iShares, an ETF (Exchange Traded Fund) brand provided by BlackRock, the world’s largest asset management company, announced on June 15 that the spot (cash) bit was approved by the U.S. Securities and Exchange Commission (SEC). Submitted documents regarding the formation of an ETF based on Coin (BTC).

Dubbed the iShares Bitcoin Trust, the fund’s assets “consist primarily of bitcoins held by custodians on behalf of the trust,” according to the filing. The custodian is the crypto asset exchange Coinbase.

The SEC has approved a number of futures-based bitcoin ETFs, but has rejected multiple bitcoin spot ETF applications from several asset managers, including Grayscale, VanEck, and WisdomTree. ing.

But this time things might be different. BlackRock is the world’s largest asset manager with more than $10 trillion in assets under management (AUM), and the company and CEO Larry Fink are collaborating with the SEC and Gary Gensler. Gary Gensler) has political power that probably rivals chairman.

“The proposed ETF will be benchmarked against the CME (Chicago Mercantile Exchange) CF Bitcoin Reference Rate,” said cryptocurrency exchange Kraken in a statement.

“CF Benchmark obtains its pricing data exclusively from cryptocurrency exchanges that adhere to the highest possible standards of market integrity and transparency. It is traceable and protects investors.”

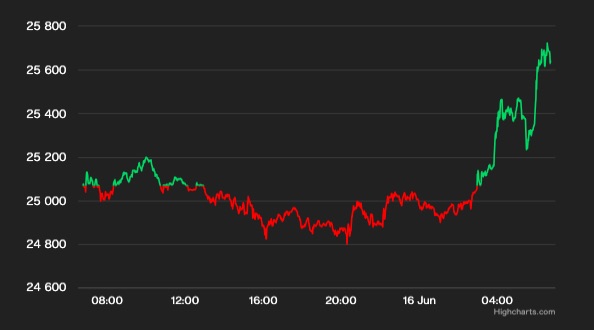

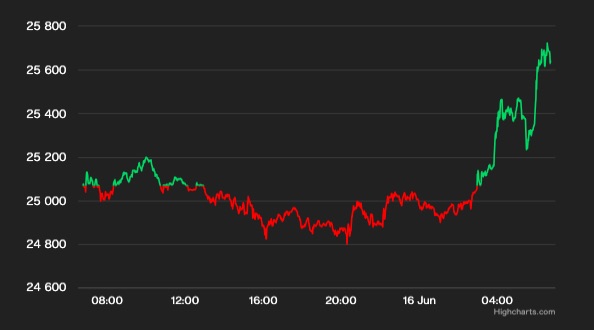

Bitcoin gained about 1% on the news and bounced back to just below $25,700.

CoinDesk

CoinDesk|Translation: coindesk JAPAN

|Editing: Takayuki Masuda

| Image: BlackRock Headquarters (Shutterstock)

|Original: BlackRock’s iShares Files Paperwork for Spot Bitcoin ETF

The post BlackRock, the world’s largest asset management company, applies for Bitcoin ETF ── Bitcoin rebounds to near $ 25,700 | CoinDesk JAPAN | Coin Desk Japan appeared first on Our Bitcoin News.

2 years ago

120

2 years ago

120

English (US) ·

English (US) ·