BONK has surged to a fresh weekly high as investor excitement grows around multiple bullish developments, including the highly anticipated launch of Tuttle Capital’s leveraged crypto ETFs.

The memecoin, which runs on the Solana blockchain, has been on a strong upward trajectory, gaining momentum from both technical breakouts and rapidly improving fundamentals.

Traders are now watching closely as BONK enters a potentially explosive phase, fueled by speculation, on-chain activity, and major institutional interest.

BONK ETF speculation boosts momentum

BONK’s rally has been supercharged after Tuttle Capital Management confirmed July 16 as the earliest possible launch date for its suite of 10 leveraged crypto ETFs, including a 2× BONK ETF.

The news has stoked bullish sentiment across the broader market, as leveraged ETFs tend to attract speculative capital and provide significant trading volume once listed.

If the ETFs go live as scheduled, BONK could receive a major liquidity injection and increased exposure to institutional traders, a rare milestone for a memecoin.

Technical analysis confirms breakout strength

The price of BONK is not only rising due to headlines but is also showing strength on the charts, with clear technical confirmation supporting the move.

On the daily chart, the token has broken out of both a falling wedge and a symmetrical triangle pattern, signalling a potential shift from consolidation to expansion.

The symmetrical triangle breakout, in particular, suggests a bullish continuation, with the current price targeting a move of roughly 37.81% towards the $0.000023 level.

Bonk price chart| Source: GeckoTerminal

Bonk price chart| Source: GeckoTerminalSupport is holding firm near $0.000013, while resistance at $0.000018 may serve as the final hurdle before a new leg up.

From a broader perspective, BONK has also broken out of a long-standing sideways accumulation zone on the weekly chart, aligning with an ascending trendline that has held since early 2024.

The price is currently holding above key weekly supports at $0.00000974 and $0.00001185, both of which previously acted as zones where bull traps emerged during failed rallies.

However, what sets the current rally apart is the increase in volume, suggesting that this breakout may carry more weight than past attempts.

Traders are also eyeing technical targets at $0.00003822 and $0.00017215, although these levels would likely only come into play if broader market conditions remain favourable and BONK continues to attract fresh interest.

Token burn adds more fuel

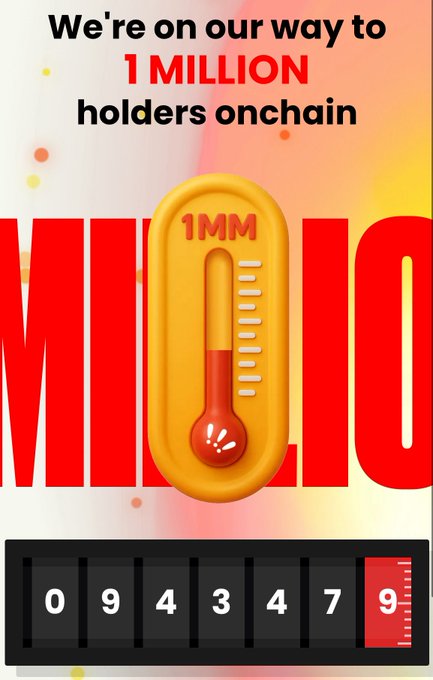

Another major development propelling BONK upward is the upcoming token burn set to take place once the project reaches 1 million holders.

Just a reminder: The Dog will be doing a 1,000,000,000,000 $BONK burn when this number hits 1,000,000👇

Currently sitting just above 943,000 holders, the memecoin is edging closer to this key milestone, which would trigger the permanent removal of 1 trillion BONK tokens from circulation.

Burn events are typically viewed as bullish because they reduce total supply, which can lead to stronger price appreciation if demand continues to build.

In BONK’s case, the convergence of technical breakouts, a nearing supply shock, and ETF-driven hype is creating a compelling short-term trading setup.

The post BONK hits weekly high as market prepares for Tuttle Capital’s ETF launch appeared first on Invezz

English (US) ·

English (US) ·