2/1 (Thursday) morning market trends (compared to the previous day)

traditional finance

- NY Dow: 38,150 -0.8%

- Nasdaq: 15,164 -2.2%

- Nikkei average: 36,286 +0.6%

- USD/JPY: 147 -0.37%

- Microsoft: $397.5 -2.42%

- NVIDIA: $615.2 -2%

- Dreamcom: 894 yen +13.7%

The NY Dow and Nasdaq fell sharply today. It was the largest one-day decline since the start of 2024. Chairman Powell’s comments after the FOMC interest rate announcement were disgusting.

At the FOMC meeting early today, it was announced that interest rates would be left unchanged for the fourth time. The policy interest rate will be maintained in the range of 5.25-5.5%.

After the interest rate announcement, Chairman Powell indicated that the monetary tightening cycle that began in 2022 is largely over, but said, “Based on this meeting, I do not think there is a high probability of a rate cut in March.” This threw a damper on the optimistic scenario of the market, which was expecting an early interest rate cut in March.

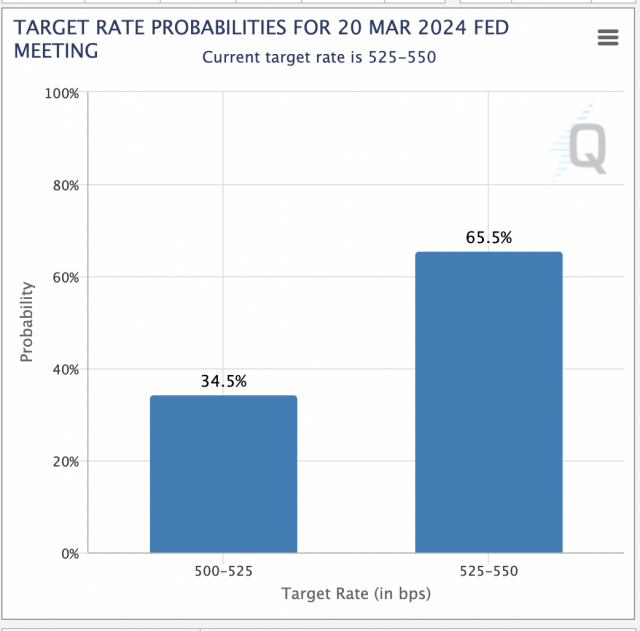

Following the chairman’s remarks, expectations for a March interest rate cut on CME’s FedWatch dropped from 40% yesterday to 34.5%. As of December 29 of last year, it was 73%, so expectations for a rate cut have fallen significantly.

Source: CME

The Fed chairman also said in a previous press conference that “the Fed stands ready to maintain the current target range for the federal funds rate for a longer period of time if we deem it appropriate.” Policy interest rates may continue to remain high.

US inflation continues to slow, as recent indicators have shown. The PCE core deflator, which the Fed focuses on, was +2.9% year-on-year in December, and appears to be slowly settling toward the 2% target. “We do not believe it would be appropriate to lower the guidance target range until we have more certainty.”

connection:What is the US financial policy meeting “FOMC” that attracts attention from investors around the world? | Easy-to-understand explanation

In an interview with CNBC, DoubleLine Capital’s Jeffrey Gundlach said, “Two important pieces of data will be released by March, but our inflation model does not predict further easing in some of the key inflation indicators.” “I haven’t seen it,” he said, predicting that the Fed’s first interest rate cut would be in June.

Today’s main market materials are as follows:.

- US January ADP employment statistics: Increased by 107,000 people, lower than the expected 150,000; reflecting the slowdown in the labor market.

- U.S. employment cost index (October-December 2023): Although it rose 0.9% from the previous quarter, it was the smallest increase since 2021; the Fed emphasizes this index as a clue to determining wage trends.

- The dollar rebounded against the yen at 147 yen after the early interest rate cut was postponed.

- Semiconductor and AI-related stocks such as AMD and Microsoft continue to fall following yesterday’s “unsatisfactory” financial results.

connection: AI/semiconductor stocks AMD and Microsoft fall after financial results | 31st Financial Tankan

connection:The reason why “Sumitomo Mitsui Card Platinum Preferred” is rapidly increasing in popularity as a new NISA savings investment

Important economic indicators/events from this week onwards

- 2/2 (Fri) 22:30 U.S. January unemployment rate

- 2/2 (Friday) 24:00 U.S. University of Michigan Consumer Attitude Index Final Values

- 2/8 (Thu) 10:30 China January Consumer Price Index (CPI)

- 2/13 (Tue) 22:30 U.S. January Consumer Price Index (CPI)

Special feature for virtual currency beginners

Cryptocurrency-related stocks fall

- Coinbase|$128.2 (-2%)

- MicroStrategy | $501.2 (-3.5%)

- Marathon Digital Holdings | $17.7 (-2.1%)

Cryptocurrency-related stocks started rising as Bitcoin returned to the $43,000 level, but turned into negative territory as US stock indexes fell due to position adjustments before the FOMC.

connection: “Long-term target for Bitcoin price is $400,000” US SkyBridge founder predicts market price after halving

Virtual currency market

- Bitcoin: $42,621 -1.6%

- Ethereum: $2,283.8 -3.4%

Cryptocurrency prices fell along with US stocks following the FOMC Chairman’s remarks. On the other hand, JUP attracted a lot of attention on its first day of launch.

connection:Jupiter’s own virtual currency “JUP” launched, listed on Binance etc. Price temporarily at $2

connection:Bitcoin takes a pause before FOMC, Sui rises 20% compared to the previous week

NISA, virtual currency related stocks special feature

The post Chairman Powell denies possibility of interest rate cut in March at FOMC meeting; US stocks plummet, impacting virtual currency market | 1st Financial Tankan appeared first on Our Bitcoin News.

1 year ago

96

1 year ago

96

English (US) ·

English (US) ·