Bitcoin traded sideways throughout early Monday after facing resistance around the $92,000 mark.

Most altcoins were in the green, with some prominent projects standing out as the biggest gainers among the top 100 cryptocurrencies.

Overall, the total valuation of the cryptocurrency market dropped roughly 3% to $3.14 trillion but had managed to recover above the $3.2 trillion mark at the time of publication.

BTC’s recent price action is currently being driven by retail traders, according to CryptoQuant analyst Ki Young Ju.

In an X post, the analyst cited that BTC transaction volumes under $100K have surged to a three-year high, with the $1K–$10K and $10K–$100K ranges seeing the biggest hikes.

According to Wu, this indicates increased retail activity that is currently moving the markets. In the current state, whales are less likely to offload their holdings as they would likely wait for “more exit liquidity.”

Wu added that retail FOMO could intensify as BTC approaches the $100K mark, potentially driving prices higher.

While he did not rule out the possibility of minor price corrections, he noted that it wouldn’t signal the “start of a bear market.”

Bitcoin’s rally during the early trading hours of the day followed news that MicroStrategy had purchased 51,780 Bitcoin for $4.6 billion over the past week, marking the company’s largest ever purchase to date.

However, the uptrend reversed, with the price dropping to $89,442 towards the end of the Asian trading session before surging back to an intra-day high of $92,653.

Analyst MMCrypto noted that the sharp rebound confirmed BTC’s breakout from a symmetrical triangle pattern, hinting at the potential for continued upward momentum.

Meanwhile, a crypto analyst with over 96,000 followers on X noted that price drops during the New York market open, as witnessed today, are often a bullish sign, as they tend to lead to a quick rebound driven by strong buying activity.

The current volatility is normal, according to Bitcoin commentator Josh Rager, who told his followers on X that bellwether crypto is “ranging and is very healthy after a 40% move up in just over a week.”

Adding to the bullish sentiment, trader Ali Martinez highlighted parallels between Bitcoin’s current trajectory and its 2020 price action.

Back in 2020, after breaking its all-time high of $19,700, Bitcoin rallied 26%, consolidated briefly, and then surged to $40,000.

This time, Ali continued, Bitcoin is up 28% since surpassing its previous all-time high and has been consolidating for the past six days.

If a similar pattern repeats, the analyst expects a potential breakout.

Overall, most analysts are eyeing $100,000 as the next target for Bitcoin in the coming weeks.

Estimates for when this milestone could be reached vary, with some predicting it could happen by the end of November, while others point to 2024 end or early 2025.

When writing, BTC had gained roughly 2% on the day, hovering above $92,000 as market volatility persisted.

The Crypto Fear and Greed Index, which gauges market sentiment, stood at 83, indicating extreme greed.

The top altcoins for the day that gained from this sense of euphoria prevailing in the market were:

Hedera (HBAR)

Hedera (HBAR) secured the largest gains of the day, rising 37.7% in the past 24 hours, bringing its market cap to $4.52 billion when writing.

Source: CoinMarketCap

The gains seen on Nov. 18 extended the altcoin’s fortnight gains to 179%, breaking past the $0.062 resistance level which HBAR failed to breach on two occasions since the end of July.

The price rally coincided with a jump in trading volume, which rose by almost 220%, hovering over $1.85 billion.

The major catalyst fueling Hedera’s rally was the recent announcement made by Canary Capital, which applied for an HBAR spot ETF.

ETF filings by major investment firms signal long-term positivity for Hedera, as they simplify access to HBAR for traditional investors and enhance its legitimacy and liquidity.

Another major news adding to the altcoin’s bullish outlook is the selection of Brian Brooks, a Hedera board member and former Binance US CEO, as a potential candidate to replace Gary Gensler as the next chairman of the U.S. Securities and Exchange Commission.

Mantra (OM)

Mantra (OM), the next leading gainer on this list, recorded 27.2% gains over the past day as its price surged from $3.44 to $4.38 at press time.

The RWA tokenization-focused altcoin has been one of the best-performing crypto assets among the top 100 cryptocurrencies over the past year, achieving gains exceeding 19,000%, which is over 125 times higher than Bitcoin’s gains during the same period.

Source: CoinMarketCap

OM’s latest rally came after its developers teased an upcoming announcement, sparking speculation of a potential partnership with a major company.

Another key factor fueling the altcoin’s price is the launch of its mainnet in October, which improved network security and enabled asset transfers at lower costs.

The community expects the blockchain network to become a leading player in the RWA sector as indicated by several social media posts.

Stellar (XLM)

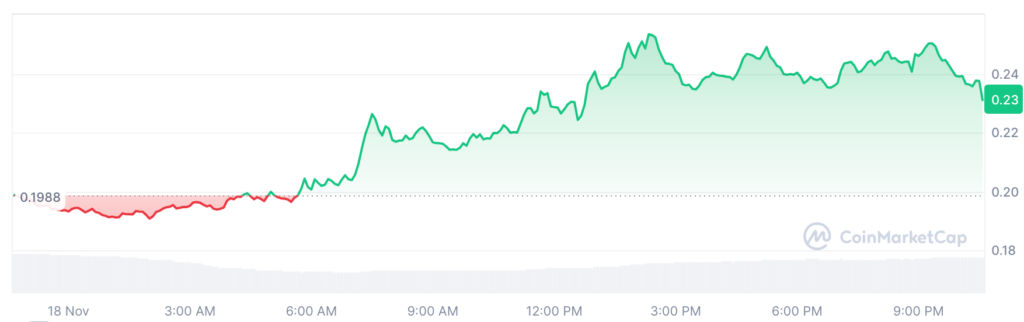

Over the past 24 hours, Stellar (XLM) climbed 20.7%, catapulting its market cap to over $7 billion when writing.

The altcoin has gained 148% over the last month, with the majority of gains coming after Donald Trump’s reelection as the United States’ president.

Source: CoinMarketCap

Notably, Stellar’s XLM was one of the cryptocurrencies deemed securities by the US SEC while filing a lawsuit against crypto exchange Coinbase in June last year.

XLM soared following Trump’s presidential victory, fueled by his promise to fire SEC head Gary Gensler on his first day in the Oval Office and replace him with crypto-friendly regulators.

The post BTC consolidates near $92K as retail trading intensifies; HBAR and OM surge appeared first on Invezz

English (US) ·

English (US) ·