Coverdash, providing small businesses, e-commerce merchants and gig-economy workers with insurance, launched its product in all 50 states after closing over $2.5 million in seed capital.

The round was led by Bling Capital, with participation from investors, including AXIS Digital Ventures, Tokio Marine Future Fund (in affiliation with World Innovation Lab), Expansion VC and Cameron Ventures. A group of strategic angel investors also participated, including Greg Hendrick, CEO of Vantage Risk; Garrett Koehn, president of CRC Insurance; and Steve Shenfeld, president of MidOcean Partners.

The New York City-based insurtech was started by Ralph Betesh, David Vainer and Avery Rubin in 2022 to help smaller businesses source coverage in seconds and to provide an embedded technology so that partners working with businesses, like online marketplaces and service providers, can plug in Coverdash’s end-to-end insurance experience with a single line of code. The company secured 35 of these partners pre-launch, Betesh told TechCrunch.

Betesh, who started his career in insurance investment banking, said that large insurance carriers want those equally large policies to show top line growth to investors, so they often focus on big companies, and have done so for years now.

However, he saw a dynamic shift in the last two or three years of big carriers looking at smaller businesses “as a way to pick up fragmented premiums without necessarily having to go head to head with each other,” Betesh said. This is where many startups were successful in developing some niche approaches to solving the insurtech problem, and also attracting venture capital dollars.

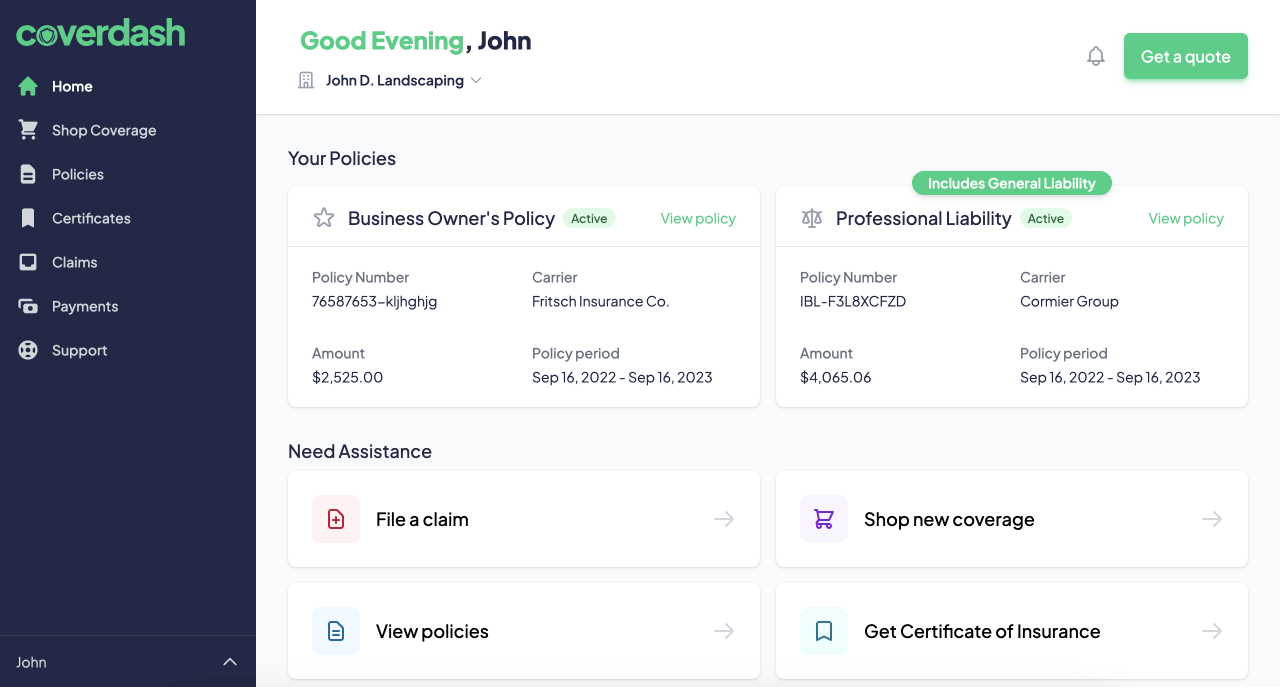

Coverdash’s insurance policy dashboard. Image Credits: Coverdash

Betesh himself began to look at what the process was for small businesses to get insurance and found, in his words, “a lot of clunkiness” and “murky” processes with no transparency. In addition, customers weren’t able to purchase policies without speaking to a human being.

“It just wasn’t the purchase experience that I would have expected,” Betesh added. “We felt like this wasn’t in alignment with small business expectations in the U.S., specifically tech-enabled small businesses.”

So the team set out to build a product that would make insurance accessible to small businesses of all shapes and sizes and one that was seamless and simple. It works with over a dozen carriers to offer policies including liability, property, workers’ compensation and cyber.

Here’s how it works: Customers come to the Coverdash site, and they can get a quote, bind policies together, pay for them and manage them in a matter of seconds. Betesh said there’s no redirection of the customer to a payment portal, a carrier portal or to speak to an agent, everything can be done through Coverdash.

Though the company is offering policies in a direct-to-consumer format, Betesh said the Coverdash’s future scale and revenue will likely come from policies sold through those partners that will embed its technology into their websites.

Meanwhile, the new funding will be used for go-to-market initiatives, product and technology development and hiring.

“The development and adoption of commercial insurance APIs within the insurtech industry has reached a tipping point, enabling innovative companies with the opportunity to drive true growth and transformation,” said Ben Ling, founder and general partner at Bling Capital, in a written statement. “We view Coverdash as the future of business insurance and embedded distribution.”

Bling Capital-backed Coverdash unveils its embedded, digital insurance for small businesses by Christine Hall originally published on TechCrunch

English (US) ·

English (US) ·