Predicting BTC to exceed $50,000 in January

Matrixport, a crypto asset (virtual currency) company founded by former Bitmain CEO Jihan Wu, predicts that Bitcoin (BTC) will exceed $50,000 (7.1 million yen) by the end of January 2024. ing. The first reason for this is that there is an increasing possibility that the SEC (US Securities and Exchange Commission) will approve the listing of a Bitcoin spot ETF in January next year.

Additionally, many ETF applicants will run TV commercials related to Bitcoin ETFs (exchange traded funds), which will be a factor supporting Bitcoin prices. Competition in the ETF market is expected to intensify over the Christmas period, with Bitcoin likely to reach $50,000 if a Bitcoin spot ETF is approved.

Against this background, it is noteworthy that Bitwise, a major US crypto asset management company, released a video on Bitcoin and ETFs on the 19th. The campaign will be widely promoted across television, social media and digital channels, including CNBC, Bloomberg and Fox Business Network.

connection:Is the race to promote Bitcoin spot ETFs starting in the US? Bitwise releases video advertisement

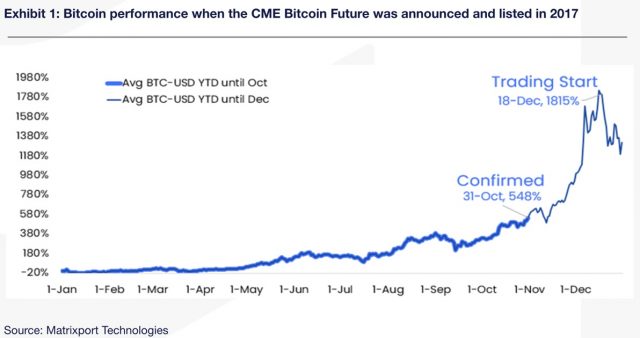

Looking back at 2017, Bitcoin rose 196% in the six to seven weeks immediately after CME Group and CBOE announced the launch of Bitcoin futures, exceeding $20,000 (approximately 2.1 million yen at the time) for the first time in history. did. It is possible that a similar scenario could occur even now.

Source: Matrixport on BIT

Matrixport originally predicted that Bitcoin would experience a correction period from December 8, 2023 until the end of the year. However, the current view is that “Bitcoin may break out (break through the resistance level)”. Historically, Bitcoin has risen an average of 3% between Christmas and New Years, with 2011, 2013, and 2020 seeing gains of more than 22%.

This prediction is based on the fact that many investors are investing in Bitcoin mining and related crypto stocks. Optimism about lower interest rates and lower yields have been a big boon for U.S. stocks. For example, the stock price of cryptocurrency exchange Coinbase (COIN.O) rose nearly 62% in November despite a drop in trading volume in the third quarter.

Source: Tradingview

U.S.-listed Bitcoin mining companies Riot Platforms (RIOT), Marathon Digital (MARA), and CleanSpark (CLSK) have risen 44%, 126.92%, and 137.24%, respectively, over the past month.

Bitcoin rose over 164% in 2023, marking its best annual performance since 2020.

connection:Expectations are rising for the Bitcoin halving, and investor interest captured by the BitBank survey

Bitcoin ETFs are not a threat to proxy stocks

Meanwhile, the stock price of business intelligence company MicroStrategy (MSTR), which holds 170,000 BTC, has increased by about 70% from $330 in October to $570 today.

“Bitcoin ETFs remain attractive and do not pose a threat to MicroStrategy’s stock,” CEO Saylor said in an interview with Bloomberg TV. The statement was intended to allay concerns that MicroStrategy’s stock, which has been seen as an alternative to Bitcoin ETFs, would become less attractive as an investment.

connection:“Bitcoin ETF is not a threat to the company’s stock” MicroStrategy Chairman Thaler

connection:

Learn about Bitcoin ETFs from the beginning: Explaining the advantages and disadvantages of investing and how to buy US stocks

We have introduced the “Heat Map” function to the CoinPost app for investors!

In addition to important news about virtual currencies, you can also see at a glance exchange information such as the dollar yen and price movements of crypto asset-related stocks in the stock market such as Coinbase.

■Click here to download the iOS and Android versions

https://t.co/9g8XugH5JJ pic.twitter.com/bpSk57VDrU

— CoinPost (virtual currency media) (@coin_post) December 21, 2023

The post “Bitcoin will exceed $50,000 by the end of January 2024” Matrixport predicts, based on the year-end sales season and the excitement of virtual currency-related stocks appeared first on Our Bitcoin News.

1 year ago

119

1 year ago

119

English (US) ·

English (US) ·