince Park Tower Tokyo

*The video is “WebX2023” pic.twitter.com/vHZmFbNjwM

— CoinPost (virtual currency media) (@coin_post) January 18, 2024

Among individual stocks, ASTR, the native token of the Japanese public blockchain Astar Network, continued to grow significantly, rising 25.4% from the previous week and 88.4% from the previous month.

Aster (ASTR), which is preparing for an upgrade roadmap called Astar 2.0, has continued to soar intermittently since its listing on South Korea’s largest company Upbit.

Under its “Asia Strategy,” Aster is promoting expansion into the Korean market, including strengthening relationships with partners and members, and the number of Korean communities has doubled since October last year, according to Upbit’s volume ranking. We reported that we were ranked high.

Current status of Astar in the Korean market

The number of community members has doubled since October

The number of community members has doubled since October The number of Discussions has increased, approximately 100 to 200 a day.

The number of Discussions has increased, approximately 100 to 200 a day. Ranked high in Upbit’s volume ranking (unit: Million KRW / 24h)

Ranked high in Upbit’s volume ranking (unit: Million KRW / 24h)

10/n pic.twitter.com/3jiciNcDdo

— Sota2.0@Astar Foundation (@Sota2_Web3) January 13, 2024

The number of ASTR holders has exceeded 640,000, and the “Total Value Locked (TVL)”, which represents the total amount of deposits into DeFi protocols, is approaching a record high.

We’ve surpassed 650K Holders!

We’ve surpassed 650K Holders!

With over 3.4 billion ASTR staked to projects!

What are the key drivers to our growth, you ask?

Easy! Various teams being incentivized to build on Astar have introduced some exciting new products, as well as activities for their supporters… pic.twitter.com/TxjrzhZYT0

— Astar Network (@AstarNetwork) January 17, 2024

Also the lock amount on Astar from 2022. All Time High is almost here. I think the team’s consistency in strategy and ability to see things through have been successful. https://t.co/5wRA7d8UaE pic.twitter.com/BJnTjUfIlt

— Sota Watanabe @Star Tale Lab (@Sota_Web3) January 17, 2024

connection:Ethereum’s new layer 2 “Astar zkEVM” announced, collaboration with Polygon

Bitcoin ETF special feature

We have introduced the “Heat Map” function to the CoinPost app for investors!

In addition to important news about virtual currencies, you can also see at a glance exchange information such as the dollar yen and price movements of crypto asset-related stocks in the stock market such as Coinbase.

■Click here to download the iOS and Android versions

https://t.co/9g8XugH5JJ pic.twitter.com/bpSk57VDrU

— CoinPost (virtual currency media) (@coin_post) December 21, 2023

Click here for a list of past market reports

The post Bitcoin weekly is weak as correction continues, Astor (ASTR) is rising 25% compared to the previous week appeared first on Our Bitcoin News.

1 year ago

155

1 year ago

155

English (US) ·

English (US) ·