In sales, a win/loss analysis is the process of determining why deals are ultimately won or lost. That’s relatively self-explanatory, but more specifically, a win/loss review aims to contrast a sales organization’s performance with an industry or competitors and figure out why an outcome occurred. This involves gathering data including sales notes and customer feedback, analyzing that data, and then sharing the results with the broader organization.

Win/loss analyses can be effective. According to Accenture, companies that perform them see an 18% jump in win rate. But if they fail to ask the right questions or ask them in the wrong way, they’re likely to break down.

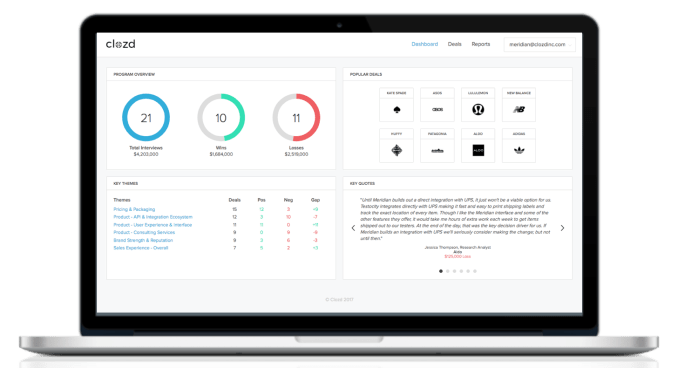

Andrew Peterson and Spencer Dent saw an opportunity to digitize — and implicitly streamline — win/loss analyses with Clozd, the startup they helped to co-found in 2017. Clozd delivers win/loss insights based on feedback from recent sales prospects, highlighting the actions a company might take to increase its win rates.

In an endorsement of that approach, Greycroft led a $52 million Series A investment in Clozd that closed today with participation from Madrona Venture Group and Album VC. It brings the company’s total raised to $56.2 million, Peterson and Dent said, the bulk of which will be put toward platform development.

“This round is a sort of ‘coming out party’ for us,” Peterson told TechCrunch. “Clozd has been quietly helping enterprises uncover the truth about why they win and lose. This partnership with Greycroft and Madrona signals just how important this problem is to solve, and that Clozd is positioned as [a] leader and innovator for win/loss analysis.”

Peterson and Dent met as colleagues at Qualtrics. Dent was previously a case team leader at Bain & Company, and before that, a general manager at consulting firm Summit Financial Marketing.

“Many leaders work off of assumptions and anecdotes about why they win and lose, instead of data. Other leaders may be afraid of what they’ll learn and make win/loss intel widely available across their orgs. So, rather than confront those issues head on, they may shy away from the practice,” Peterson and Dent said in an email interview. “In early 2017, [we] became convinced that countless enterprise solution providers, like Qualtrics, were in desperate need of better win/loss intelligence and believed it was a huge market opportunity. So, in spite of the huge opportunity cost of leaving IPO-bound Qualtrics, [we] walked away from their leadership roles at Utah’s hottest tech company to start Clozd in Spencer’s basement.”

Clozd integrates with customer relationship management (CRM) software to monitor for a “closed” sales opportunity. Next, the platform sends interviews and surveys about the deal to involved reps and buyers. Clozd then synthesizes the responses, providing insights about why the win or loss occurred and sharing them with stakeholders across the organization.

Beyond software, Clozd offers consulting services to help with tasks such as designing win-lose analysis programs, conducting buyer interviews, administering surveys, and developing summary reports.

“Clozd offers direct, out-of-the-box integration with Salesforce Sales Cloud and Slack and an automated quantitative survey module for triggering win/loss surveys to recent prospects. Win-rate monitoring allows our clients to monitor their sales win rate in real time,” Peterson and Dent said. “CEOs and executive teams routinely get asked by their boards why they win and lose deals against key competitors. Historically, most executive teams have given anecdotal responses to those kinds of questions. Clozd gives them … data-driven insights that lead to a much more productive dialogue in board meetings.”

Image Credits: Clozd

The question is whether platforms like Clozd can convince skeptical organizations to embrace win/loss reviews. In a 2019 report, Accenture found that less than half of companies conduct them.

If Clozd’s growth is any indication, there’s a decent chance that they can. Despite competition from consultancies like Primary Intelligence, DoubleCheck Research, and Anova Consulting Group, startup currently has over 175 business-to-business customers and notched 129% year-over-year growth in revenue in 2021.

“We have been profitable and cash flow positive every year of our history,” Peterson and Dent said. “Our gross margin in 2021 was 75% and unlike many tech startups we ended 2021 profitable and cash flow positive.”

Peterson and Dent said that the near-future plan is to introduce localization and new integrations with CRMs, business intelligence tools, and messaging apps. Further down the line, Clozd could gain natural language processing features for processing feedback from clients’ prospects, the pair said, as well as analyses that correlate data about wins or losses (e.g., deal size, customer segment, product, and industry) with outcomes (e.g., wins or losses) to calculate the potential impact if companies were to make changes to their strategies.

“The pandemic has accentuated the need for win/loss analysis. In any downturn, it will become even more important that companies maximize every single at bat that they have in the sales process. As sales pipelines dried up during the pandemic companies realized, more than ever, that they need to be very deliberate and proactive about monitoring and improving their sales win rate,” Peterson and Dent said. “Win/loss analysis allows product teams, sales leaders, and product marketing leaders to find out why deals are really being won and lost, and what aspects of product development will truly influence the company’s ability to win more deals.”

English (US) ·

English (US) ·