The post Bitcoin Whale Activity Suggests a Price Plummet Ahead appeared first on Coinpedia Fintech News

Bitcoin made its second attempt to break free of the $68,300 resistance and faced rejection one more time. However the price is stable and BTC is trading around $67,670. A lot of whale movements have been detected after months which raises some concerns. Let’s explore what is happening in the market and what we can expect of it.

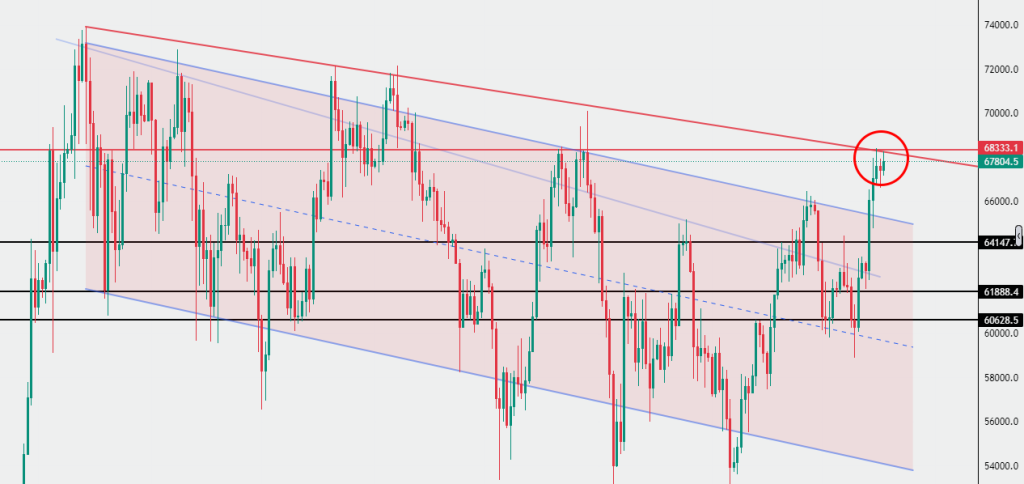

The Chart Analysis

The Bitcoin daily chart shows that the crypto is facing a massive resistance at the current level. A number of new resistance factors have appeared in the chart since March this year barring the price to move up.

The hourly chart shows that after facing rejection from $68,300 the largest received support from the $66,650 level. MACD histogram shows weakened buyers and was recorded at 63.7. On the other hand, RSI is also in a correction state. It however also shows a diversion which indicates towards an upcoming price fall. To adjust with this diversion, the price might have to retrace back to the $65,000 area.

The Whale Activities

According to data from the on-chain data platform Santiment, a lot of whale activities have been recorded in the past two days. This surge in big holders’ activities is the highest in over 2 months. The platform shared its findings in an X post. Its data shows around 11,697 whale transactions that exceed $100k in value each.Such kind of Bitcoin whale activity has not been witnessed since the Japan stock market crash on August 4. This sudden rise in whale activity hints at something big coming.

On the other hand, Coinglass whale activity tracker shows that big account holders have their shorts open for btc at and above this level. The highest intensity of these high value shorts can be seen around $68,500, $69,000 and at $69,500. This gives a clear idea of why bitcoin is unable to break past the $68,300.

What to Expect?

Although the community is expecting a high surge in bitcoin price, the data says otherwise. As stated earlier that the RSI is hinting at a price fall for the correction, the whales may also take out some profit. If this happens, it can create a dominos effect that could plummet the btc price. The area above this zone is all filled with difficulties. It would be interesting to see if Bitcoin can pass these or will get trapped.

1 month ago

31

1 month ago

31

Bitcoin's whale transactions have spiked to their highest level in over 10 weeks, with 11,697 $100K+ transfers on the network Tuesday, and Wednesday on pace for a high mark as well.

Bitcoin's whale transactions have spiked to their highest level in over 10 weeks, with 11,697 $100K+ transfers on the network Tuesday, and Wednesday on pace for a high mark as well. Additionally, conversations across social media have veered heavily toward BTC over…

Additionally, conversations across social media have veered heavily toward BTC over…

English (US) ·

English (US) ·