The Malaysian Securities Commission has ordered Bybit trading firm and its business chief to end operations.

The media release highlighted that the exchange has operated in Malaysia without local certificates.

The Securities Commission Malaysia (SC) has reprimanded Bybit Technology Limited (previously known as Bybit Fintech Limited) (Bybit) and its CEO, Ben Zhou (Yuchen Zhou), for operating a digital asset exchange (DAX) in Malaysia without registration.

Bybit winds up services in Malaysia

According to the agency’s recent order, seemingly communicated to Bybit on December 11, 2024, the exchange should halt its mobile apps and website in the nation within two weeks.

Moreover, Bybit should ban all advertisements directed to Malaysian citizens and deactivate the Telegram support channel.

🇲🇾Malaysia’s Securities Commission (SC) has ordered cryptocurrency exchange #Bybit to cease operations within the country, citing the platform’s unregistered status as a digital asset exchange. Bybit is required to deactivate its website, mobile applications, and any other…

The regulator flagged Bybit’s regulatory compliance and investor protection.

The trading platform violated the Capital Markets & Services Act 2007 section 7 (1) by operating without the Recognized Market Operator license.

The Securities Commission added Bybit and CEO Zhou to the Investor Alert list for breaching similar regulations since July 2021.

Meanwhile, SC confirmed that the crypto company has complied with the directives.

The regulator urged Malaysian investors to use licensed platforms to avoid financial crimes such as money laundering. The agency added,

The public should alert the SC if they come across any suspicious websites or receive any unsolicited phone calls or emails offering unauthorized investment schemes, especially those that promise high returns with little or no risks.

Bybit confirmed SC’s enforcement through the Malaysian Telegram group, stating that users should brace for possible conveniences.

Meanwhile, the team promises to resume operations after securing the appropriate certificates.

Evolving European regulations

Bybit’s latest move to exit the Malaysian market comes as Europe’s comprehensive Markets in Crypto Assets regulatory framework takes shape.

The MiCA regulations, set to take effect on December 30, 2024, have shaken the crypto markets. Multiple firms have adjusted their offerings to comply with the new laws.

Further, Bybit left France in August 2024 amid stiffer licensing requirements.

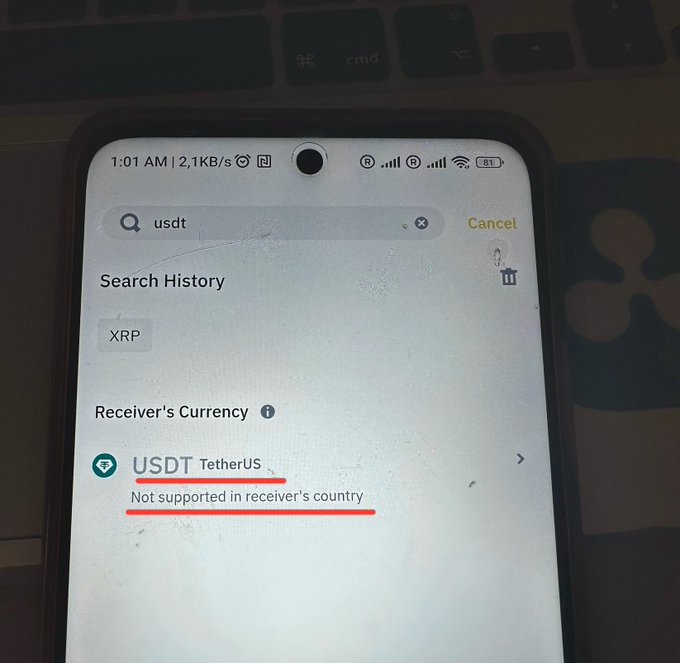

Also, Tether has struggled over the past months amid increased delisting as firms prepared for MiCA.

Coinmarketcap data shows USDT’s market capitalization has lost over $2 billion, from $140.5B to around $138B in a week – marking a significant dip after steady growth in 2024.

The new policy requires stablecoin issuers to have specific certificates to operate in the EU region.

Reports allege that Tether doesn’t satisfy the needed requirements.

That has forced multiple European exchanges to delist Tether USDT, signaling the expected regulatory clampdown.

In conclusion, the crypto space braces for significant shifts amid the evolving regulatory landscape.

Trading firms continue to adjust their operations as Europe’s MiCA framework goes into effect.

As regulatory developments unfold, staying updated remains crucial for investors.

The post Bybit halts operations in Malaysia after regulator’s order appeared first on Invezz

English (US) ·

English (US) ·