The price of Ethereum (ETH) has fallen due to the fact that Celsius, a cryptocurrency lending company that is undergoing bankruptcy proceedings and is undergoing restructuring, has unstaked the cryptocurrency, which is believed to be the cause of ETH’s slump in recent months. It could rise in the coming weeks as the company said it would remove factors that may have caused the stock to rise.

The company, which is transforming itself into a Bitcoin mining operator, previously said its activities would include staking. The company has also been selling staking rewards on the open market to cover costs related to its reorganization plan.

“Celsius will de-stake the ETH that has provided valuable rewards to offset certain costs incurred throughout the restructuring process,” the company said in a post to X. “Massive unstaking activity in the coming days will unlock ETH and ensure timely distribution to creditors.”

Celsius will unstake existing ETH holdings, which have provided valuable staking rewards income to the estate, to offset certain costs beginning throughout the restructuring process

— Celsius (@CelsiusNetwork) January 4, 2024

According to data from the analytical tool Arkham, crypto wallets linked to Celsius hold Ethereum worth $151 million (approximately 21.9 billion yen, equivalent to 1 dollar = 145 yen), with an annual interest rate of 4% to 5. It seems that they are earning a yield of more than %.

While staking rewards may not be the cause of large ETH sales, they may be contributing to negative sentiment towards the token, along with other factors such as interest in other blockchains.

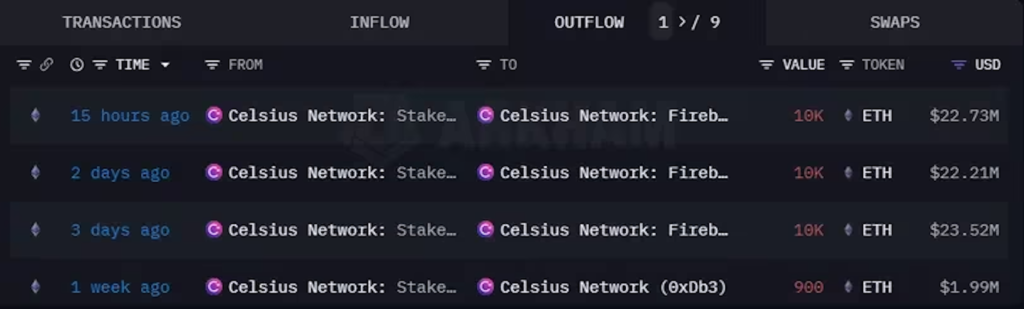

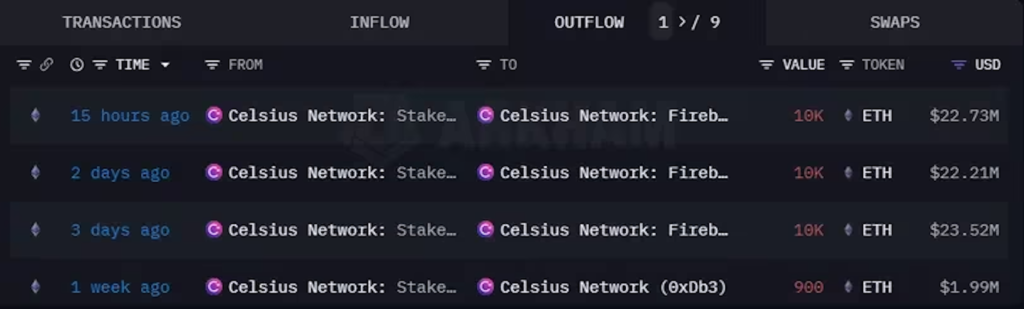

Meanwhile, Celsius sent more than 30,000 ETH to custodian Fireblocks in the past week, with some of it deposited at crypto exchange Coinbase, where it may have been exchanged for stablecoins. be.

Millions of dollars worth of Ethereum has been sent to custodians and exchanges over the past week. (Arkham)

Millions of dollars worth of Ethereum has been sent to custodians and exchanges over the past week. (Arkham)|Translation: CoinDesk JAPAN

|Edited by: Toshihiko Inoue

|Image: Shutterstock

|Original text: Celsius to Unstake Thousands of Ether, Possibly Easing ETH Selling Pressure

The post Celsius, which is undergoing reconstruction, unstakes its ETH holdings | CoinDesk JAPAN appeared first on Our Bitcoin News.

1 year ago

125

1 year ago

125

English (US) ·

English (US) ·