Web3 business creation

The Ministry of Economy, Trade and Industry announced on the 16th that the Cabinet has decided to add crypto assets (virtual currency) to the list of assets that investment business limited partnerships (LPS) can acquire and hold.

If this legal reform comes to fruition, Japanese venture capital firms (VCs) will be able to invest in projects that only issue virtual currencies. The move was welcomed by many in the industry, as it lowered the hurdles for Japan's Web3 companies to raise funds and conduct business.

wonderful~! !

To explain this simply, under Japanese rules up until now, VCs were not able to invest in crypto assets. Some projects only issue crypto assets without issuing stocks. (Astar, Oasy, etc.)… https://t.co/In6iNagzXm

— Hiro Kunimitsu (@hkunimitsu) February 16, 2024

LPS is a type of investment partnership formed for the purpose of investing in unlisted venture companies. It is common for VCs to invest in startup companies in the form of LPS, as they can invest with their liability limited to the amount invested.

Web3 companies would be able to start their businesses more easily if they were able to raise funds from VCs, but under the previous rules, when receiving investment from LPS, only stocks etc. could be handed over, and virtual currency could not be handed over.

According to the above post by Thirdverse CEO Kunimitsu, under previous laws, Web3 projects often had to raise funds from overseas VCs, which was a major barrier to entry. Mr. Kunimitsu expressed his hope that this Cabinet decision will be a major opportunity for many Web3 startup companies to emerge from Japan.

If this legal reform is implemented, there will be benefits for LPS as well. As the number of investors increases and Web3 companies grow, they will be more likely to benefit from the Web3 policy promoted by the government.

The Nikkei Shimbun reported on this rule revision in September last year. At the time, it was reported that the government would submit a bill to revise the LPS Act to the Diet in 2024.

connection: Attention from overseas: Japanese government to ease regulations on funding for virtual currency companies

The Ministry of Economy, Trade and Industry has announced that the “Bill for Partial Amendment of the Industrial Competitiveness Enhancement Act, etc. to Promote the Creation of New Businesses and Investment in Industry,'' which includes the above-mentioned contents, is currently under session. He explained that the bill will be submitted to the ordinary session of the Diet.

To realize your wishes

Overseas projects are also showing interest in LPS rule revisions. At the time of the above-mentioned Nikkei Shimbun report, there were voices of expectation that innovative Web3 projects could be born on a regular basis in Japan.

As with the tax system, industry groups and local governments have been requesting this rule revision for some time. For example, in December last year, the Japan Crypto Asset Business Association (JCBA) released its recommendations to the Ministry of Economy, Trade and Industry.

connection: Fukuoka City proposes deregulation of virtual currency companies = Cabinet Office

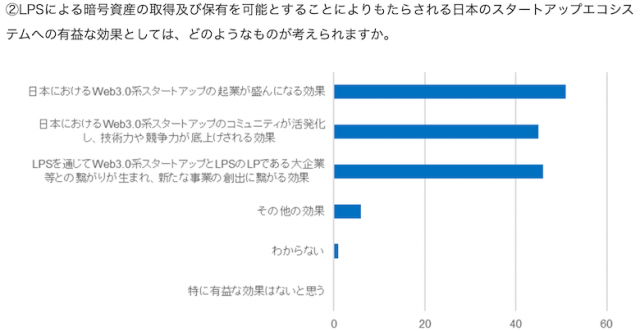

Before making recommendations, JCBA conducted a survey of VCs, Web3 startups, virtual currency exchanges, and law firms. At that time, we asked about the beneficial effects of the recent rule revisions. The results are as follows, and it is expected that Web3 businesses will become more popular.

Source: JCBA

At this time, JCBA proposed to the Ministry of Economy, Trade and Industry that LPS be allowed to operate the following businesses with the aim of promoting the Web3 business.

- Acquisition, holding and operation of virtual currencies (excluding those for the purpose of payment)

- Acquisition, holding and operation of NFT (non-fungible token)

- Acquisition and possession of virtual currency for the purpose of payment

- Acquisition and possession of electronic payment instruments

- Virtual currency lending

What is NFT?

Abbreviation for “Non-Fungible Token”, a digital token that is non-fungible and has unique value. Technology is used in a wide range of areas, including games, music, artwork, and various certificates.

Virtual currency glossary

Virtual currency glossary

connection: “NFT as a national growth strategy” interview with Liberal Democratic Party Digital Society Promotion Headquarters member Masaaki Taira

Japan's Web3 Policy Special Feature

The post Cabinet approves bill regarding LPS virtual currency acquisition to promote Japanese VC investment in Web3 companies appeared first on Our Bitcoin News.

1 year ago

118

1 year ago

118

English (US) ·

English (US) ·