The post Blackrock’s Bitcoin Holdings Hit New Highs: Is This a Bullish Indicator for BTC? appeared first on Coinpedia Fintech News

Do you know how much Bitcoin Blackrock holds right now? It is not less than 354,208.7. In the category of ETFs, Blackrock’s iShares Bitcoin Trust is the one that holds the maximum number of Bitcoins. For the last six months, its On-Chain Holding has shown a steady rise. Is this an indication of the rising confidence of institutional investors in BTC? Let’s see what data communicates.

Bitcoin Holdings by Category

Among the major categories, the category of ETFs is crucial for the fact that it holds the highest number of Bitcoins. Of the 21 million BTC, it holds at least 5.202%. The category holds as many as 1,092,501 Bitcoins.

| Category | BTC Holdings (in Number) | BTC Holdings (in %) |

| ETFs | 1,092,501 | 5.202% |

| Countries | 516,336 | 2.459% |

| Public Companies | 333,249 | 1.596% |

| Private Companies | 359,638 | 1.713% |

| BTC Mining Companies | 57,996 | 0.276% |

| DeFi | 115,986 | 0.743% |

Blackrock Bitcoin Holdings: An Overview

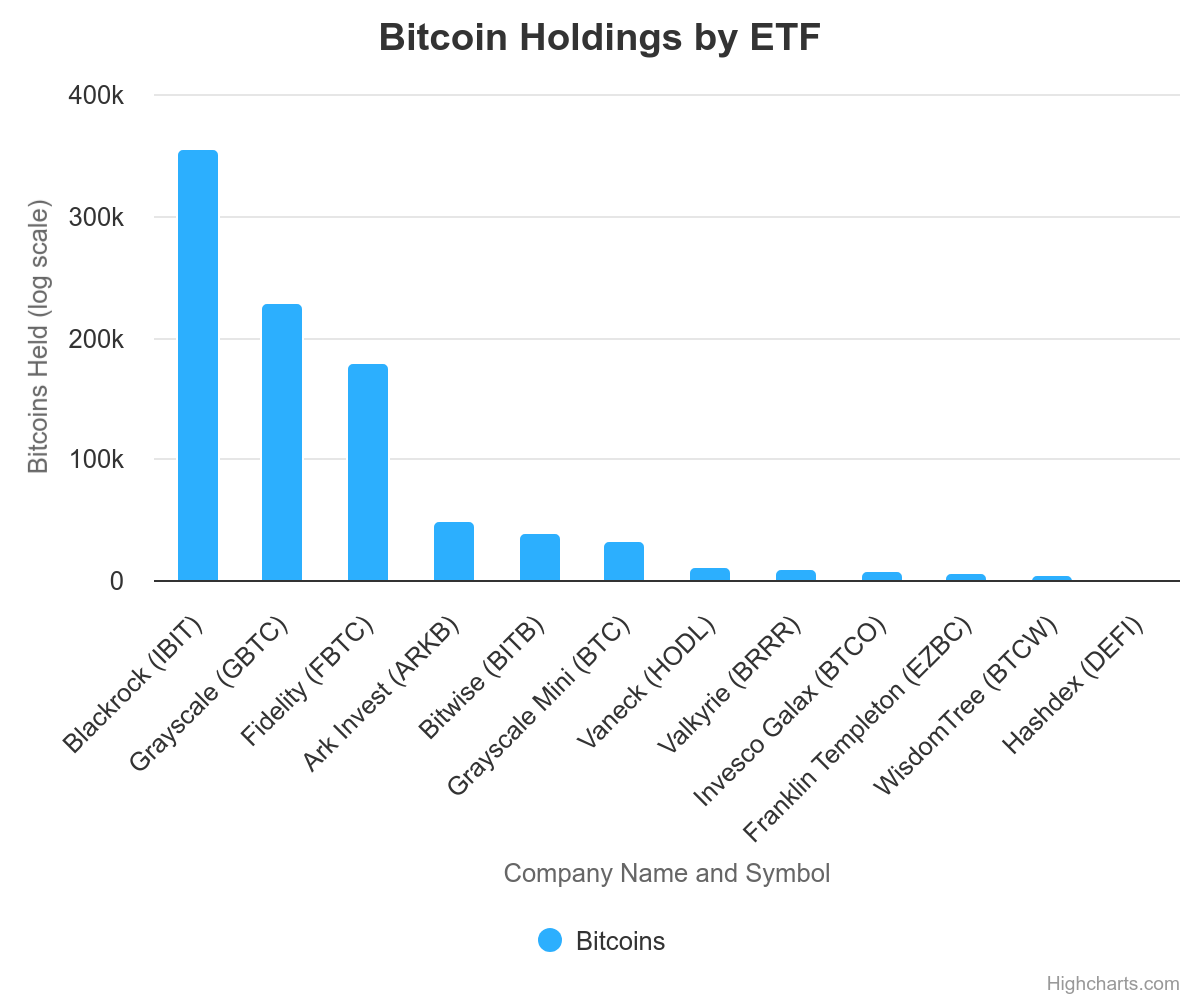

Blackrock is a prominent player in the ETF category.

It tops the list of BTC holdings in the category with at least 354,208.7 Bitcoins (that is at least 1.687% of the 21 million BTC).

Nearly 6 months before, on 26th February 2024, the On-Chain Holding of IBIT was just around 132,282 BTC. In early June, it crossed the mark of 289,058 BTC. In the beginning of this month, on August 1, 2024, it recorded 342,978BTC. And, you know now where it stands.

The data clearly shows an upward trajectory.

IBIT Spot Bitcoin ETF Flow Analysis

While analyzing the 3-month chart of the IBIT Spot Bitcoin ETF Flows, we can see some strong inflows. On 22nd July, an inflow of $526.7 million was recorded. Between 23rd March and 7th June, several inflows of above average intensity were witnessed. The strongest reported during that period was the inflow of $349.9 million registered on 6th June.

Let’s conclude. The aggressive Bitcoin accumulation of Blackrock can be regarded as the signal of increased institutional confidence in Bitcoin. There are chances that it will trigger an upward momentum in the BTC price, which now stands at $62.799.23 and has recorded a 30-day fall of 6.9%.

Also Read: Analyst Benjamin Cowen Suggests Shifting Focus to Ethereum Over Bitcoin

1 year ago

43

1 year ago

43

![Jupiter [JUP] surges amid 62% daily volume spike – Can bulls hold?](https://ambcrypto.com/wp-content/uploads/2025/08/Jupiter-Featured.webp)

English (US) ·

English (US) ·