The post Cadabra Finance Review. Explore High APY and verified Yield Sources On Cadabra: Join yield pools with ABRA token. appeared first on Coinpedia Fintech News

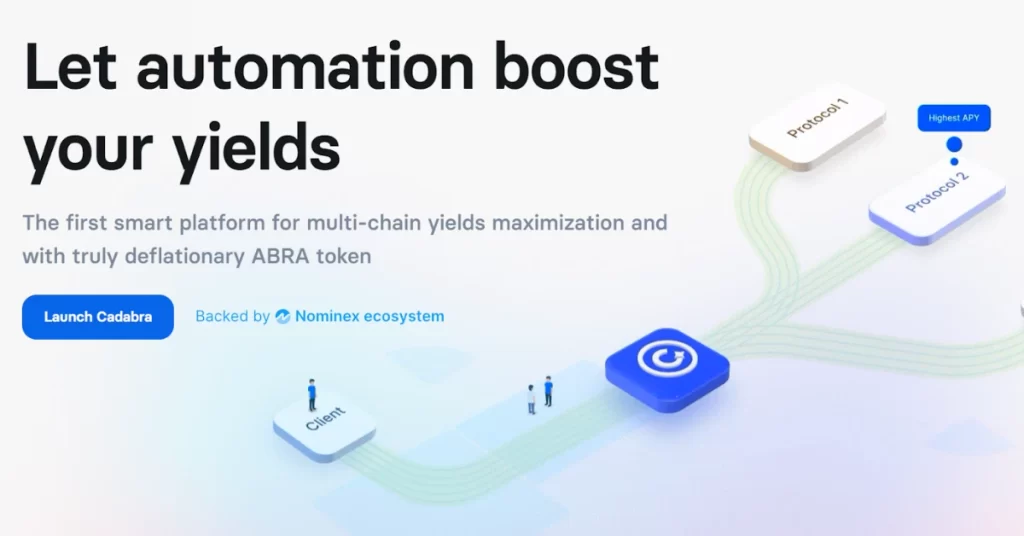

The world of decentralized finance (DeFi) is constantly evolving, offering new opportunities for passive income. Traditional yield aggregators often come with high risks, low stability, and minimal automation. Users are left manually managing their assets, risking losses in low-performing pools. Cadabra Finance addresses these challenges by introducing a platform that automates fund allocation, ensuring users maximize returns without the need for constant manual intervention.

However, with the many options available, finding a platform that combines high returns, security, and user-friendly features can be challenging. Cadabra Finance introduces a game-changing level of automation. No more laborious reallocation of assets or worrying about underperforming pools. Cadabra’s advanced algorithms automatically move funds to the most lucrative protocols, ensuring users enjoy a seamless and optimized earning experience.

The founders of Cadabra Finance are the creators and developers of CEX Nominex and DEX Nomiswap. In November 2023, these marketplaces generated a daily trading volume of $14.83 million. At the peak of its popularity, Nomiswap was the third most blocked funds (TVL) DEX in the Binance Smart Chain network.

Cadabra Offers

- Seamless Automation for Effortless Earnings:

Traditional aggregators demand manual effort in reallocating assets, prone to errors. Cadabra Finance automates the process, intelligently shifting funds to high-performing pools without user intervention, ensuring a hassle-free and optimized experience. All you have to do is choose a strategy that matches the level of risk you are willing to take.

- Dynamic Risk Management and Tailored Strategies:

Experience flexibility in risk management with Cadabra’s range of strategies catering to diverse risk appetites. Automated risk assessment ensures funds are directed to secure protocols, allowing users to tailor their investment approach with confidence.

Why Choose Cadabra Finance?

Cadabra Finance stands out as the best yield protocol in the crypto market due to its unique features:

1. Automation Advantage: Unlike competitors, Cadabra automates routine actions, such as rebalancing and compounding, ensuring that users don’t lose funds in low-performing pools.

2. Single Point of Entry: Cadabra offers a user-friendly experience, allowing investors to access multiple strategies with just a few clicks on the platform. There’s no need to navigate different networks or understand complex DeFi protocols.

3. Proactive Project Integration: The development team actively seeks and integrates new projects into strategies, saving users from the hassle of market analysis. Cadabra automatically redirects funds to the most profitable protocols, maximizing profits.

4. Cross-Chain Functionality: Cadabra’s cross-chain capability simplifies user experience. Users can invest in a strategy on one network while benefiting from projects on other networks, seamlessly facilitated by Cadabra’s automated processes.

How Cadabra Finance Works

The fundamental operation revolves around users depositing funds into the Cadabra strategy, which then autonomously allocates these funds within the selected strategy across different protocols. The user’s primary responsibility is to choose a strategy aligned with their risk tolerance.

A strategy is essentially a customized version of the widely used ERC20 token standard. When funds are deposited into a strategy, users receive a token in return, resembling the mechanics of liquid staking tokens.

To Simplify:

1. Your Share in the Strategy:

– When you deposit funds into Cadabra, you get a token in return.

– This token represents your stake in the assets managed by the strategy.

– It’s like a receipt, confirming your commitment to the pool with a specific amount.

2. Flexibility with Your Tokens:

– You can exchange these tokens for the actual assets of the strategy whenever you want.

– Your ownership is proportional – if you own 10% of the tokens, you own 10% of the assets in all the underlying protocols.

3. Choosing Strategies Based on Your Goals:

– Strategies are groups of projects where Cadabra allocates funds.

– You get to pick which strategies your money goes into and which protocols it’s distributed among before you invest.

– Strategies are categorized by risk, so you can find the right balance between return and risk (APY).

4. Automatic Actions to Maximize Profits:

– Cadabra takes care of two key actions: rebalancing and compounding.

– Rebalancing adjusts your investments among different sources to maximize profits based on changing market conditions.

– Compounding exchanges rewards for tokens and reinvests them automatically, using the 1inch liquidity aggregator for the best rates.

5. Withdraw Your Funds Anytime:

– You have the freedom to withdraw your funds whenever you like.

– Automated algorithms facilitate smooth liquidity transfers within approved protocols specified in the contract.

6. Transparent Updates and Options to Exit:

– New protocols are added with a time-locking mechanism, ensuring transparency about updates.

– You always have the flexibility to withdraw your funds if there’s something you’re not comfortable with.

In a nutshell, Cadabra simplifies the process of learning passive income in the crypto world. You choose your strategy, watch your investment grow automatically, and have the flexibility to adjust or withdraw whenever you want. It’s like having a smart investment assistant working for you!

Well Designed Tokenomics Is A Key To Stable Growth Of Token

In recent years, numerous DeFi projects have adopted a common tokenomics approach, enticing users with high APRs to provide liquidity and purchase the project’s tokens. However, this model often leads to a significant drawback: the token’s inevitable devaluation due to rampant inflation. It’s worth noting that Cadabra has developed tokenomics that benefits everyone: strategy users, ABRA token holders and long-term investors alike.

Cadabra Finance introduces a groundbreaking tokenomics model designed to anchor all rewards with tangible profits. ABRA tokens are used for almost all the main mechanics of the project, which allow you to receive additional rewards. In essence, the rewards obtained through strategies in the form of tokens from third-party protocols are strategically employed to perform buybacks of ABRA tokens, thereby exerting a positive impact on the token’s price.

Crucially, it should be emphasized that token issuance within Cadabra is a one-time event. The predetermined and finite total number of ABRA tokens stands at 13, 333, 337, and once this issuance is complete, no further tokens will be created. This unique approach ensures a controlled and sustainable token supply.

The project launch and trading of the ABRA token is scheduled for the end of November. The token will start trading immediately on the open market, where there will be no sellers as there was no pre-sale of tokens, and the team’s own tokens are locked for 3 months.

Cadabra Finance Referral Program: The Most profitable in Market

Cadabra Finance stands out with its distinctive referral program, offering rewards for both personal token locking and referrals at levels 1 and 2.

Rewards for Personal Token Locking:

When users lock ABRA tokens, they receive immediate “cashback” in the form of new ABRA tokens. The quantity of ABRA tokens awarded is influenced by the duration of the token lock. During the initial month after Cadabra’s launch, rewards escalate.

For instance, if you lock tokens for up to 1 year within the first two weeks, your uAPY (unlocking Annual Percentage Yield) will be 32. 20%, while waiting until the third week yields a uAPY of 27. 60%.

Rewards from Referrals (Levels 1 and 2):

Referral program participants earn a percentage of the tokens that their referred users receive for personally staking when they start using Cadabra through the referral link. All referral rewards are instantly paid.

The reward percentage is determined by the participant’s “rank, ” achieved through staking personal ABRA tokens, and is contingent on the token quantity.

Cadabra Finance’s referral program proves to be a lucrative incentive for both personal token locking and building a referral network.

For more detailed information, visit https://cadabra.gitbook.io/home/general/referral-program.

Conclusion:

In conclusion, Cadabra Finance redefines passive income in DeFi by offering a secure, automated, and user-friendly platform. With a team backed by successful crypto projects, a revolutionary tokenomics model, and a generous referral program, Cadabra Finance is positioned as a leader in the yield aggregation space. For those looking to optimize passive income with minimal risk, Cadabra Finance is undoubtedly a platform worth exploring and investing in.

1 year ago

129

1 year ago

129

English (US) ·

English (US) ·