The recent rise in alternative networks to Ethereum, such as Solana and Avalanche, is driving users such as crypto investors to other blockchains for returns and capital allocation. The Cardano ecosystem’s assets under custody (TVL) have increased rapidly over the past few weeks.

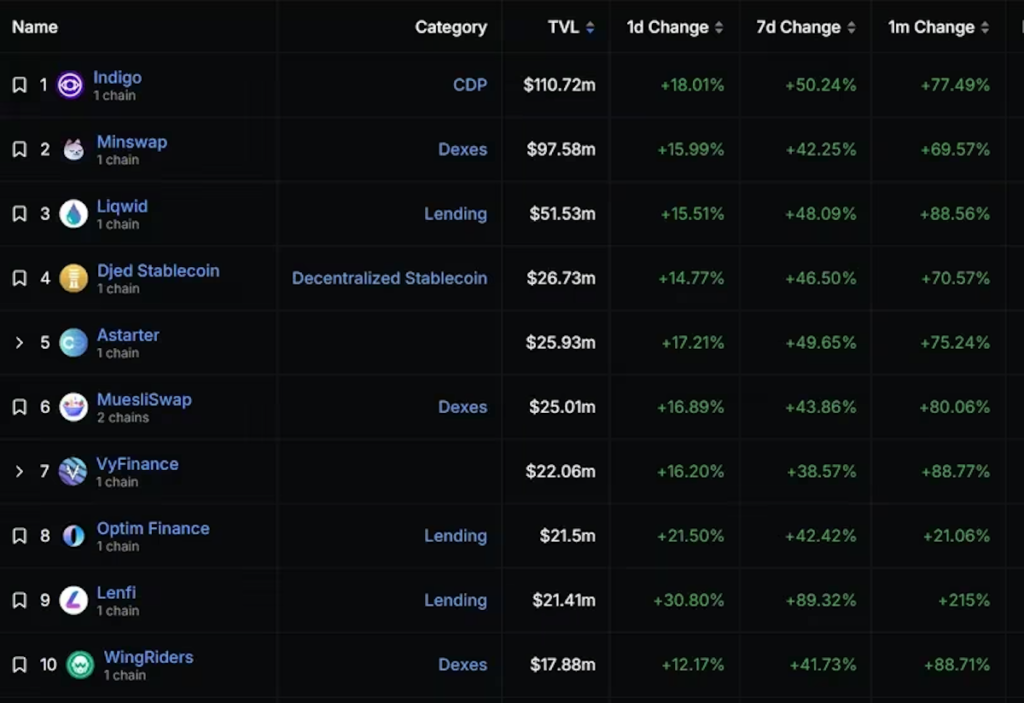

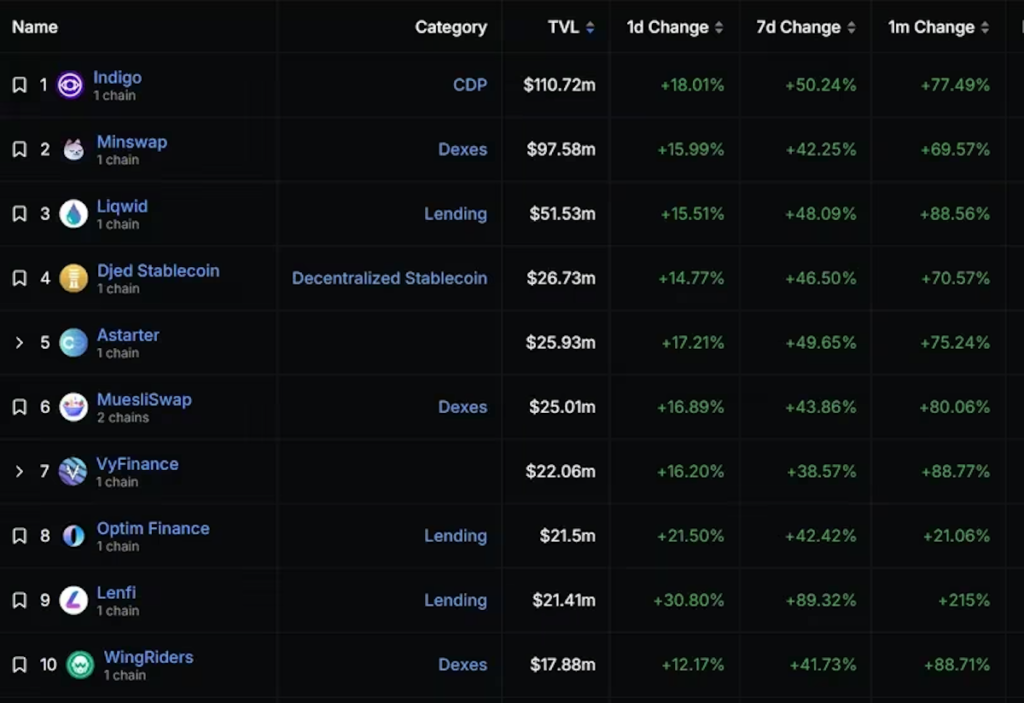

The total TVL of all Cardano-based projects exceeded $440 million (approximately 61.6 billion yen, exchanged at 140 yen) earlier this week, the highest ever recorded in April of $330 million. (approximately 46.2 billion yen). Most of the growth occurred in the last week, with lending protocol Indigo and decentralized exchange (DEX) Minswap each increasing their TVL by more than 50% to nearly $100 million.

Djed (DJED), a stablecoin pegged to the US dollar, has seen a supply increase of over 45% over the past week. This indicates that investors are putting capital into the token to take advantage of the yield.

Meanwhile, TVL for smaller protocols LendFi and Spectrum Finance is up 90%, suggesting users are starting to take riskier bets.

Cardano’s TVL has skyrocketed in the past 24 hours. (DefiLlama)

Cardano’s TVL has skyrocketed in the past 24 hours. (DefiLlama)This on-chain growth has driven up the price of Cardano (ADA), which is used to pay for network activity. Data shows the token has soared around 17% in the past 24 hours, extending its monthly rally to nearly 80%, while bets on leveraged futures against further movement in ADA price increased by 100% over the same period. did.

As such, Cardano’s DeFi ecosystem is rapidly rising alongside other blockchains.

The total amount of capital locked or staked across all decentralized finance (DeFi) protocols rose to a six-month high in early December, led by Solana, as optimism around blockchain has rebounded in recent weeks. It reached $50 billion (approximately 7 trillion yen).

|Translation: CoinDesk JAPAN

|Edited by: Toshihiko Inoue

|Image: Danny Nelson/CoinDesk

|Original text: Total Value of Cardano DeFi Ecosystem Nears $450M Amid Layer 1 Push; ADA Rockets 17%

The post Cardano’s TVL approaches $450 million ─ ADA rises 17% | CoinDesk JAPAN appeared first on Our Bitcoin News.

1 year ago

81

1 year ago

81

English (US) ·

English (US) ·