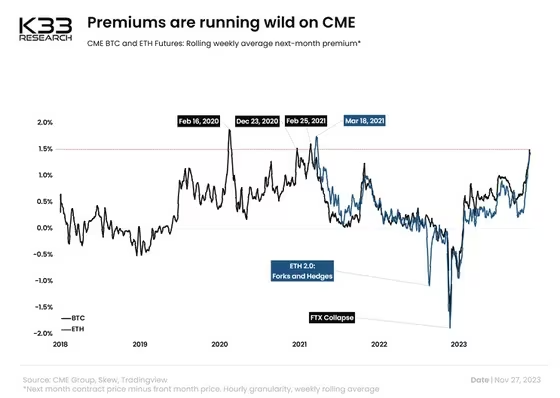

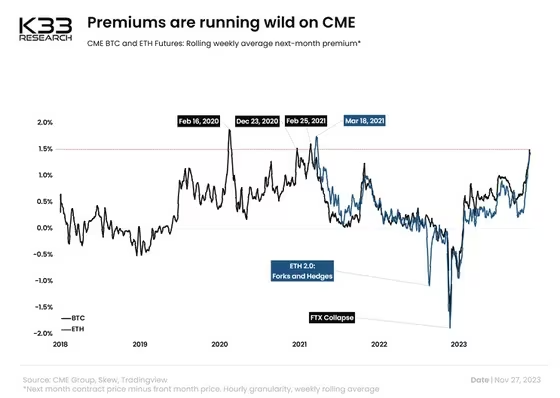

- The price spread between forward and near-term Bitcoin and Ethereum futures contracts widened last week to its highest level since 2021.

- Contango indicates bullish market sentiment.

An unusual pattern has recently emerged in the Chicago Mercantile Exchange (CME) futures market for Bitcoin (BTC) and Ethereum (ETH), indicating a strong investment trend with long positions in major crypto assets (virtual currencies). has been done.

Contango expands

A futures contract is a legal contract to buy or sell an underlying asset at a predetermined price on a specific future date, called the expiration date. Normally, futures markets are in a state of “contango.” Contango is a term used to describe futures prices rising more than spot prices, where futures with a nearer expiry date are priced higher than futures with a more distant expiration date. When buying pressure increases, contango often widens.

Bitcoin and Ethereum futures have recently found themselves in a similar situation, with so-called “near-term futures” contracts trading at a significant premium compared to “near-term” contracts, according to data from crypto market analysis firm K33 Research. However, this is a rare occurrence since 2018. Near-term contracts are those with a maturity closest to the current date, and futures contracts are those that will mature next.

“This speaks to very bullish sentiment in CME with a strong desire to add long exposure, leading to a sharp rise in yield premiums,” VetleLunde, senior analyst at K33 Research, told CoinDesk. I’m doing it,” he explained.

The size of CME futures is 5 BTC and 50 ETH respectively. At the time of writing this article, the contract expiring in December is the near-term contract, and the contract expiring in January is the future contract. The November issue has already expired on the 27th.

Rising premiums on term futures indicate bullish sentiment (K33 Research)

Rising premiums on term futures indicate bullish sentiment (K33 Research)The weekly rollover spread between futures and near-term contracts for Bitcoin and Ethereum recently widened to an annualized 1.5%, the first level since the bull market era of early 2021.

This pattern has only occurred four times before, three during bull markets and once a few weeks before the coronavirus crash in March 2020.

Runde said contango in both markets narrowed slightly on the 27th, but continued to suggest bullish sentiment.

“Yesterday we saw a significant reduction in contango, with 7,000 BTC worth of open interest being closed in the December contract, and Ethereum reaching its all-time high after building up last week after a similar pattern to Bitcoin,” Lunde said. The assumed open interest has been erased.” “Yield premiums continue to equate to double digits, meaning CME sentiment remains very bullish,” he said.

Possibility of unwinding of long positions

Pear Protocol founder Huf told CoinDesk that the recent contango expansion is due to bullish bets by traditional finance (TradFi) market participants. “This shows that traditional finance has long exposure, but not via physical. This is a very vulnerable positioning that will be resolved as we move higher towards the upcoming approval of physical ETFs. There is a possibility.”

Huff said rising futures premiums could revive interest in basis trading and cash-and-carry arbitrage. This strategy involves buying crypto assets in the spot market and selling futures at the same time. This strategy was one of the most favored strategies during the 2020-2021 bull market, allowing traders to capture a premium while avoiding price volatility.

|Translation and editing: Rinan Hayashi

|Image: Wance Paleri/Unsplash

|Original text: CME-Listed Bitcoin, Ether Futures Flash a Rare Bullish Signal

The post Bullish signal occurs in CME Bitcoin Ethereum futures | CoinDesk JAPAN appeared first on Our Bitcoin News.

1 year ago

61

1 year ago

61

English (US) ·

English (US) ·