$2.3 billion worth of Ethereum (ETH) options contracts expire June 30 on major crypto derivatives exchange Deribit.

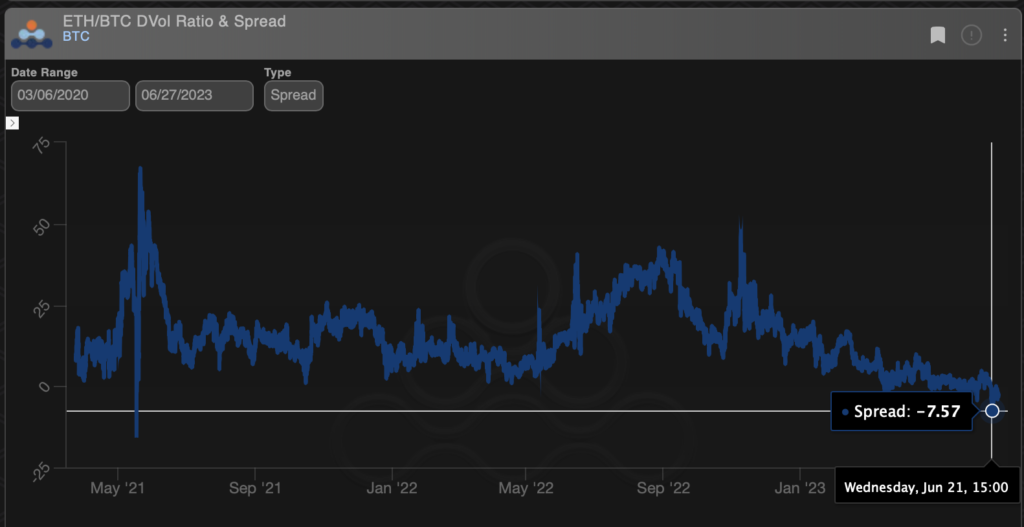

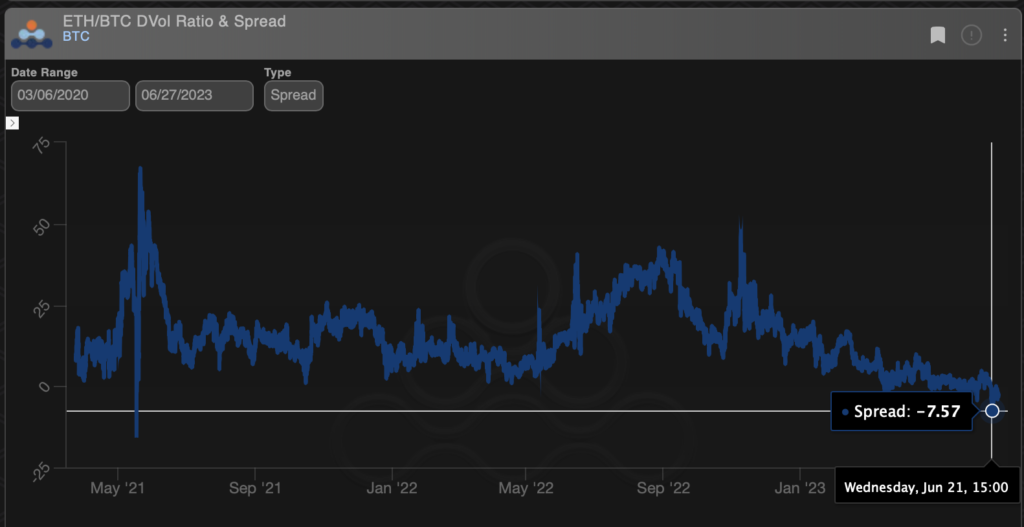

Ahead of this all-important quarterly settlement, Deribit has negative spreads between Ethereum (ETH DVOL) and Bitcoin (BTC DVOL) in the 30-day Implied Volatility (IV) Index.

According to Deribit, the negative spread, which indicates relative Ethereum stability, is due to increased institutional interest in “overwriting” or selling Ethereum call options. This dynamic movement creates the potential for significant market volatility around the 30-day expiration.

Overwriting involves selling or writing overvalued call options or strong derivative bets, usually against long-term buy-and-hold positions. This is a popular way to earn additional income on top of holdings in the physical market. Call sellers protect buyers from price increases in exchange for a fixed reward.

Since the beginning of the year, the market has seen a large flow of Ethereum overwriting, reducing implied volatility. Implied volatility (IV) is the price volatility that traders expect and is positively affected by demand for options.

Overwriting traders may roll over their positions as the June contract settles this Friday. In other words, a short position expiring on Friday could be unwound and moved to a July or September maturity. That could lead to a big shift in IV pricing in the Bitcoin and Ethereum markets.

“ETH has seen substantial selling (of call options) by institutional investors and these traders are called ‘ETH overwriters’ aka ‘ETH volatility selling whales’! Surprisingly, This led to a scenario where ETH’s DVOL (an implied volatility index similar to VIX) was lower than that of BTC,” Deribit Chief Risk Officer Shaun Fernando told CoinDesk. .

“As these substantive positions near expiry, it could lead to an attractive shift in volatility as participants consider rolling over positions,” Fernando added.

Spreads hit three-year lows last week (Amberdata)

Spreads hit three-year lows last week (Amberdata)The ETH-BTC DVOL spread was -2.5 at the time of writing, according to Amberdata, and hit a three-year low of -7.8 last week. Implied volatility (IV) represents a trader’s expectation of price volatility over a specified period of time and is positively influenced by option demand. A call option represents a bullish bet on the underlying asset and a put represents a bearish bet.

According to over-the-counter crypto liquidity network Paradigm, the ETH price is likely to remain in the $1800-1900 range, although the rollover could affect the ETH-BTC DVOL spread.

“Looking at the ETH dealer gamma towards expiry, we expect the $1800-$1900 strike to attract spots. The main reason is that there is more,” Paradigm said in its latest market forecast.

|Translation: coindesk JAPAN

|Editing: Toshihiko Inoue

| Image: Amberdata

|Original: Whale Drives Ether-Bitcoin Volatility Spread Lower Ahead of Options Expiry

The post BTC and ETH volatility indicators are in an unusual state due to whale movements | CoinDesk JAPAN | CoinDesk Japan appeared first on Our Bitcoin News.

2 years ago

117

2 years ago

117

English (US) ·

English (US) ·