The post Cardano (ADA) Price Prediction for February 25 appeared first on Coinpedia Fintech News

ADA, the native token of the Cardano blockchain, has experienced a significant price drop in the past 24 hours, reaching a crucial support level. As of today, February 25, 2025, ADA has dropped 13% and is currently trading near $0.67, while its trading volume has surged by 110%.

Cardano (ADA) Technical Analysis and Upcoming Level

According to expert technical analysis, ADA’s recent price drop has brought it to a crucial support level at the $0.65 mark. Historically, this level has acted as a strong price reversal zone. Additionally, ADA’s daily chart is flashing a bullish signal, as technical indicators show a bullish divergence over the same period.

Source: Trading View

Source: Trading ViewBesides this bullish divergence, ADA’s daily chart appears to be forming a double-bottom price action pattern on the daily timeframe. This bullish outlook suggests that ADA’s price could soon recover and experience notable upside momentum.

Based on recent price action and historical trends, if ADA holds above the $0.65 level, there is a strong possibility that the asset could soar by 20%, reaching the $0.84 level in the near future.

Mixed-Sentiment By On-Chain Metrics

Following a notable price drop and as ADA reaches a crucial support level, whales and long-term holders have been accumulating ADA tokens, according to on-chain analytics firm Coinglass. Data from spot inflow/outflow reveals that exchanges have witnessed a significant outflow of $22 million worth of ADA tokens.

Source: Coinglass

Source: CoinglassThis substantial outflow from exchanges suggests potential accumulation, which could create buying pressure and drive further upside momentum, a trend that the price has already begun to experience gradually.

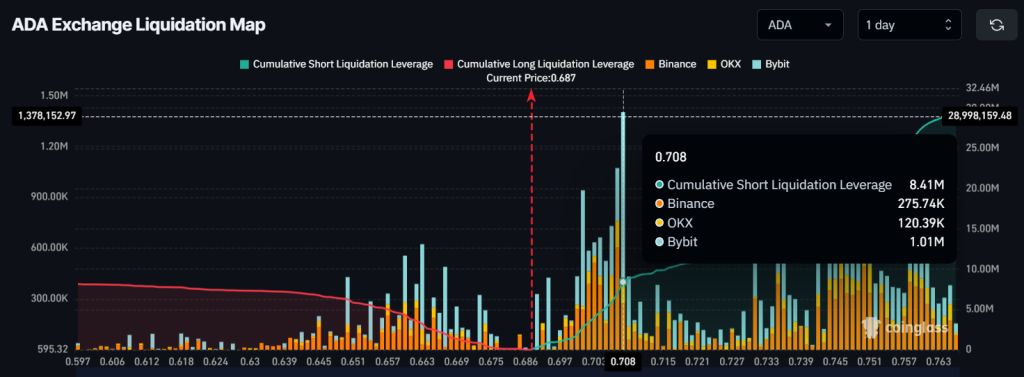

Despite the bullish market sentiment among whales and long-term holders, traders appear to be betting on the short side, expecting the price to continue declining in the coming days. At press time, the major liquidation areas are at $0.663 on the lower side and $0.708 on the upper side, with traders being over-leveraged at these levels.

Source: Coinglass

Source: CoinglassAdditionally, traders have held $3.25 million worth of long positions and $8.41 million worth of short positions at these levels. This data indicates that bears remain active and are currently dominating the asset.

2 months ago

54

2 months ago

54

English (US) ·

English (US) ·