The post Buy Signal For Bitcoin? BlackRock Adds 4,323 BTC appeared first on Coinpedia Fintech News

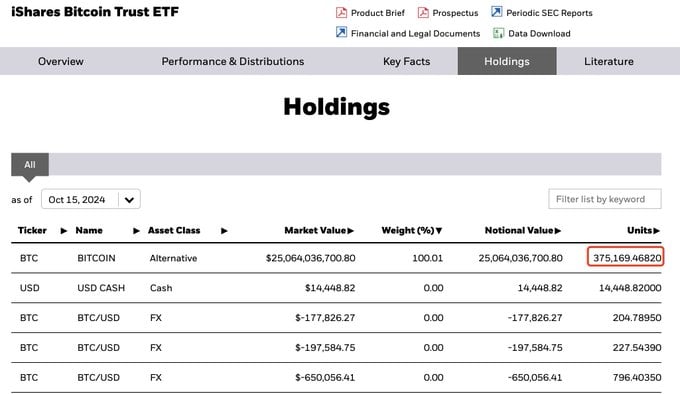

The world’s largest asset management BlackRock, has once again made a significant move in the cryptocurrency industry. On October 16, 2024, the blockchain-based transactions tracker Lookonchain made a post on X, stating that the asset management giant has increased its Bitcoin holding by 4,323 BTC worth nearly $293.41 million.

Source: X (Previously Twitter)

Source: X (Previously Twitter)BlackRock $293 Million BTC Purchase

This massive purchase follows the firm’s sale of 182 BTC, worth $11.34 million, on October 11, 2024, as reported by CoinPedia. However, BlackRock’s latest BTC purchase has sparked a bullish sentiment among investors and traders, as the asset approaches a strong resistance level where it previously faced significant selling pressure and a price decline of over 20%.

Bitcoin Technical Analysis and Upcoming Levels

According to expert technical analysis, BTC appears bullish but faces strong resistance at the upper boundary of the descending channel pattern. Since March 2024, BTC has reached this level nearly six times, each time experiencing a price decline.

Source: Trading View

Source: Trading ViewHowever, this time, sentiment has shifted. If BTC breaches the resistance level and closes a daily candle above the $68,800 level, there is a strong possibility that the asset could reach its all-time high and potentially set a new one.

Bullish On-Chain Metrics

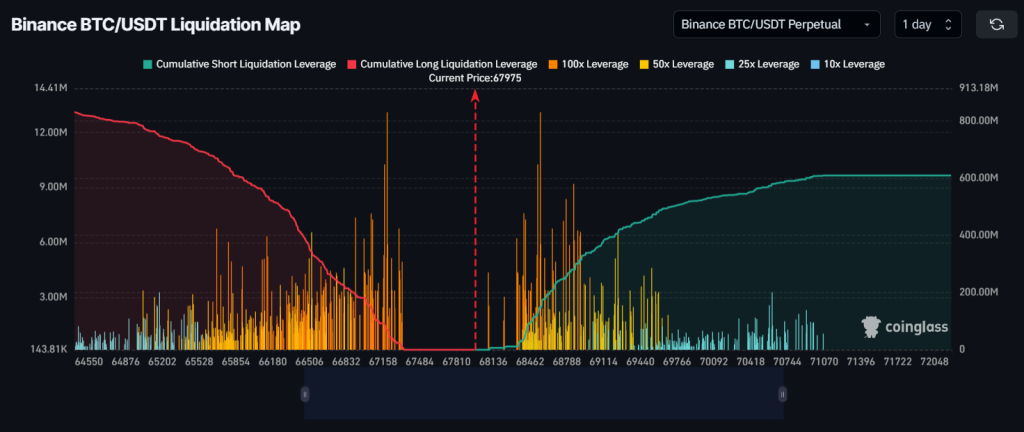

Bitcoin’s positive outlook is further supported by on-chain metrics. According to the on-chain analytics firm CoinGlass, BTC’s Long/Short ratio currently stands at 1.03, indicating bullish sentiment among traders. Additionally, its future open interest has jumped by 4.9% over the past 24 hours, signaling growing trader interest and a potential build-up of positions compared to the previous day.

Major Liquidation Levels

As of now, the major liquidation levels are at $67,300 on the lower side and $68,600 on the upper side, with traders being over-leveraged at these levels, according to the on-chain analytics firm CoinGlass.

If sentiment remains unchanged and BTC reaches the $68,600 level, nearly $568,400 worth of short positions will be liquidated. Conversely, if sentiment shifts and the price drops to $67,300, approximately $6.7 million worth of long positions will be liquidated.

While examining these liquidation data, it appears that bulls’ bets on long positions are significantly higher compared to bears’ short positions.

Current Price Momentum

At press time, BTC is trading near the $68,010 level and has experienced a price surge of over 1.7% in the past 24 hours. During the same period, its trading volume jumped by 12%, indicating higher participation from traders and investors compared to the previous day.

1 month ago

22

1 month ago

22

English (US) ·

English (US) ·