The post Bitcoin Whale Buys Big as Price Struggles at 200 EMA, Bullish Signal or What? appeared first on Coinpedia Fintech News

In the current bearish market sentiment, Bitcoin’s (BTC) price facing strong resistance from the 200 Exponential Moving Average (EMA) on a daily time frame. Amid this struggle, a whale wallet address “3G98jS” found this as a perfect opportunity and purchased over 322 BTC worth $19 million from Binance, as reported by an on-chain analytic firm Eyeonchain.

Whale’s Aggressive BTC Accumulation

With this recent purchase, the whale’s BTC holding increased to 8,881 coins worth $523 million. However, since the BTC price has been struggling to break this 200 EMA for the last six days, this whale has added over 2,322 BTC worth $136 million, during the same period. This shows that it is an ideal buying level for investors.

In addition to the recent accumulation, whales and sharks have purchased over 133.3K BTC from retail investors who sold in a panic over the past few weeks, as reported by CoinPedia on August 29, 2024.

Bitcoin Technical Analysis and Key Levels

According to expert technical analysis, BTC is in a downtrend and currently experiencing strong resistance from the 200 EMA. Meanwhile, its Relative Strength Index (RSI) is in an oversold territory, indicating a potential trend reversal.

Source: Trading View

Source: Trading ViewBased on the price action, if BTC breaks out of the current resistance level and closes a daily candle above $59,700, there is a high chance Bitcoin’s price could soar to the $61,500 level.

Bullish On-Chain Metrics Support Positive Outlook

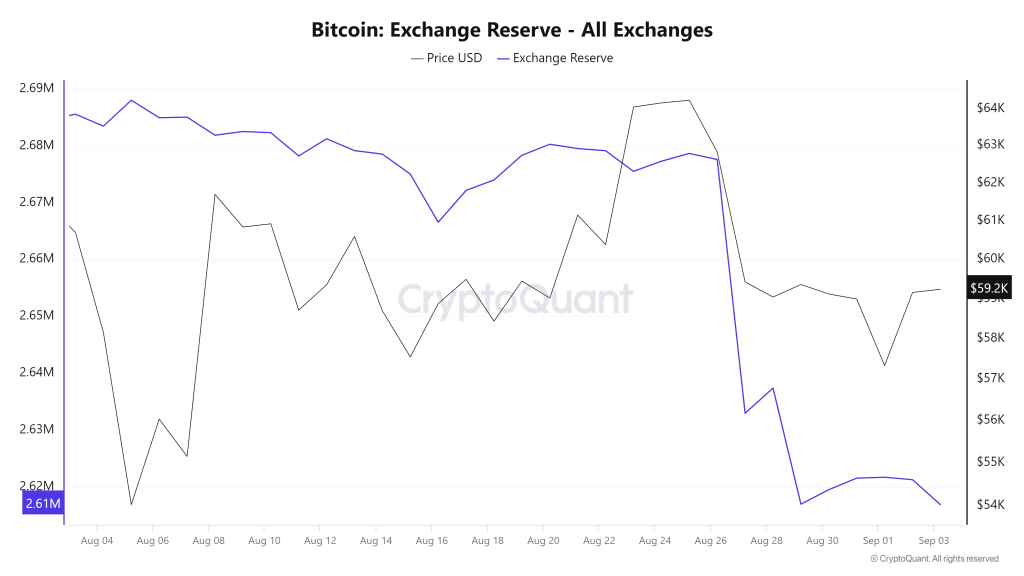

As of now, the BTC’s on-chain metrics indicate a bullish signal. According to the on-chain analytic firm CryptoQuant, BTC’s exchange reserve metric signals a bullish outlook, currently at its lowest level in the last 30 days. This metric also suggests an ideal buying opportunity.

Source: CryptoQuant

Source: CryptoQuantAdditionally, another on-chain metric named BTC exchanges inflow, is also at its lowest level, indicating a potential buying signal.

At press time, BTC is trading near the $59,000 level and has experienced a price surge of over 1.25% in the last 24 hours. Meanwhile, its open interest has jumped by 1.15% during the same period, suggesting growing demands from investors amid price decline.

11 months ago

44

11 months ago

44

English (US) ·

English (US) ·