While the U.S. Federal Reserve (Fed) maintains its tight monetary stance, China appears no longer hesitant to expand credit, a positive sign for cryptocurrencies and other risk assets. It’s becoming

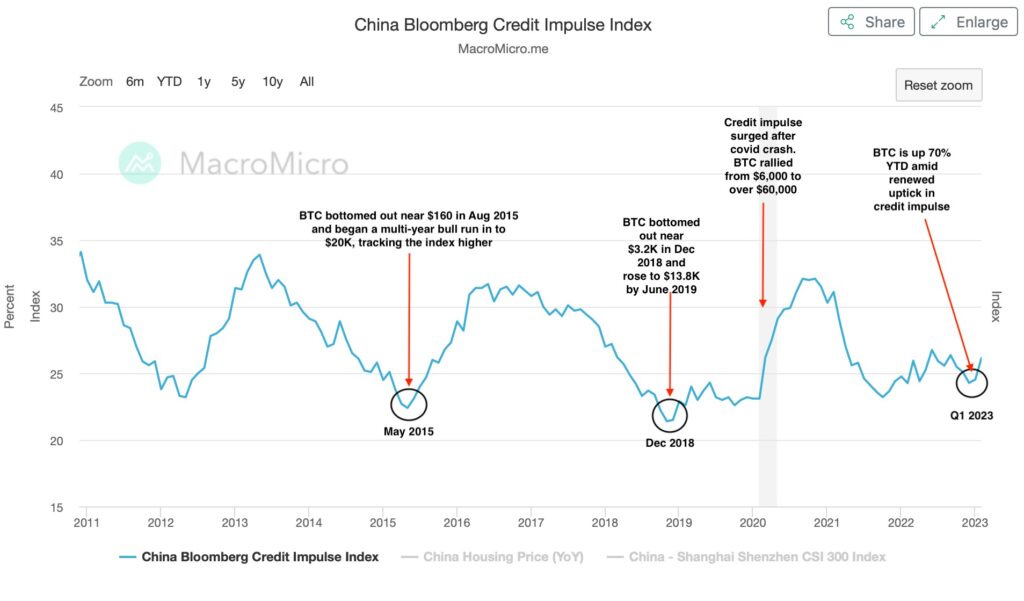

China’s credit impulse index — the share of new credit or bank loans in gross domestic product — has risen to 26% from 24% at the start of the year, according to data site MacroMicro.

A rise in China’s credit impulse could boost the global financial cycle, support risk sentiment and boost asset prices and lending, the Fed said in a November document.

New bank lending in China hits record high

Bitcoin (BTC) is a risky asset, more or less tied to the stock market. According to Credit Suisse, there has historically been a strong correlation between China’s credit impulse and Asian stock markets.

Moreover, in the past, periods of credit expansion in China have coincided with bitcoin’s bearish-to-bullish trend shift. So a continued rise in the credit impulse could bode well for Bitcoin.

China’s new bank loans hit a record 10.6 trillion yuan ($1.54 trillion) in the first quarter of 2023, up 27% year-on-year.

“This liquidity tide will continue to drive risk assets and crypto assets,” David Brickell, director of institutional sales at crypto liquidity network Paradigm, said in a newsletter earlier this month. I wrote.

MacroMicro/CoinDesk

MacroMicro/CoinDeskBitcoin movement coincides with credit impulse

China’s credit impulse soared after March 2020’s coronavirus-induced market decline. Bitcoin surged sixfold over the next 12 months to exceed $60,000.

Bitcoin is up more than 70% this year, recovering from a bear market amid an uptrend in China’s credit impulse. After the credit impulse bottomed out in May 2015 and December 2018, it rose as well.

Analysts expect further credit expansion in China in the coming months.

“China’s credit cycle has bottomed out and the recovery will continue as shadow bank credit and equity financing increase,” said Chi Lo, senior market strategist for APAC at BNP Paribas Asset Management3. said in a document released on May 29.

|Translation: coindesk JAPAN

|Editing: Takayuki Masuda

|Image: MacroMicro/CoinDesk

| Original: China’s ‘Credit Impulse’ Is Picking Up. Here’s Why It Matters to Bitcoin

The post China’s ‘Credit Impulse’ rises, is it a tailwind for Bitcoin | coindesk JAPAN | Coindesk Japan appeared first on Our Bitcoin News.

2 years ago

84

2 years ago

84

English (US) ·

English (US) ·