Virtual currency market this week from 2/1 (Sat) to 2/17 (Fri)

Mr. Hasegawa, an analyst at the major domestic exchange bitbank, illustrates this week’s bitcoin chart and analyzes the future outlook.

table of contents

- Bitcoin on-chain data

- Contributed by bitbank

Bitcoin on-chain data

Number of BTC transactions

Number of BTC transactions (monthly)

Number of active addresses

Number of active addresses (monthly)

BTC mining pool remittance destination

Exchange/Other Services

bitbank analyst analysis (contribution: Yuya Hasegawa)

Weekly report from 2/1 (Sat) to 2/17 (Fri):

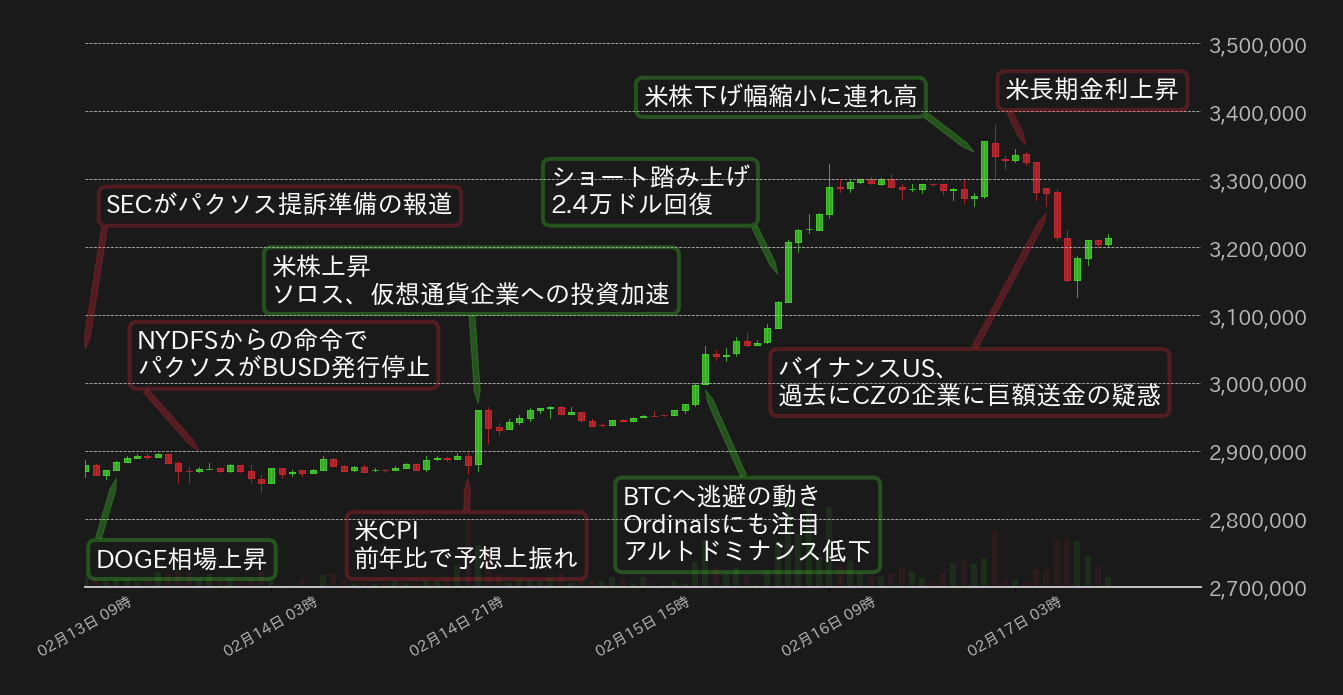

This week’s bitcoin (BTC) vs. yen exchange rate rebounded, recovering 3 million yen. The dollar-denominated price briefly touched the high of last August ($25,200 ≒ 3.38 million yen).

Following last week’s settlement of Kraken with the U.S. Securities and Exchange Commission (SEC), reports that the SEC is preparing a lawsuit against stablecoin issuer Paxos weighed its topside around 2.9 million yen. Although it was BTC, it was expected to recover by 2.9 million yen due to the rise in the Dogecoin (DOGE) market at the beginning of the week.

On the other hand, on the same day, the NY Financial Services Authority issued an order to Paxos to suspend the issuance of Binance USD (BUSD).

On the 14th, amid concerns about a slowdown in the pace of inflation, the US Consumer Price Index (CPI) for January was announced, and the year-on-year comparison exceeded market expectations, prompting the BTC market to temporarily test its lower price. However, the rise of US stocks and the disclosure of documents to the SEC that George Soros’ funds had increased their exposure to cryptocurrency-related companies led the BTC market to rise again.

In addition, while the SEC is tightening regulations on coins, there is a movement to escape funds to BTC, which is the only “product” certified by the committee, and a small amount due to the influence of the Bitcoin NFT project, Ordinals. The increase in the number of addresses holding BTC has been favorably received, and the market price has recovered to 3 million yen.

On the 15th (US time), the pair followed up with the liquidation of the short market, and touched 3.3 million yen.

On the 16th, US time, the US Producer Price Index (PPI) in January exceeded market expectations, and although there was a time when the top price was slightly heavy, US stocks, which were cheap, narrowed the range of decline. One touch to 3.38 million yen with a tailwind.

However, as a result of this, the US dollar-denominated US dollar touched the high of August last year, and the rise slowed down due to the sense of achievement of the target. In addition, Reuters reported that 53.7 billion yen in funds from Binance US had been transferred to a trading firm operated by CZ in 2021, accelerating the decline of the market.

[Fig. 1: BTC vs Yen chart (1 hour)]

Source: Created from bitbank.cc

As expected, the pace of deceleration in the US CPI slowed down, but the BTC market made unexpected price movements.

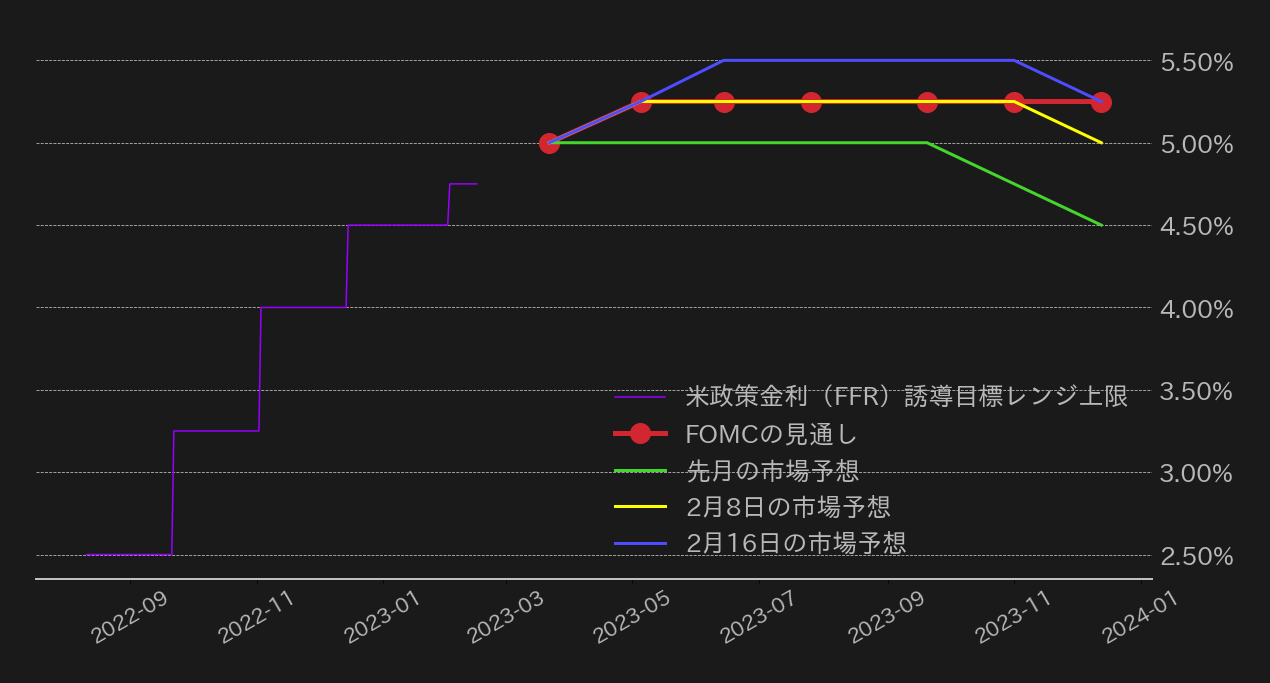

However, the US long-term interest rate, which has returned to its highest level in two months, puts pressure on the topside, and Wednesday’s rise turned out to be a bull trap. Bitcoin quickly regained its dominance as the SEC accelerated its crackdown on the industry, but amid growing speculation that the US Federal Reserve (Fed) will continue to raise interest rates until June. BTC’s upside will be limited.

On the other hand, this week saw a significant revision to the rate outlook for the federal funds rate futures market. The market remained more optimistic than the FOMC forecast last December, but the majority outlook as of Wednesday was more hawkish than the FOMC forecast last December. It is a thing.

Under these circumstances, the minutes of the January FOMC meeting will be released next week, but with inflation indicators remaining at a high level and NY Federal Reserve Bank President Williams indicating that there is room for an interest rate hike up to 5.5%, we should be able to withstand some surprises. I’m looking at it.

Given that January’s FOMC statement and Chairman Powell’s press conference were more dovish than ever before, next week’s agenda should pass without a hitch.

[Fig. 2: Upper limit of US policy interest rate target range, outlook for FOMC and futures market]

Source: Created from FRED and fedwatch

On the other hand, regarding SEC regulations, we need to continue to be vigilant next week, as the prosecution of Mr. Dou Quon of Terra Luna was reported today.

Although regulation of altcoins is certainly not directly related to Bitcoin, stablecoins play an important role in supporting market liquidity, and if regulation of prominent issuers continues, the market will continue to decline. Let’s get mentally worse.

The BTC/USD exchange rate failed to try its high in August last year, but it is currently supported by the base line of the daily Ichimoku Kinko Hyo, with a psychological milestone of $23,000 awaiting below.

While it has been pointed out that there is a lack of material to try to rise above again, it is pointed out that there are not a few market participants who are aiming for a dip in the market after Wednesday’s sharp rise. mosquito. If it fails to hold the same level, Wednesday’s rally will be halved and a full rally in sight.

connection:bitbank_markets official website

Last report:Alt-led Bitcoin drop, can a catastrophe be avoided?

The post Bitcoin, which reached a high in August last year, should be wary of worsening market sentiment next week | bitbank analyst contribution appeared first on Our Bitcoin News.

2 years ago

192

2 years ago

192

English (US) ·

English (US) ·