BuzzFeed Stock Soars

Following a report that US digital media company BuzzFeed plans to provide content using AI (artificial intelligence) technology of US OpenAI, the company’s stock price (BZFD) rose 119% from the previous day on the 26th (US time). soared. After hitting a high of $2.45 (318 yen) at one point, it closed at $2.09.

BuzzFeed will use AI technology developed by OpenAI to generate and personalize content such as online quizzes, The Wall Street Journal reported, citing anonymous sources. BuzzFeed confirmed to Reuters that it uses a public API instead of Open AI’s ChatGPT product.

BuzzFeed CEO Jonah Peretti said in an internal message this week that he expects AI to lead the way in content creation, personalization and animation in the next 15 years.

In 2023, AI-inspired content will be part of our core business from the R&D stage. Quiz content will be enhanced, brainstorming informed, and content personalized for users.

OpenAI released an interactive AI language model “ChatGPT” on November 30, 2010. In January 2011, IT giant Microsoft announced plans to invest 1.3 trillion yen ($10 billion) in OpenAI, attracting attention.

Relation:Microsoft invests 1.3 trillion yen in OpenAI, which develops “ChatGPT”

The Wall Street Journal reported on the previous day, 25th, that Meta signed a multi-year deal with BuzzFeed at the end of 2022. Meta will pay BuzzFeed $10 million (¥1.3 billion) for marketing and content creation for Facebook and Instagram creators.

AI Boom in Stock and Cryptocurrency Markets

BuzzFeed offers breaking news, journalism, quizzes, celebrity news, food, recipes, DIY hack videos, and more. The official YouTube channel boasts 20.2 million subscribers, and creates videos that have a great response one after another, such as “1 dollar street food around the world” and “$17 fried chicken vs. $500 fried chicken”.

The company raised about $20 million in Series B funding after graduating from the Y Combinator program in 2011. At the end of 2021, it will merge with a special purpose acquisition corporation (SPAC) and go public, raising a total of about $700 million (data: Crunchbase).

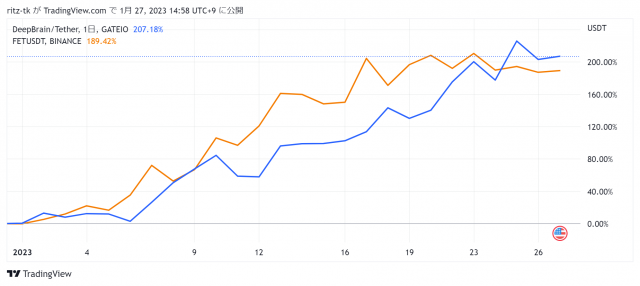

Source: Tradingview

BuzzFeed’s share price (BZFD) has fallen 44% over the past 12 months and is down more than 90% as of Jan. 25 from when it went public.

Net loss for the third quarter of 2022 expanded to $27 million (3.5 billion yen) from $3.6 million a year ago. In December, it said it would cut about 12% of its workforce to keep costs down.

Relation:2023, where we can expect technology fields such as AI ── US ARK Invest

In 2023, expectations for artificial intelligence are rising in the stock market, led by the major US hedge fund ARK Invest, and this trend is spreading to the crypto asset (virtual currency) market.

Source: Tradingview

Due to the popularity of “ChatGPT” on Twitter, etc., speculative buying of AI (artificial intelligence)-related crypto asset (virtual currency) tokens is also gathering. According to data from CoinMarketCap, FetchAI (FET) and DeepBrain (DBC) are up about 200% since the beginning of the year (as of January 27).

The post BuzzFeed Stock Soars 119% After OpenAI Content Boost appeared first on Our Bitcoin News.

2 years ago

170

2 years ago

170

English (US) ·

English (US) ·