Chainlink (LINK) ranks in the top 10

Chainlink (LINK), a decentralized oracle network, has gained about 30% over the past week. Its performance is outstanding even among cryptocurrencies ranked in the top 60 by market capitalization.

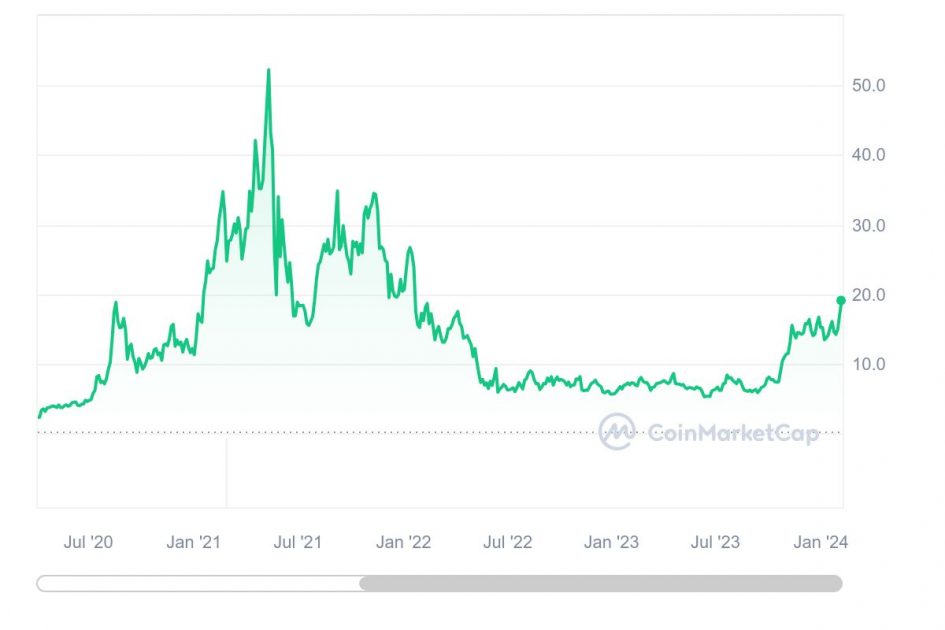

Source: CoinMarketCap

Over the weekend, the stock surpassed the $18 (2,674 yen) mark for the first time in almost two years, making a spectacular recovery from the low of about $5 recorded in June 2023. Its current market capitalization is approximately $10.4 billion (1.6 trillion yen), making it the 10th largest asset on the market. Currently, LINK is facing significant resistance at $20.

LINK was rated by K33 Research, a cryptocurrency analysis firm, as the safest option among stocks related to the “tokenization of real-world assets (RWA),” which is expected to attract attention in 2024.

In the trend of RWA (real asset) tokenization, DeFi (decentralized finance) protocol Pendle, which promotes the tokenization of US Treasury interest rates, has also seen remarkable growth, with a 26% increase compared to the previous week. Pendle’s total assets under management (TVL) have increased rapidly from $230 million at the beginning of January to $800 million.

“For traditional financial institutions to adopt blockchain and tokenized RWA at scale, they need data, compute, and cross-chain capabilities. Only the Chainlink platform provides these three.” , Chainlink emphasized in the official X.

connection:Why investors are interested in real asset tokenization and what is Real World Assets (RWA)?

Tokenization allows assets such as gold, stocks, and real estate to be treated as digital tokens on the blockchain. Tokenized RWA could be worth up to $16 trillion by 2030, according to a report by Boston Consultancy Group.

As the foundational infrastructure for DeFi (decentralized finance), Chainlink has built a bridge between blockchain and data in the outside world through oracles and extensive partnerships. Chainlink plays an integral role in the advancement of tokenization in capital markets, enabling the settlement of tokenized assets on public and private blockchains. It also supports communication between traditional finance and blockchain, helping to facilitate DvP (Delivery versus Payment), which coordinates the delivery of assets and payment of funds.

connection:What is the virtual currency Chainlink? Explaining how it works

Top 5 rising/falling stocks (compared to previous week, market capitalization within 100)

| Flare (+29.04%) | Jupiter (-64.28%)* |

| Pendle (+26.45%) | FTX Token (-34.56%) |

| Chainlink (+23.72%) | Manta Network (-19.50%) |

| Pyth Network (+20.04%) | SATS (-12.89%) |

| Render (+18.27%) | Bonk (-11.47%) |

The post Chainlink continues to grow and enters the top 10 market capitalization Trends in RWA tokenization appeared first on Our Bitcoin News.

1 year ago

68

1 year ago

68

English (US) ·

English (US) ·