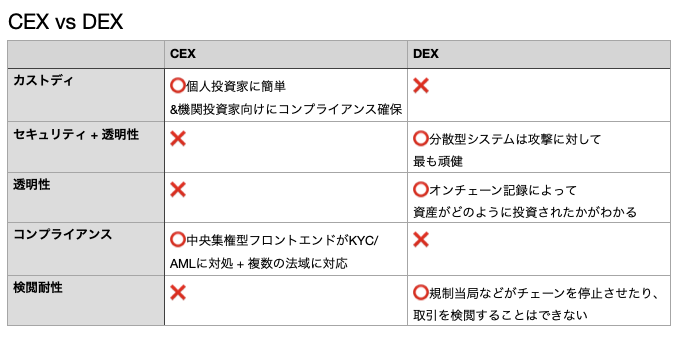

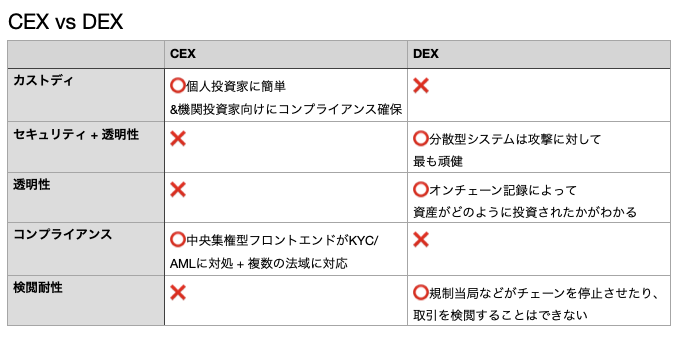

- Centralized exchanges (CEX) and decentralized exchanges (DEX) are often seen as competitors. But CEX could become complementary if it had a decentralized backend and enabled security, transparency and permissionless trading.

- A centralized front end is necessary for users who cannot or do not want self-custody. Not everyone uses DEX.

- On-chain transparency prevents issues related to asset misuse and confusion, including outright fraud.

- A centralized exchange (CEX) can perform KYC (know your customer) and AML (anti-money laundering), filter tokens, and implement compliance measures that are critical to your business.

- A decentralized exchange (DEX) will be a permissionless backend. No government can suspend or censor, whether for good or malicious reasons.

- With the infrastructure development, DEX is now able to handle assets on multiple chains – removing a major difference with CEX.

CEX and DEX complement each other

It is becoming clear that centralized exchanges (CEX) can no longer support the growth of crypto assets.

CEX has lost billions of dollars due to external attacks (Mt.Gox), internal asset abuse (FTX), and regulatory crackdowns (Binance and Coinbase). Decentralized exchanges (DEXs), on the other hand, can address all three of these issues.

Nevertheless, CEX remains essential for users who do not want self-custody and operators who need compliance. To meet those needs and protect itself from the threats it faces, CEX now needs a hybrid solution that incorporates DEX technology. Specifically, they need an on-chain smart contract layer as a backend to a centralized frontend.

Related article: Centralized exchanges (CEX) will not disappear

At the same time as these needs are new interoperable infrastructures that enable such integration. That’s why I argue that every CEX needs a DEX.

Basic knowledge of DEX and CEX

A few months after the Mt. Gox hack was made public, the first DEX has appeared. DEXs have gained popularity as a way to stay safe and away from CEX, which was considered a “honeypot” of tempting money for hackers.

In fact, according to data up to 2020, a total of $15 billion in cryptocurrency was stolen from CEX, including Mt Gox. But as CEX has evolved, the threat of such hacks has become much smaller. Currently, the trading volume of CEX is 10 to 100 times higher than that of DEX.

But of course, there are other threats besides hacking. In the case of FTX, executives mingled billions of dollars in client assets with their own money through sister hedge funds, which they eventually lost. Two of the biggest cryptocurrency exchanges, Binance and Coinbase, are facing an existential threat from the world’s most powerful financial regulators.

DEX provides strong protection against all three threats: hacking, fraud, and over-regulation by regulators.

And finally, it became possible to support functions that were previously exclusive to CEX. This means that any token on any chain can now be traded.

Binance quickly realized the potential of DEX and developed its own decentralized blockchain and DEX. OKX soon followed. Coinbase also announced that it will launch a Layer 2 blockchain called “Base”. The fact that major CEX is developing a distributed system speaks volumes. DEX is not necessarily a competitor of CEX, but rather complements each other.

Let me explain why every CEX needs a DEX (and every DEX needs a CEX).

Sergey Gorbunov/Axelar

Sergey Gorbunov/AxelarDEX is safe

Decentralization improves robustness against failures and attacks. This is also the principle that drove the early development of the Internet to make computer systems resilient to nuclear attacks.

The robustness of the decentralized approach is also demonstrated by the fact that the Bitcoin and Ethereum blockchains have stood the test of time and demonstrated reliability as a system.

A decentralized approach is the best way to protect the system from attacks and failures.

CEX is easy to use

DEXs are generally more robust than CEXs, but lack functionality, such as the inability to trade tokens issued on different blockchains. With the development of interchain infrastructure, DEXs can also handle token transactions on different chains, and scale horizontally to process transactions faster.

However, the core feature of DEX, which is decentralized, may be what keeps many users away. Not everyone wants to manage their own private key. Mass adoption, whether in user numbers or trading volume, will not be a reality without a (centralized) custodial onramp.

DEX transparency

Of course, one of the most successful custodial onramps is that FTX. Before its dramatic bankruptcy, FTX had been an astonishing success.

The problem was that there was no way for users to verify how FTX managed their assets. Users used to deposit their assets for trading and earning income, but they were used for investments like gambling and lost.

For DEXs, transactions are published on-chain. Users can verify the integrity of their assets and check how they are treated. Assets can still be mixed up, but it will be harder to hide them from users.

Not all transactions need to be recorded on-chain. However, if CEX and DEX are integrated, the DEX running on the backend will have visibility into where assets are stored and how they are being used each time the CEX frontend periodically makes payments to the backend blockchain. can be done. This means users can use Block Explorer to make sure their assets are safe.

CEX ensures compliance

DEXs require complex and fragile “oracles”, partly because it is difficult to integrate off-chain information. On the other hand, CEX makes it easy.

A centralized front-end can easily handle Know Your Customer (KYC) and Anti-Money Laundering (AML) processes, restrict listed tokens, and apply other filters mandated by regulations depending on the jurisdiction. or exclude some tokens. A single CEX with a DEX running on the backend can also build multiple frontends for different jurisdictions.

How a compliant user experience (UX) integrates seamlessly with a permissionless backend is up to individual exchanges. Perhaps we will offer different levels of permissionlessness depending on user requirements.

DEX is permissionless

Since its inception, crypto-assets (virtual currencies) have been embraced by users and developers as a way to protect themselves from governments that abuse or overuse their power. Governments have blacklisted bitcoin addresses, seized bitcoins, and tracked users, but no government has yet succeeded in shutting down the network.

A backend that inherits the nature of Bitcoin is unstoppable. The use of such systems will always be permissionless, i.e. without a gatekeeper. That’s why Bitcoin is used in both good and bad regimes, and by everyone from dissidents to criminals and simply law-abiding individuals trying to defend themselves against an incompetent government. It is

A decentralized backend serves a similar function for CEX. In other words, users are assured that the tools for processing transactions will be resistant to excesses of power, regardless of what governments do against exchange operators.

Composability, interoperability and horizontal scaling

For many true proponents, a decentralized exchange has always been a dream. Crypto-assets are decentralized and should be operated in a decentralized system.

Yet, in all the crypto craze, CEX has provided an on-ramp and leading experience for the majority of users. There are two main reasons.

- CEX, which has a database to process transactions, has high throughput and high speed. No need to validate transactions on a more robust decentralized network.

- Similarly, with a database intervening, CEX makes it easy to list various blockchain token pairs. On the other hand, DEX could only handle token pairs of the same blockchain. Even basic trading such as the ETH-BTC pair was not possible.

DEXs have changed in both respects as blockchain interoperability has improved. Cross-chain token swaps on DEXs are made possible by interoperability networks like Axelar, which handles “General Message Passing” between blockchains.

On the backend, similar cross-chain capabilities now allow any Web3 application to scale horizontally. DEX avoids congestion by developing a single application “app chain” dedicated to its own throughput, or by choosing a chain with high throughput. Such a mechanism can connect users, assets and applications hosted on other chains.

Interoperability opens up the possibility of continuous horizontal scaling. Applications can migrate to faster, newer blockchain technologies as they emerge. No need to ask users to migrate.

Finally, and perhaps most hopefully, having a DEX as the backend will allow CEX to collaborate with other developers to integrate functionality and features into new “super apps”.

In short, the day is fast approaching when the development of decentralized applications will become less of a challenge for blockchain infrastructure and more a matter of competitive advantage and ultimately survival.

|Translation and editing: Akiko Yamaguchi, Takayuki Masuda

|Image: Shutterstock

|Original: Every CEX Needs a DEX

The post Centralized Exchange (CEX) Needs Decentralized Exchange (DEX) | CoinDesk JAPAN | Coin Desk Japan appeared first on Our Bitcoin News.

2 years ago

96

2 years ago

96

English (US) ·

English (US) ·